Answered step by step

Verified Expert Solution

Question

1 Approved Answer

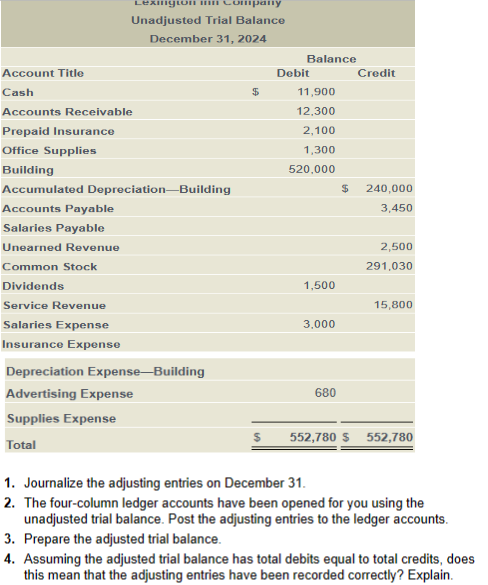

**Please answer as soon as possible**Several of my questions are not getting answered*** The unadjusted trial balance of Lexington Inn Company at December 31, 2024

**Please answer as soon as possible**Several of my questions are not getting answered*** The unadjusted trial balance of Lexington Inn Company at December 31, 2024 , and the data needed for the adjustments follow.

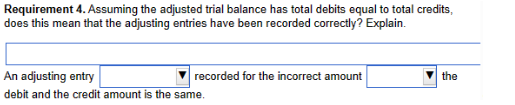

Choice options for Requirement 4:

No. Even if total debits equals total credits, this does not mean that the adjusting entries have been recorded correctly.

Yes. If total debits equals total credits, the adjusting entries must have been recorded correctly.

Could have been

Could never be

Because

Even though

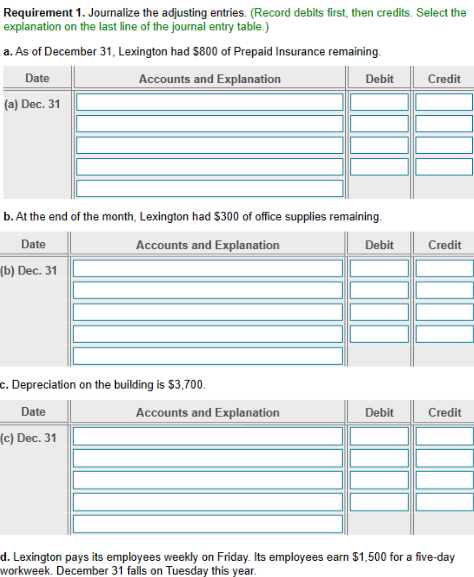

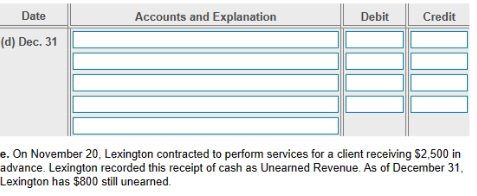

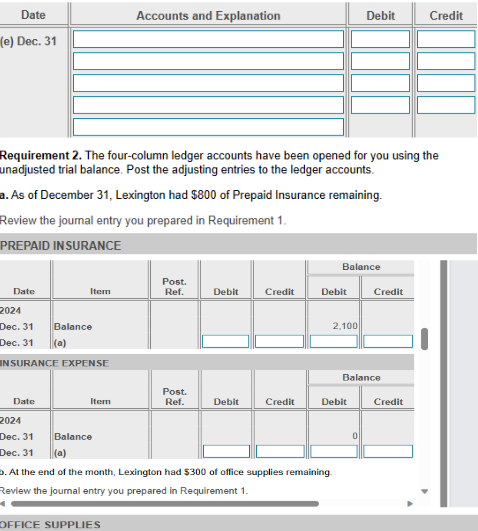

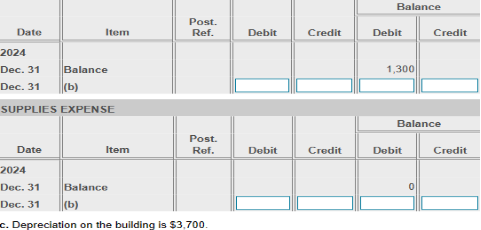

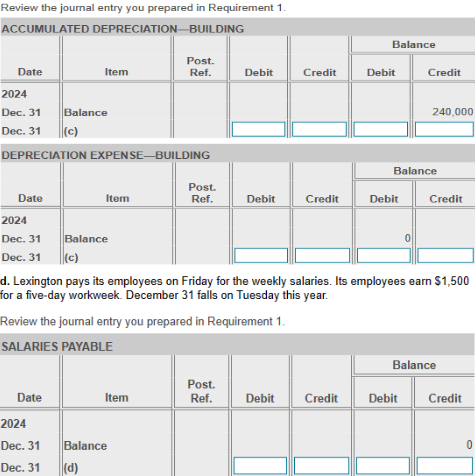

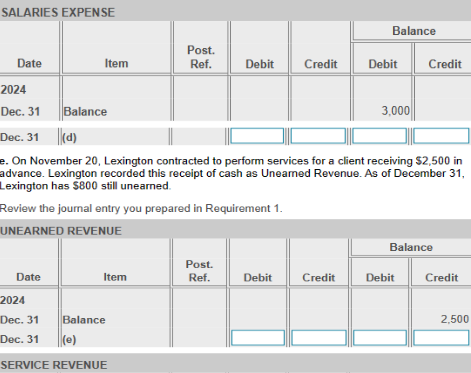

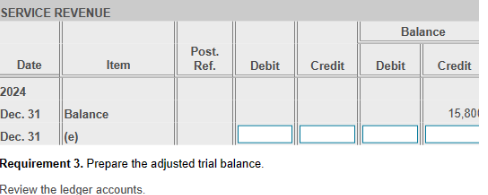

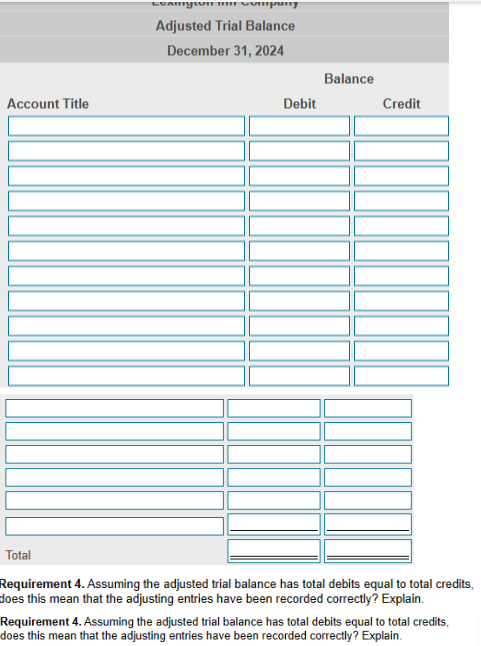

1. Journalize the adjusting entries on December 31 . 2. The four-column ledger accounts have been opened for you using the unadjusted trial balance. Post the adjusting entries to the ledger accounts. 3. Prepare the adjusted trial balance. 4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain. Requirement 1. Journalize the adjusting entries. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. As of December 31, Lexington had $800 of Prepaid Insurance remaining. b. At the end of the month, Lexington had $300 of office supplies remaining. c. Depreciation on the building is $3,700. d. Lexington pays its employees weekly on Friday. Its employees earn $1,500 for a five-day workweek. December 31 falls on Tuesday this year. On November 20 , Lexington contracted to perform services for a client receiving $2,500 in advance. Lexington recorded this receipt of cash as Unearned Revenue. As of December 31 , Lexington has $800 still unearned. Requirement 2. The four-column ledger accounts have been opened for you using the unadjusted trial balance. Post the adjusting entries to the ledger accounts. a. As of December 31, Lexington had $800 of Prepaid Insurance remaining. Review the journal entry you prepared in Requirement 1. PREPAID INSURANCE . At the end of the month, Lexington had $300 of office supplies remaining. Review the joumal entry you prepared in Requirement 1. c. Depreciation on the building is $3,700. Review the journal entry you prepared in Requirement 1. d. Lexington pays its employees on Friday for the weekly salaries. Its employees earn \$1,500 for a five-day workweek. December 31 falls on Tuesday this year. Review the journal entry you prepared in Requirement 1. e. On November 20, Lexington contracted to perform services for a client receiving $2,500 in advance. Lexington recorded this receipt of cash as Unearned Revenue. As of December 31, Lexington has $800 still unearned. Review the joumal entry you prepared in Requirement 1. SERVICE REVENUE Requirement 3. Prepare the adjusted trial balance. Review the ledger accounts. Requirement 4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain. Requirement 4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain. Requirement 4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain. An adjusting entry recorded for the incorrect amount the debit and the credit amount is the sameStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started