Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer ASAP my hw is due soon. answer correct for thumbs up Deadiline: you must submit this assignment electronically via Canvas using the submission

please answer ASAP my hw is due soon. answer correct for thumbs up

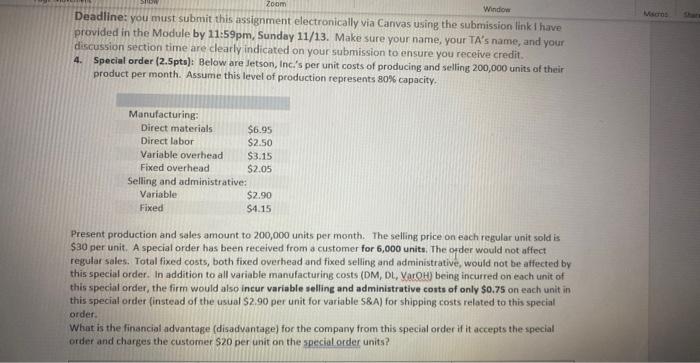

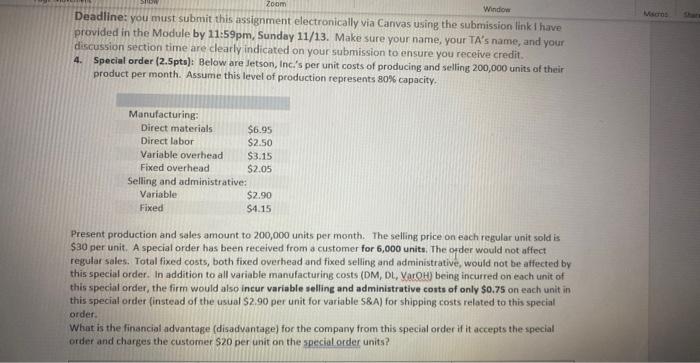

Deadiline: you must submit this assignment electronically via Canvas using the submission linkt have provided in the Module by 11:59pm, Sunday 11/13. Make sure your name, your TA's name, and your discussion section time are clearly indicated on your submission to ensure you receive credit. 4. Special order (2.5pts): Below are Jetson, Inci's per unit costs of producing and selling 200,000 units af their product per month. Assume this level of production represents 80% capacity. Present production and sales amount to 200,000 units per month. The selling price on each regular unit sold is $30 per unit. A special order has been received from a customer for 6,000 units. The ofder would not affect regular sales. Total fixed costs, both fixed overhead and fixed selling and administrative, would not be affected by this special order. In addition to all variable manufacturing costs (DM, DL, VarQH) being incurred on each unit of this special order, the firm would also incur variable selling and administrative costs of only $0.75 on each unit in this special order (instead of the usual \$2.90 per unit for variable S\&A) for shipping costs related to this special order. What is the financial advantage (disadvantage) for the company from this special order if it accepts the special order and charges the customer $20 per unit on the special order units

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started