Please answer asap, i will provide thumbs up and positive feedback. Thank you

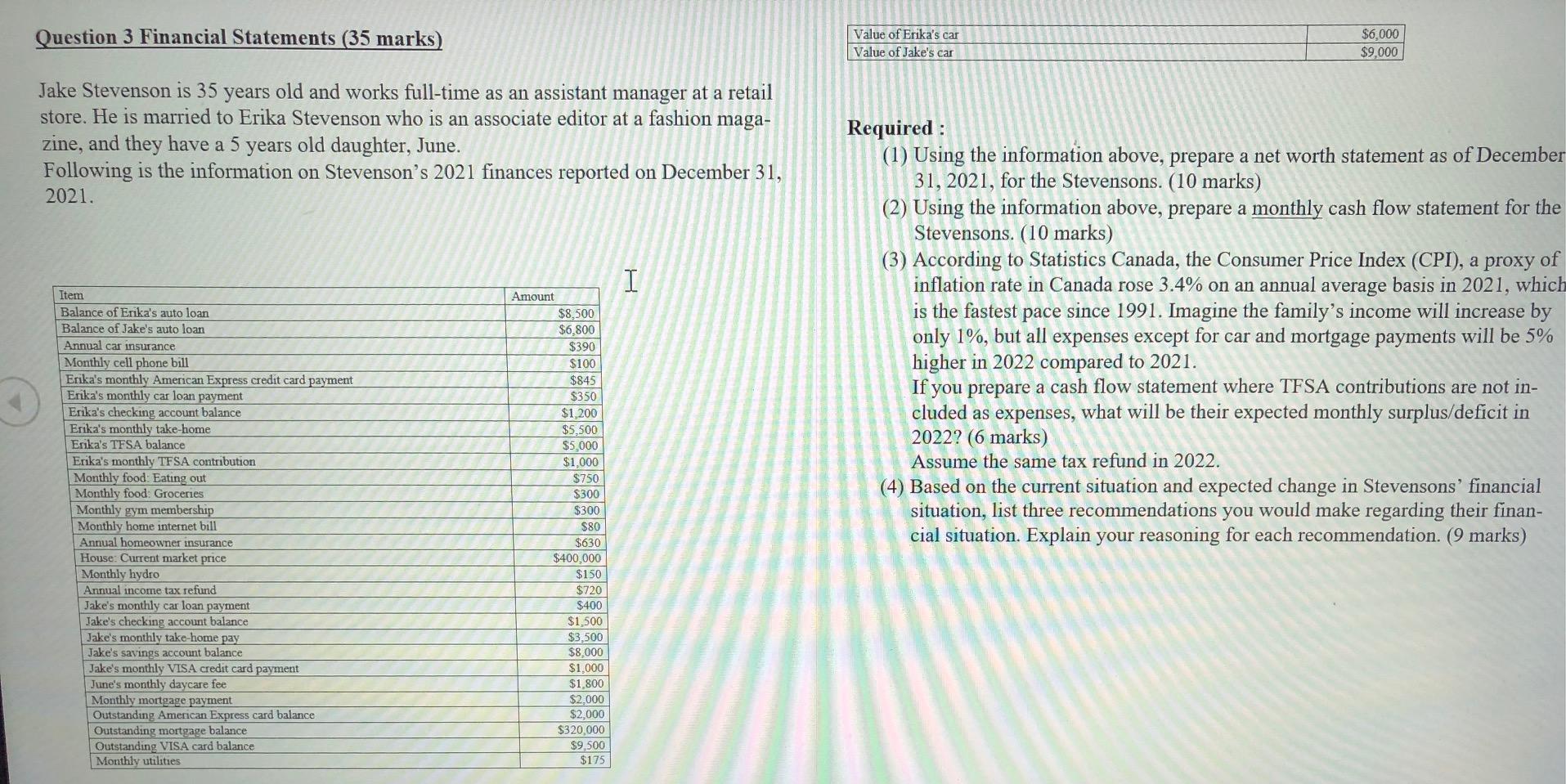

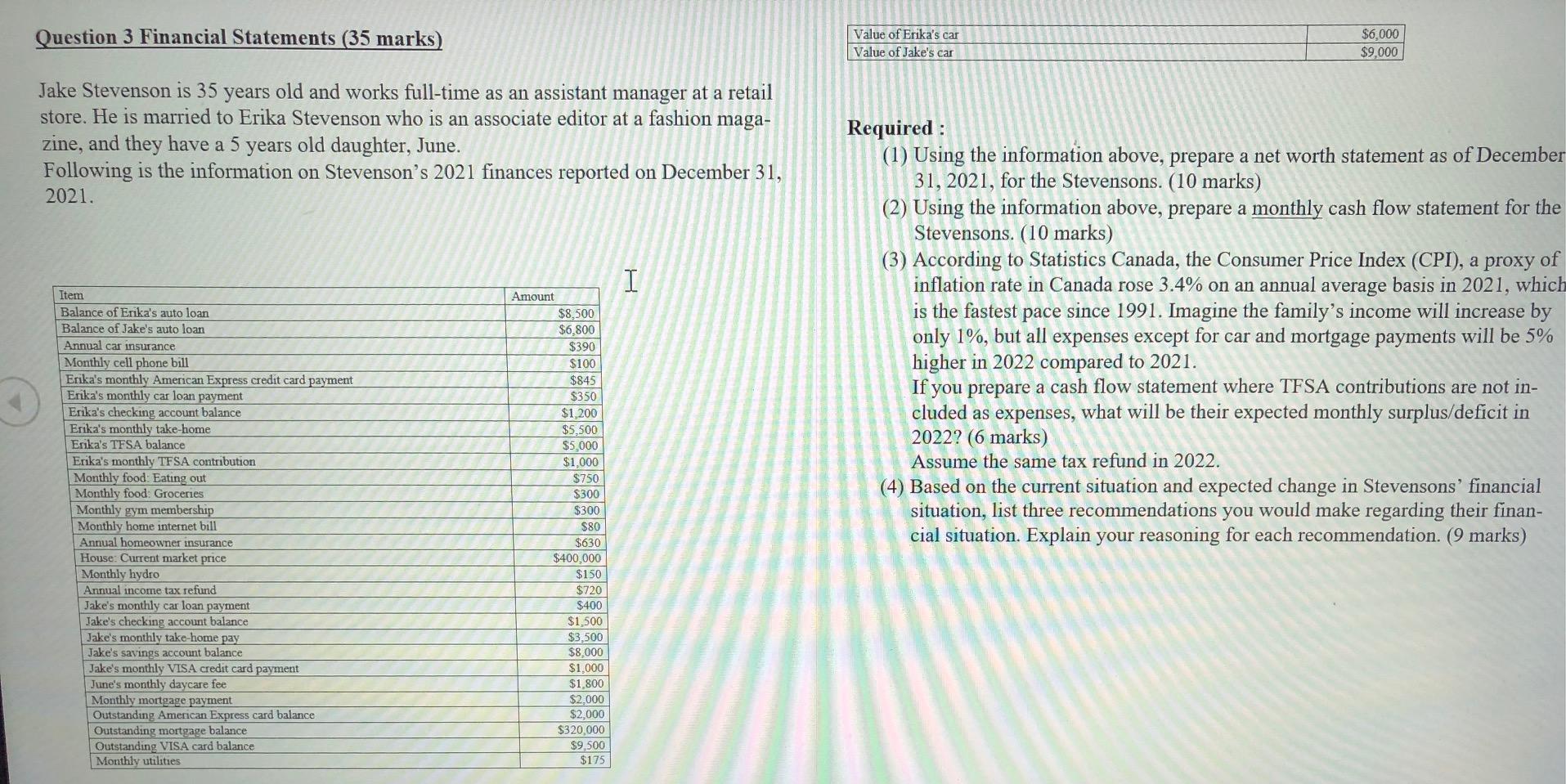

Question 3 Financial Statements (35 marks) $6,000 Value of Erika's car Value of Jake's car $9,000 Jake Stevenson is 35 years old and works full-time as an assistant manager at a retail store. He is married to Erika Stevenson who is an associate editor at a fashion maga- zine, and they have a 5 years old daughter, June. Following is the information on Stevenson's 2021 finances reported on December 31, 2021. I Item Balance of Erika's auto loan Balance of Jake's auto loan Annual car insurance Monthly cell phone bill Erika's monthly American Express credit card payment Erika's monthly car loan payment Erika's checking account balance Erika's monthly take home Erika's TFSA balance Erika's monthly TFSA contribution Monthly food: Eating out Monthly food. Groceries Monthly gym membership Monthly home internet bill Annual homeowner insurance House: Current market price Monthly hydro Annual income tax refund Jake's monthly car loan payment Jake's checking account balance Jake's monthly take home pay Jake's savings account balance Jake's monthly VISA credit card payment June's monthly daycare fee Monthly mortgage payment Outstanding American Express card balance Outstanding mortgage balance Outstanding VISA card balance Monthly utilities Amount $8,500 $6,800 $390 $100 $845 $350 $1,200 $5.500 $5,000 $1,000 $750 $300 $300 $80 $630 $400,000 $150 $720 $400 $1,500 $3,500 $8,000 $1,000 $1,800 $2,000 $2.000 $320,000 $9.500 $175 Required: (1) Using the information above, prepare a net worth statement as of December 31, 2021, for the Stevensons. (10 marks) (2) Using the information above, prepare a monthly cash flow statement for the Stevensons. (10 marks) (3) According to Statistics Canada, the Consumer Price Index (CPI), a proxy of inflation rate in Canada rose 3.4% on an annual average basis in 2021, which is the fastest pace since 1991. Imagine the family's income will increase by only 1%, but all expenses except for car and mortgage payments will be 5% higher in 2022 compared to 2021. If you prepare a cash flow statement where TFSA contributions are not in- cluded as expenses, what will be their expected monthly surplus/deficit in 2022? (6 marks) Assume the same tax refund in 2022. (4) Based on the current situation and expected change in Stevensons' financial situation, list three recommendations you would make regarding their finan- cial situation. Explain your reasoning for each recommendation. (9 marks) Question 3 Financial Statements (35 marks) $6,000 Value of Erika's car Value of Jake's car $9,000 Jake Stevenson is 35 years old and works full-time as an assistant manager at a retail store. He is married to Erika Stevenson who is an associate editor at a fashion maga- zine, and they have a 5 years old daughter, June. Following is the information on Stevenson's 2021 finances reported on December 31, 2021. I Item Balance of Erika's auto loan Balance of Jake's auto loan Annual car insurance Monthly cell phone bill Erika's monthly American Express credit card payment Erika's monthly car loan payment Erika's checking account balance Erika's monthly take home Erika's TFSA balance Erika's monthly TFSA contribution Monthly food: Eating out Monthly food. Groceries Monthly gym membership Monthly home internet bill Annual homeowner insurance House: Current market price Monthly hydro Annual income tax refund Jake's monthly car loan payment Jake's checking account balance Jake's monthly take home pay Jake's savings account balance Jake's monthly VISA credit card payment June's monthly daycare fee Monthly mortgage payment Outstanding American Express card balance Outstanding mortgage balance Outstanding VISA card balance Monthly utilities Amount $8,500 $6,800 $390 $100 $845 $350 $1,200 $5.500 $5,000 $1,000 $750 $300 $300 $80 $630 $400,000 $150 $720 $400 $1,500 $3,500 $8,000 $1,000 $1,800 $2,000 $2.000 $320,000 $9.500 $175 Required: (1) Using the information above, prepare a net worth statement as of December 31, 2021, for the Stevensons. (10 marks) (2) Using the information above, prepare a monthly cash flow statement for the Stevensons. (10 marks) (3) According to Statistics Canada, the Consumer Price Index (CPI), a proxy of inflation rate in Canada rose 3.4% on an annual average basis in 2021, which is the fastest pace since 1991. Imagine the family's income will increase by only 1%, but all expenses except for car and mortgage payments will be 5% higher in 2022 compared to 2021. If you prepare a cash flow statement where TFSA contributions are not in- cluded as expenses, what will be their expected monthly surplus/deficit in 2022? (6 marks) Assume the same tax refund in 2022. (4) Based on the current situation and expected change in Stevensons' financial situation, list three recommendations you would make regarding their finan- cial situation. Explain your reasoning for each recommendation. (9 marks)