Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer ASAP,, i will rate up if right thank u Tyson purchased a fleet of 20 trucks on July 1, 2019 for $120,000 each.

Please answer ASAP,, i will rate up if right thank u

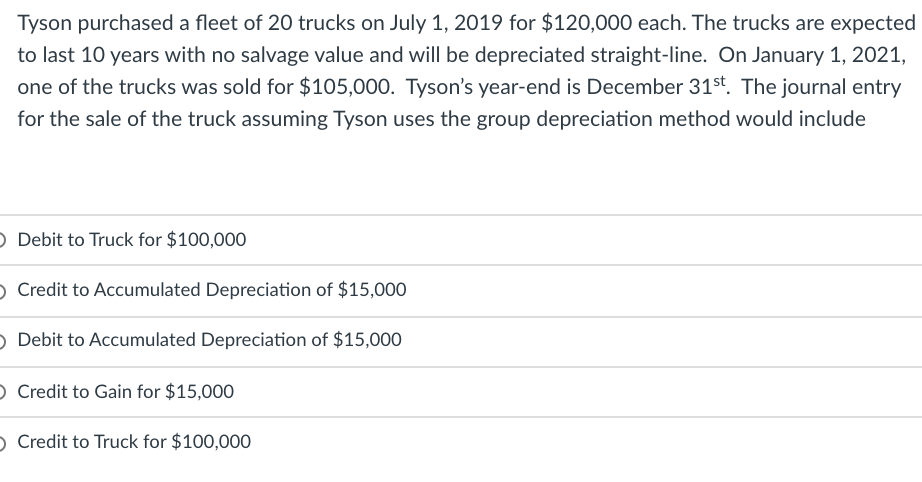

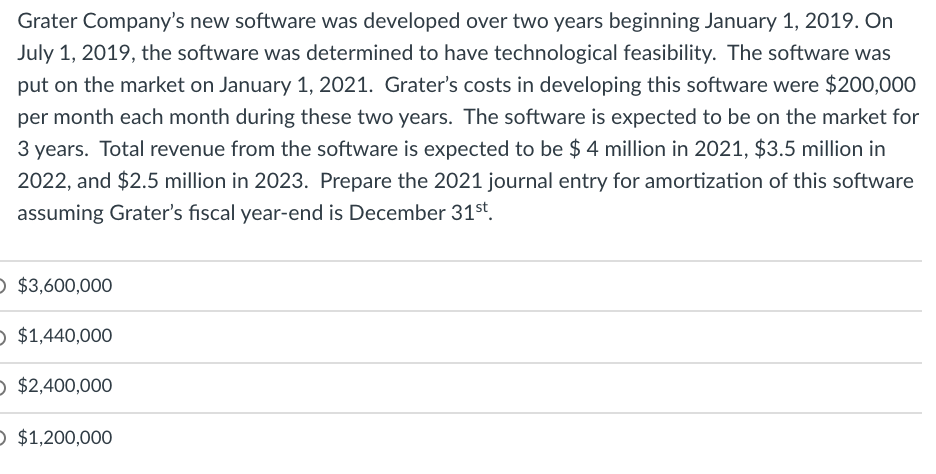

Tyson purchased a fleet of 20 trucks on July 1, 2019 for $120,000 each. The trucks are expected to last 10 years with no salvage value and will be depreciated straight-line. On January 1, 2021, one of the trucks was sold for $105,000. Tyson's year-end is December 31st. The journal entry for the sale of the truck assuming Tyson uses the group depreciation method would include Debit to Truck for $100,000 Credit to Accumulated Depreciation of $15,000 Debit to Accumulated Depreciation of $15,000 Credit to Gain for $15,000 Credit to Truck for $100,000 Grater Company's new software was developed over two years beginning January 1, 2019. On July 1, 2019, the software was determined to have technological feasibility. The software was put on the market on January 1, 2021. Grater's costs in developing this software were $200,000 per month each month during these two years. The software is expected to be on the market for 3 years. Total revenue from the software is expected to be $ 4 million in 2021, $3.5 million in 2022, and $2.5 million in 2023. Prepare the 2021 journal entry for amortization of this software assuming Grater's fiscal year-end is December 31st. $3,600,000 $1,440,000 $2,400,000 $1,200,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started