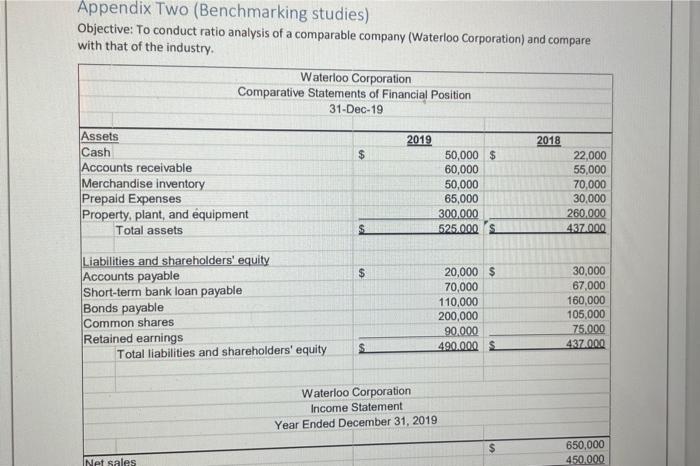

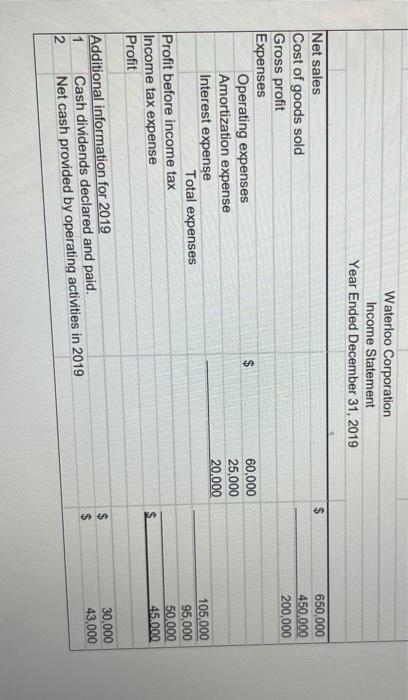

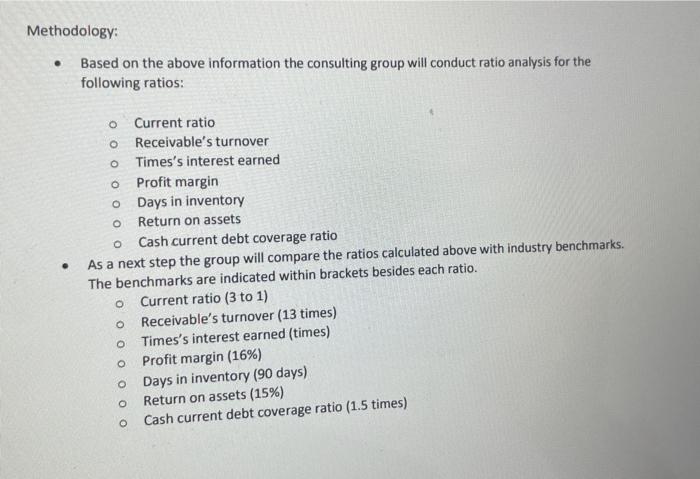

Capstone V30 - student.pdf X + ja/AppData/Local/Microsoft Windows/INetCache/Content.Outlook/Z4C78JGI/Capstone%20v30%20-%20student.pdf D A D CASE It was a regular working day in April 21, when four business partners gathered together for a strategy session for their organization: What About Wraps (WAW). Background: WAW operated a chain of Quick Service Restaurants (QSR) in business localities in the GTA, Mississauga, Brampton, Oakville, Kitchener, Waterloo, and Cambridge. Their first outlet opened in 2007 in Vaughn and then continued to expand to other areas. WAW outlets offered food and beverages for takeout and delivery only. There was no dine in option available. Rapid expansion of the food delivery service provided a strong tailwind for WAW. Since their outlets did not require a prominent location, the leasing costs were minimized. The above factors contributed to the success and growth of WAW till Covid struck in early 2020. Most of the revenue generated by WAW was from lunch items, afternoon snacks, and early evening dinners consumed by clients working in their offices. With 90% of clients working from home, the demand for such services almost disappeared overnight. WAW had to downsize its operations, close outlets, and lay off nearly 60% of its workforce. Positive news began to appear in April 21 with the arrival of vaccines in Canada. Both the Federal and Provincial governments expressed confidence in vaccinating a majority of the population by Fall 21 and allow restaurants to function normally by November 21. About business partners Ana Coelho (Ana) is the Senior Vice President-Marketing. She spent over fifteen years with Fortune 500 companies in the Consumer-Packaged Goods sector. She developed multi-channel marketing strategies for WAW which led to WAW being positioned as an agile innovating enterprise. Emily Jones (Emily) was the Corporate Chef for WAW. She spent nearly twenty years with leading hotel chains in Western Canada before taking on her current role in WAW. She displayed exemplary skill developing new products which contributed to the profitability of WAW Appendix Two (Benchmarking studies) Objective: To conduct ratio analysis of a comparable company (Waterloo Corporation) and compare with that of the industry. Waterloo Corporation Comparative Statements of Financial Position 31-Dec-19 $ Assets Cash Accounts receivable Merchandise inventory Prepaid Expenses Property, plant, and equipment Total assets 2019 50,000 $ 60,000 50,000 65,000 300.000 525.000 2018 22,000 55,000 70,000 30,000 260,000 437.000 $ Liabilities and shareholders' equity Accounts payable Short-term bank loan payable Bonds payable Common shares Retained earnings Total liabilities and shareholders' equity 20,000 $ 70,000 110,000 200,000 90.000 490,000 $ 30,000 67,000 160,000 105,000 75.000 437,000 Waterloo Corporation Income Statement Year Ended December 31, 2019 $ 650,000 450.000 Net sales Waterloo Corporation Income Statement Year Ended December 31, 2019 $ 650,000 450.000 200,000 $ Net sales Cost of goods sold Gross profit Expenses Operating expenses Amortization expense Interest expense Total expenses Profit before income tax Income tax expense Profit 60,000 25,000 20.000 105,000 95,000 50.000 45.000 $ 30,000 43,000 $ Additional information for 2019 1 Cash dividends declared and paid. 2 Net cash provided by operating activities in 2019 Methodology: Based on the above information the consulting group will conduct ratio analysis for the following ratios: . O O . o Current ratio Receivable's turnover Times's interest earned o Profit margin Days in inventory Return on assets Cash current debt coverage ratio As a next step the group will compare the ratios calculated above with industry benchmarks. The benchmarks are indicated within brackets besides each ratio. Current ratio (3 to 1) Receivable's turnover (13 times) Times's interest earned (times) Profit margin (16%) Days in inventory (90 days) Return on assets (15%) Cash current debt coverage ratio (1.5 times) o O o O CASE It was a regular working day in April 21, when four business partners gathered together for a strategy session for their organization: What About Wraps (WAW). Background: WAW operated a chain of Quick Service Restaurants (QSR) in business localities in the GTA, Mississauga, Brampton, Oakville, Kitchener, Waterloo, and Cambridge. Their first outlet opened in 2007 in Vaughn and then continued to expand to other areas. WAW outlets offered food and beverages for takeout and delivery only. There was no dine in option available. Rapid expansion of the food delivery service provided a strong tailwind for WAW. Since their outlets did not require a prominent location, the leasing costs were minimized. The above factors contributed to the success and growth of WAW till Covid struck in early 2020. Most of the revenue generated by WAW was from lunch items, afternoon snacks, and early evening dinners consumed by clients working in their offices. With 90% of clients working from home, the demand for such services almost disappeared overnight. WAW had to downsize its operations, close outlets, and lay off nearly 60% of its workforce. Positive news began to appear in April 21 with the arrival of vaccines in Canada. Both the Federal and Provincial governments expressed confidence in vaccinating a majority of the population by Fall '21 and allow restaurants to function normally by November 21. About business partners Ana Coelho (Ana) is the Senior Vice President Marketing. She spent over fifteen years with Fortune 500 companies in the Consumer-Packaged Goods sector. She developed multi-channel marketing strategies in mila innovating enterprise