please answer as soon as possible, I will upvote

please answer as soon as possible, I will upvote

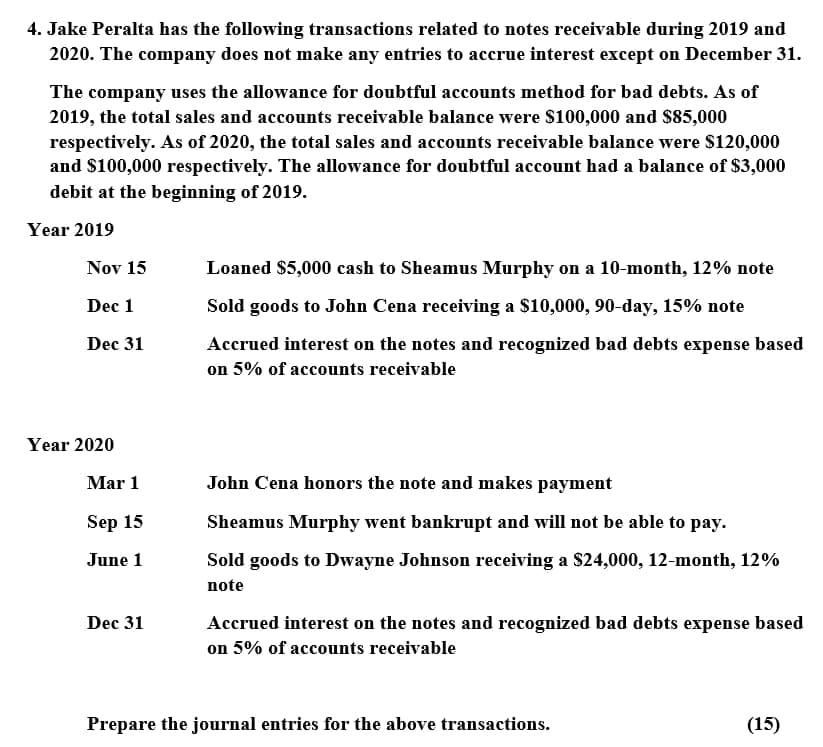

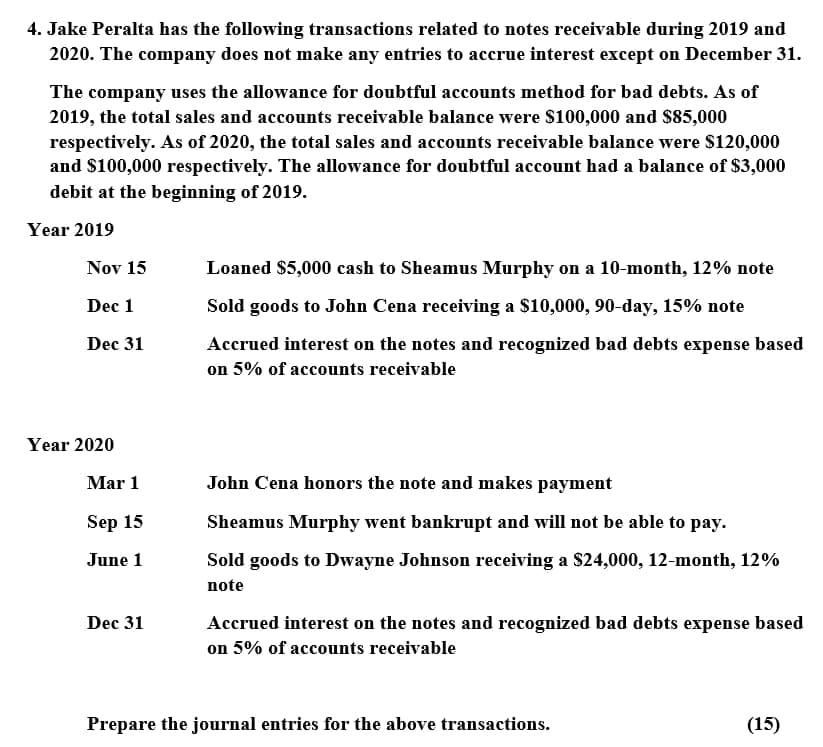

4. Jake Peralta has the following transactions related to notes receivable during 2019 and 2020. The company does not make any entries to accrue interest except on December 31. The company uses the allowance for doubtful accounts method for bad debts. As of 2019, the total sales and accounts receivable balance were $100,000 and $85,000 respectively. As of 2020, the total sales and accounts receivable balance were $120,000 and $100,000 respectively. The allowance for doubtful account had a balance of $3,000 debit at the beginning of 2019. Year 2019 Nov 15 Loaned $5,000 cash to Sheamus Murphy on a 10-month, 12% note Dec 1 Sold goods to John Cena receiving a $10,000, 90-day, 15% note Dec 31 Accrued interest on the notes and recognized bad debts expense based on 5% of accounts receivable Year 2020 Mar 1 Sep 15 John Cena honors the note and makes payment Sheamus Murphy went bankrupt and will not be able to pay. Sold goods to Dwayne Johnson receiving a $24,000, 12-month, 12% note June 1 Dec 31 Accrued interest on the notes and recognized bad debts expense based on 5% of accounts receivable Prepare the journal entries for the above transactions. (15) 4. Jake Peralta has the following transactions related to notes receivable during 2019 and 2020. The company does not make any entries to accrue interest except on December 31. The company uses the allowance for doubtful accounts method for bad debts. As of 2019, the total sales and accounts receivable balance were $100,000 and $85,000 respectively. As of 2020, the total sales and accounts receivable balance were $120,000 and $100,000 respectively. The allowance for doubtful account had a balance of $3,000 debit at the beginning of 2019. Year 2019 Nov 15 Loaned $5,000 cash to Sheamus Murphy on a 10-month, 12% note Dec 1 Sold goods to John Cena receiving a $10,000, 90-day, 15% note Dec 31 Accrued interest on the notes and recognized bad debts expense based on 5% of accounts receivable Year 2020 Mar 1 Sep 15 John Cena honors the note and makes payment Sheamus Murphy went bankrupt and will not be able to pay. Sold goods to Dwayne Johnson receiving a $24,000, 12-month, 12% note June 1 Dec 31 Accrued interest on the notes and recognized bad debts expense based on 5% of accounts receivable Prepare the journal entries for the above transactions. (15)

please answer as soon as possible, I will upvote

please answer as soon as possible, I will upvote