Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer as soon as possible 4.) Mandlatech's financial year is the calendar year. The company's cost of equity capital is 8%. At the end

Please answer as soon as possible

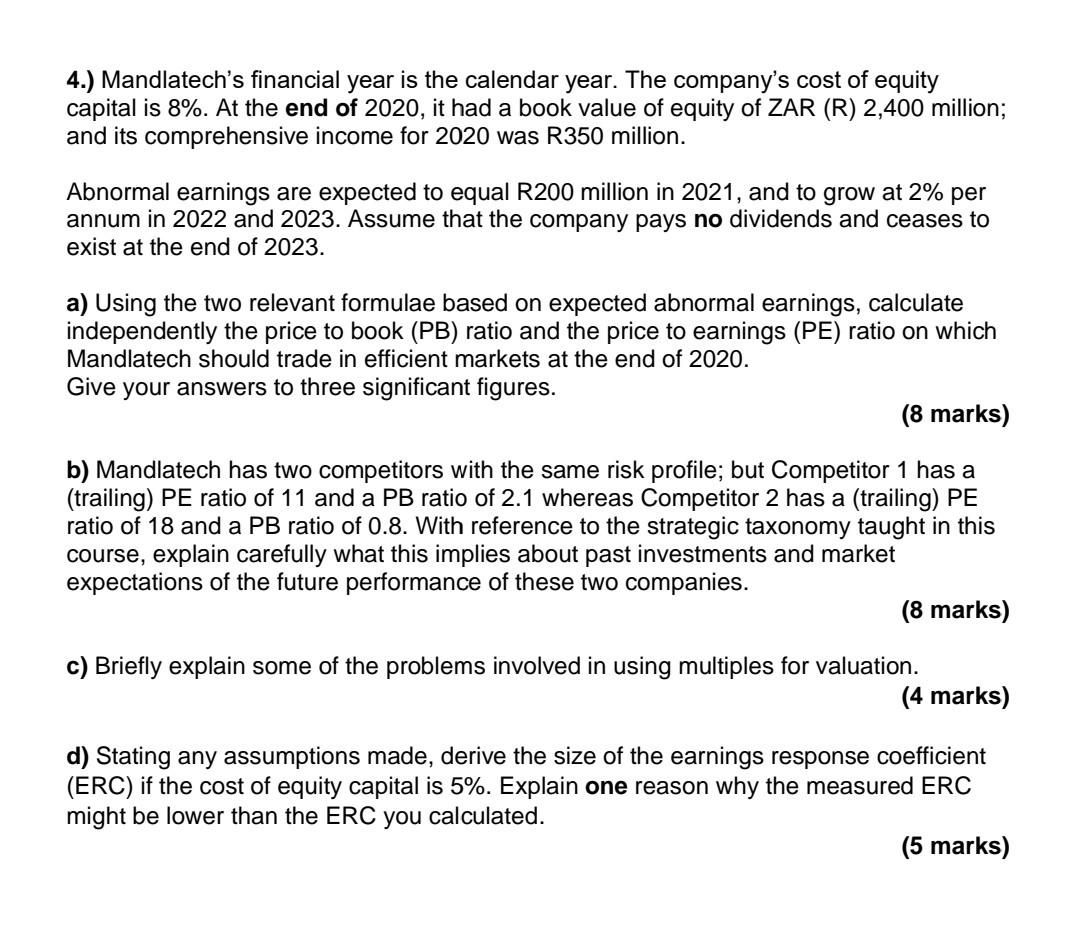

4.) Mandlatech's financial year is the calendar year. The company's cost of equity capital is 8%. At the end of 2020, it had a book value of equity of ZAR (R) 2,400 million; and its comprehensive income for 2020 was R350 million. Abnormal earnings are expected to equal R200 million in 2021, and to grow at 2% per annum in 2022 and 2023. Assume that the company pays no dividends and ceases to exist at the end of 2023. a) Using the two relevant formulae based on expected abnormal earnings, calculate independently the price to book (PB) ratio and the price to earnings (PE) ratio on which Mandlatech should trade in efficient markets at the end of 2020. Give your answers to three significant figures. (8 marks) b) Mandlatech has two competitors with the same risk profile; but Competitor 1 has a (trailing) PE ratio of 11 and a PB ratio of 2.1 whereas Competitor 2 has a (trailing) PE ratio of 18 and a PB ratio of 0.8. With reference to the strategic taxonomy taught in this course, explain carefully what this implies about past investments and market expectations of the future performance of these two companies. (8 marks) c) Briefly explain some of the problems involved in using multiples for valuation. (4 marks) d) Stating any assumptions made, derive the size of the earnings response coefficient (ERC) if the cost of equity capital is 5%. Explain one reason why the measured ERC might be lower than the ERC you calculatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started