please answer as soon as

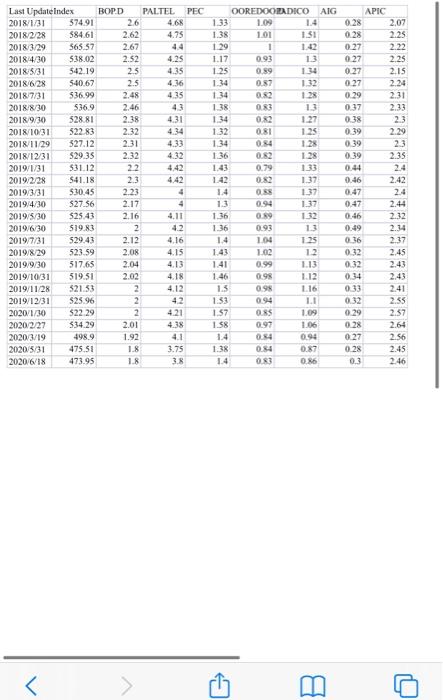

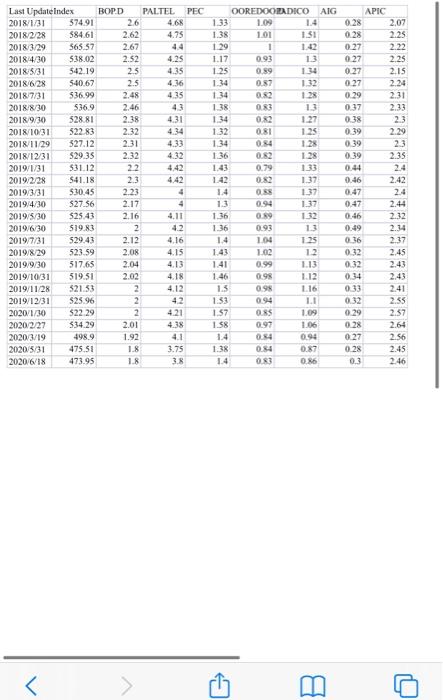

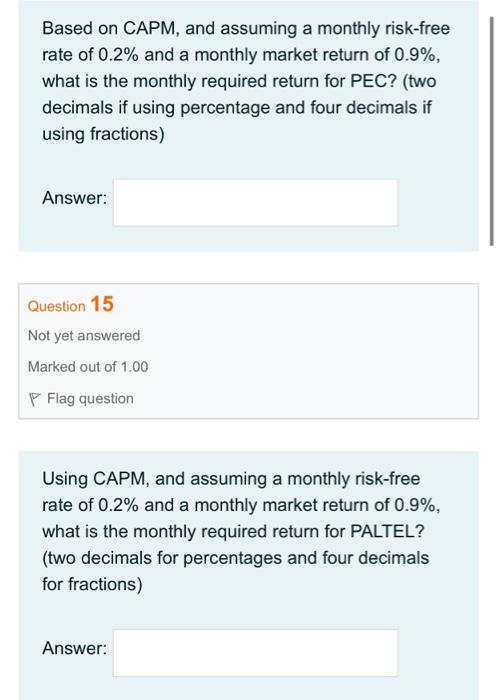

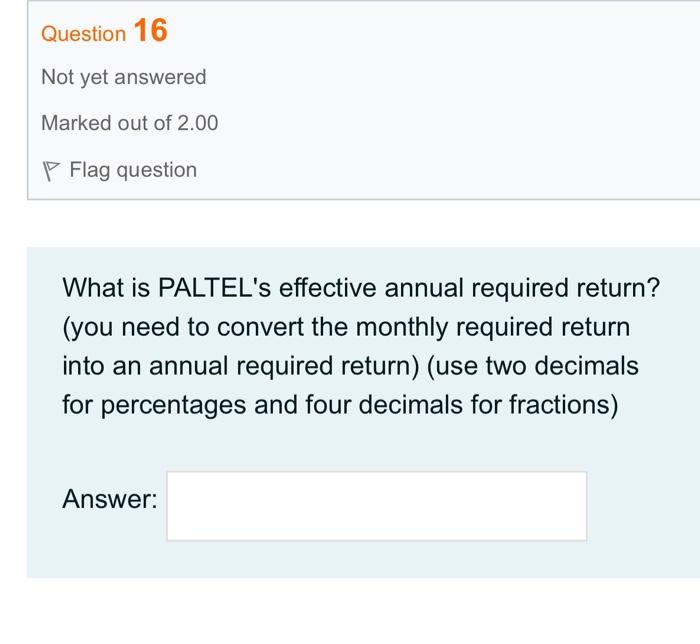

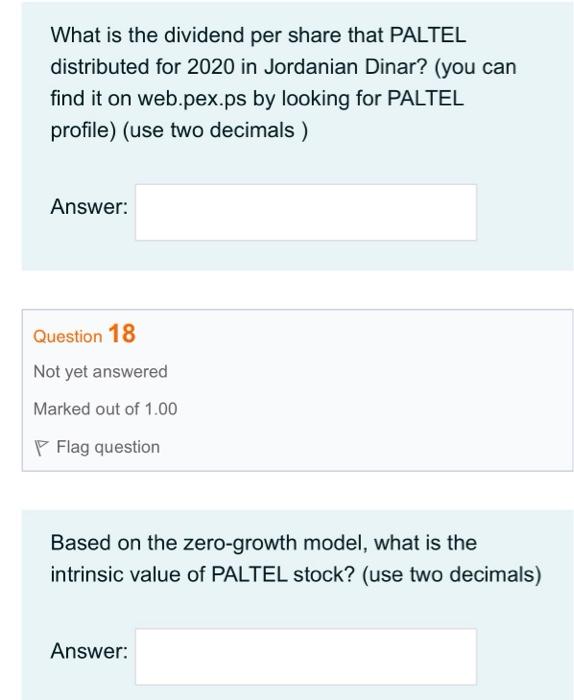

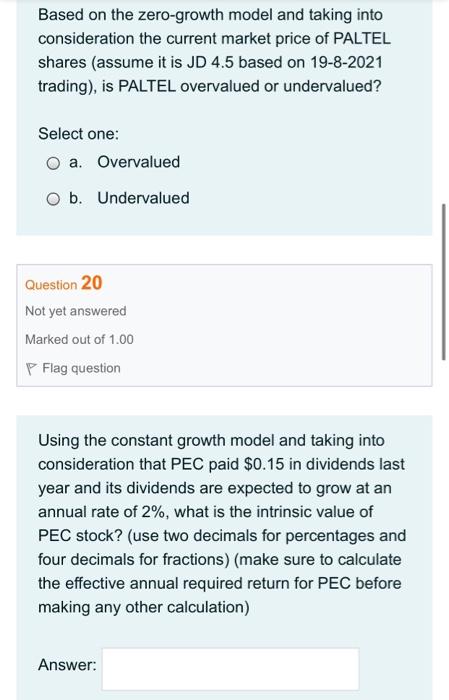

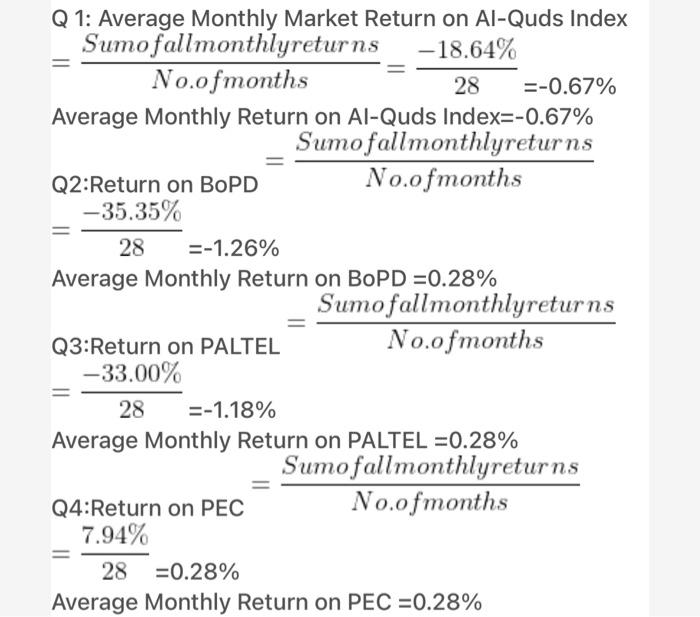

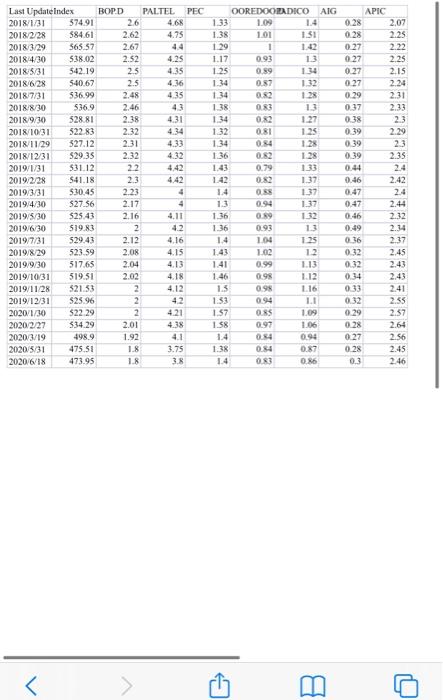

Last Update Index 2018/1/31 574.91 2018/2/28 584,61 20183/29 565.57 20184/30 538.02 2018/5/31 542.19 2018/628 540.67 2018/7/31 536.99 2018/8/30 536.9 2018/9/30 528.81 2018/10/31 52283 2018/11/29 527.12 2018/12/31 $29.35 2019/1/31 531.12 2019/2/28 541.18 2019/3/31 530.45 2019/4/30 $27.56 2019/5/30 $25.43 2019/6/30 519.83 2019/7/31 529.43 2019/8/29 523.59 2019/9/30 517.65 2019/10/31 519.51 2019/11/28 521.53 2019/12/31 $25.96 2020/1/30 $22.29 2020/2/27 334.29 2020/3/19 498.9 2020/531 475.51 2020/6/18 473.95 BOPD 26 2.62 2.67 2.52 25 2.5 2.48 2.46 2.38 2.32 2.31 2.32 22 2.3 2.23 2.17 PALTEL PEC 4.68 4.75 4.4 4.25 4.35 4.36 4.35 43 4.31 4.34 4.33 4.32 4.42 4.42 4 1.33 1.38 1.29 1.17 125 1.34 1.34 1.38 1.34 1.32 1.34 1.36 1.43 142 OOREDOOZADICO AIG APIC 1.09 0.28 2.02 101 1.SI 0.28 2.25 1 1.42 0.27 2.22 0.93 13 0.27 2.25 0.89 144 0.27 2.15 0.87 1.32 027 2.24 082 128 0.29 2.31 OR 13 0.37 2.33 082 1.27 0.38 23 081 1.25 0.39 2.29 0.84 1.28 0.39 23 082 1.28 0.39 2.35 0.79 133 0.44 2.4 0X2 1.37 0.46 2.42 OR 137 0.47 2.4 0.94 1.37 0.47 089 1.32 0.46 2.32 0.93 0.49 2.34 1.04 1.25 0.36 2.37 102 1.2 0.32 2.45 0.99 113 0.32 2.43 098 112 034 2.43 09 1 16 033 2.41 0.94 LI 032 2.55 ORS 1.09 0.29 2.57 0.97 1.06 0.28 2.64 044 094 0.27 2.56 054 0.87 0.28 2.45 03 0.86 0.3 2.46 2.44 2.16 2 2.12 2.08 2.04 2.02 2 2 2 2.01 1.92 1.8 18 4.11 42 4.16 4.15 4.13 4.18 4.12 42 421 4.38 4.1 3.75 3.8 1.3 1.36 1.36 1.4 1.43 1.41 1.46 1.3 1.33 1.57 1.58 1.4 1.38 14 m Based on CAPM, and assuming a monthly risk-free rate of 0.2% and a monthly market return of 0.9%, what is the monthly required return for PEC? (two decimals if using percentage and four decimals if using fractions) Answer: Question 15 Not yet answered Marked out of 1.00 P Flag question Using CAPM, and assuming a monthly risk-free rate of 0.2% and a monthly market return of 0.9%, what is the monthly required return for PALTEL? (two decimals for percentages and four decimals for fractions) Answer: Question 16 Not yet answered Marked out of 2.00 P Flag question What is PALTEL's effective annual required return? (you need to convert the monthly required return into an annual required return) (use two decimals for percentages and four decimals for fractions) Answer: What is the dividend per share that PALTEL distributed for 2020 in Jordanian Dinar? (you can find it on web.pex.ps by looking for PALTEL profile) (use two decimals ) Answer: Question 18 Not yet answered Marked out of 1.00 Flag question Based on the zero-growth model, what is the intrinsic value of PALTEL stock? (use two decimals) Answer: Based on the zero-growth model and taking into consideration the current market price of PALTEL shares (assume it is JD 4.5 based on 19-8-2021 trading), is PALTEL overvalued or undervalued? Select one: O a. Overvalued O b. Undervalued Question 20 Not yet answered Marked out of 1.00 Flag question Using the constant growth model and taking into consideration that PEC paid $0.15 in dividends last year and its dividends are expected to grow at an annual rate of 2%, what is the intrinsic value of PEC stock? (use two decimals for percentages and four decimals for fractions) (make sure to calculate the effective annual required return for PEC before making any other calculation) Answer: Q 1: Average Monthly Market Return on Al-Quds Index Sumofallmonthlyreturns -18.64% No.ofmonths 28 =-0.67% Average Monthly Return on Al-Quds Index=-0.67% Sumofallmonthlyreturns Q2:Return on BOPD No.ofmonths -35.35% 28 =-1.26% Average Monthly Return on BOPD =0.28% Sumofallmonthlyreturns Q3: Return on PALTEL No.ofmonths -33.00% 28 =-1.18% Average Monthly Return on PALTEL =0.28% Sumo fallmonthlyreturns Q4:Return on PEC No.ofmonths 7.94% 28 =0.28% Average Monthly Return on PEC =0.28%