Answered step by step

Verified Expert Solution

Question

1 Approved Answer

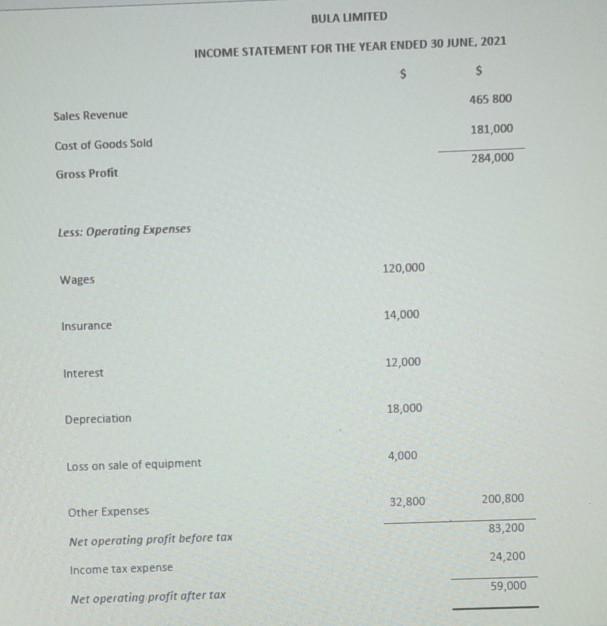

please answer as soon as possible thank you BULA LIMITED INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE, 2021 $ $ 465 800 Sales Revenue

please answer as soon as possible thank you

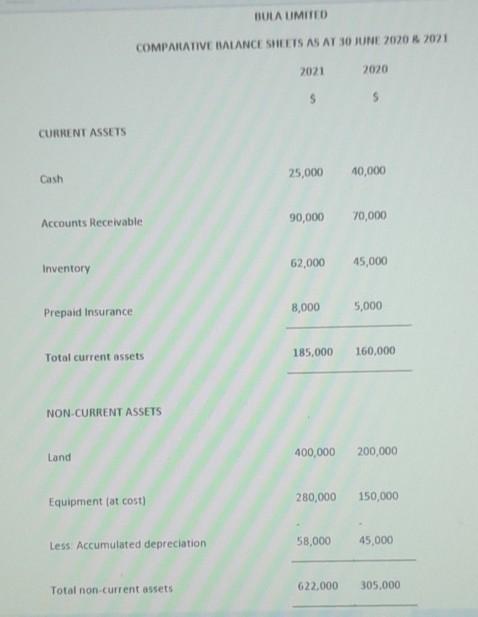

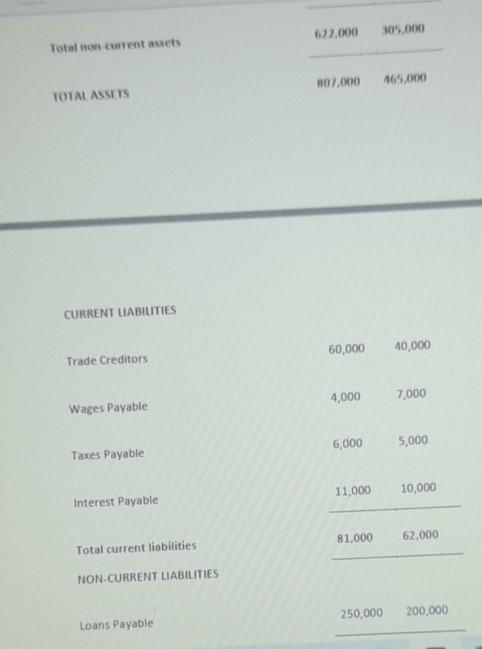

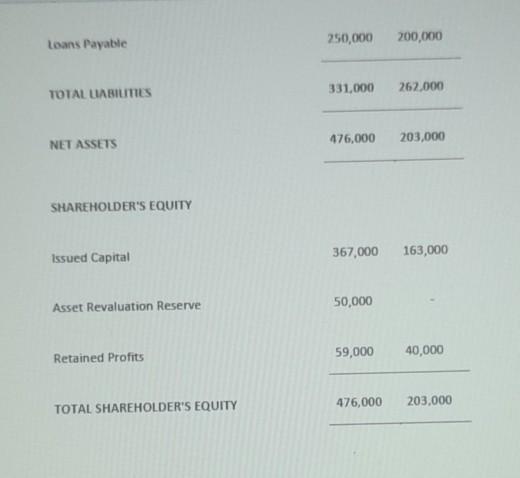

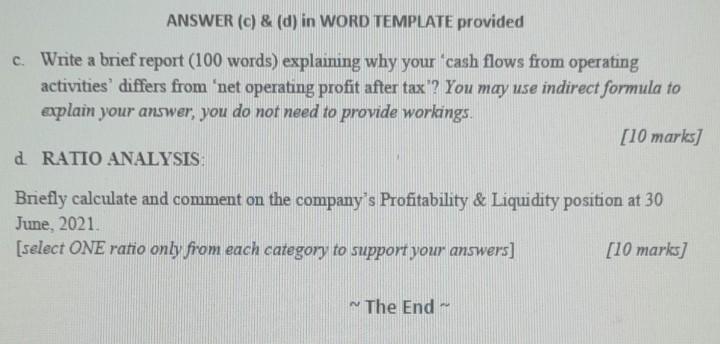

BULA LIMITED INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE, 2021 $ $ 465 800 Sales Revenue 181,000 Cost of Goods Sold 284,000 Gross Profit Less: Operating Expenses 120,000 Wages 14,000 Insurance 12,000 Interest 18,000 Depreciation 4,000 Loss on sale of equipment 32,800 200,800 Other Expenses 83,200 Net operating profit before tax 24,200 Income tax expense 59,000 Net operating profit after tax BULA UMITED COMPARATIVE BALANCE SHEETS AS AT 30 JUNE 2020 2021 2021 2020 5 CURRENT ASSETS Cash 25,000 10,000 90,000 70,000 Accounts Receivable Inventory 62,000 45,000 Prepaid Insurance 8,000 5,000 Total current assets 185,000 160,000 NON-CURRENT ASSETS Land 400,000 200,000 Equipment (at cost) 280,000 150,000 Less. Accumulated depreciation 58,000 45,000 622.000 Total non-current assets 305.000 622.000 305.000 Total non current assets 107.000 165.000 TOTAL ASSETS CURRENT UABILITIES 60,000 40,000 Trade Creditors 4,000 7,000 Wages Payable 6,000 5,000 Taxes Payable 11,000 10,000 Interest Payable 81,000 62.000 Total current liabilities NON-CURRENT LIABILITIES 250,000 200,000 Loans Payable Loans Payable 250,000 200,000 331,000 262.000 TOTAL LIABILITIES 476,000 NET ASSETS 203,000 SHAREHOLDER'S EQUITY Issued Capital 367,000 163,000 Asset Revaluation Reserve 50,000 Retained Profits 59,000 40,000 476,000 203,000 TOTAL SHAREHOLDER'S EQUITY ANSWER (C) & (d) in WORD TEMPLATE provided c. Write a brief report (100 words) explaining why your cash flows from operating activities' differs from 'net operating profit after tax"? You may use indirect formula to explain your answer, you do not need to provide worlaings. [10 marks] d RATIO ANALYSIS Briefly calculate and comment on the company's Profitability & Liquidity position at 30 June, 2021 [select ONE ratio only from each category to support your answers] [10 marks] The EndStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started