Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer ASAP Answer this COMPULSORY question Question 1 (Reward) The current operating profits of Commercial Division of Apollo Ltd are 80 million and its

Please answer ASAP

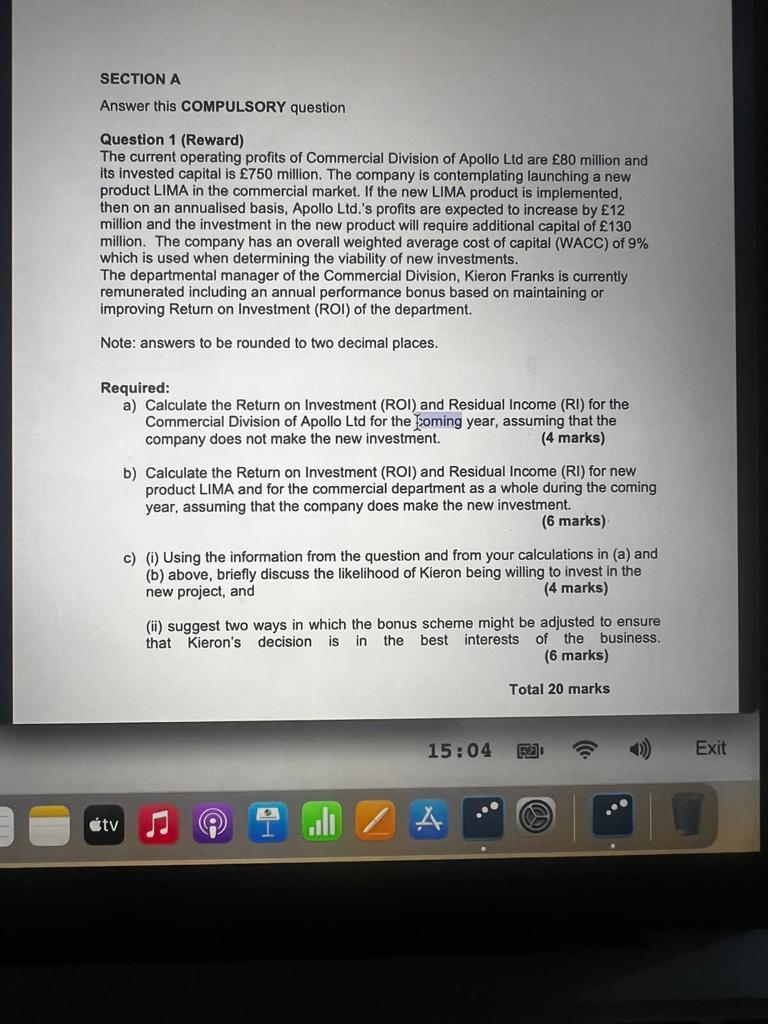

Answer this COMPULSORY question Question 1 (Reward) The current operating profits of Commercial Division of Apollo Ltd are 80 million and its invested capital is 750 million. The company is contemplating launching a new product LIMA in the commercial market. If the new LIMA product is implemented, then on an annualised basis, Apollo Ltd.'s profits are expected to increase by 12 million and the investment in the new product will require additional capital of 130 million. The company has an overall weighted average cost of capital (WACC) of 9% which is used when determining the viability of new investments. The departmental manager of the Commercial Division, Kieron Franks is currently remunerated including an annual performance bonus based on maintaining or improving Return on Investment (ROI) of the department. Note: answers to be rounded to two decimal places. Required: a) Calculate the Return on Investment (ROI) and Residual Income (RI) for the Commercial Division of Apollo Ltd for the Eoming year, assuming that the company does not make the new investment. ( 4 marks) b) Calculate the Return on Investment (ROI) and Residual Income (RI) for new product LIMA and for the commercial department as a whole during the coming year, assuming that the company does make the new investment. ( 6 marks) c) (i) Using the information from the question and from your calculations in (a) and (b) above, briefly discuss the likelihood of Kieron being willing to invest in the new project, and ( 4 marks) (ii) suggest two ways in which the bonus scheme might be adjusted to ensure that Kieron's decision is in the best interests of the business. (6 marks) Answer this COMPULSORY question Question 1 (Reward) The current operating profits of Commercial Division of Apollo Ltd are 80 million and its invested capital is 750 million. The company is contemplating launching a new product LIMA in the commercial market. If the new LIMA product is implemented, then on an annualised basis, Apollo Ltd.'s profits are expected to increase by 12 million and the investment in the new product will require additional capital of 130 million. The company has an overall weighted average cost of capital (WACC) of 9% which is used when determining the viability of new investments. The departmental manager of the Commercial Division, Kieron Franks is currently remunerated including an annual performance bonus based on maintaining or improving Return on Investment (ROI) of the department. Note: answers to be rounded to two decimal places. Required: a) Calculate the Return on Investment (ROI) and Residual Income (RI) for the Commercial Division of Apollo Ltd for the Eoming year, assuming that the company does not make the new investment. ( 4 marks) b) Calculate the Return on Investment (ROI) and Residual Income (RI) for new product LIMA and for the commercial department as a whole during the coming year, assuming that the company does make the new investment. ( 6 marks) c) (i) Using the information from the question and from your calculations in (a) and (b) above, briefly discuss the likelihood of Kieron being willing to invest in the new project, and ( 4 marks) (ii) suggest two ways in which the bonus scheme might be adjusted to ensure that Kieron's decision is in the best interests of the business. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started