please answer asap

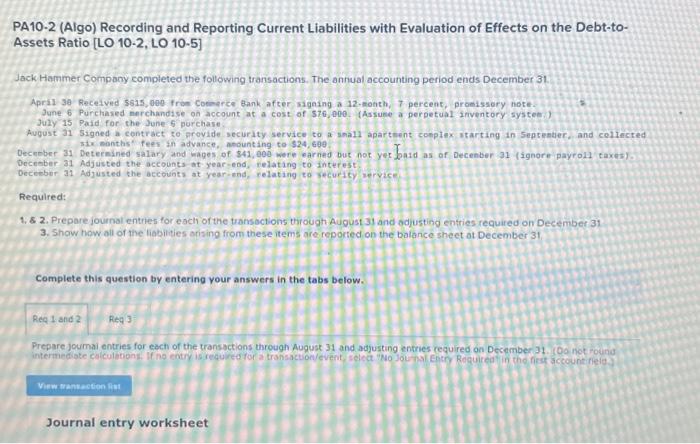

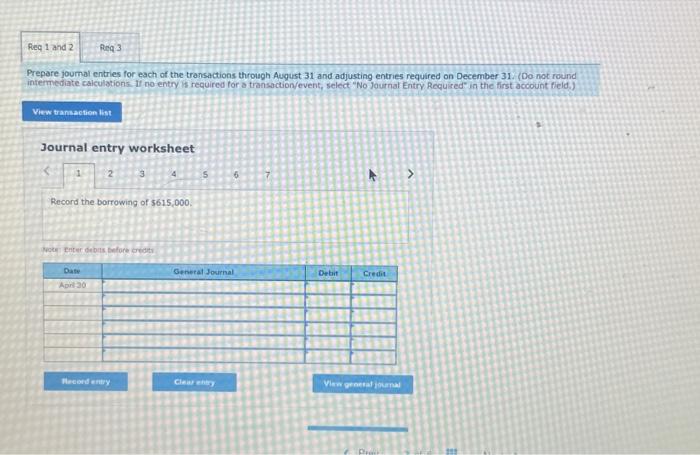

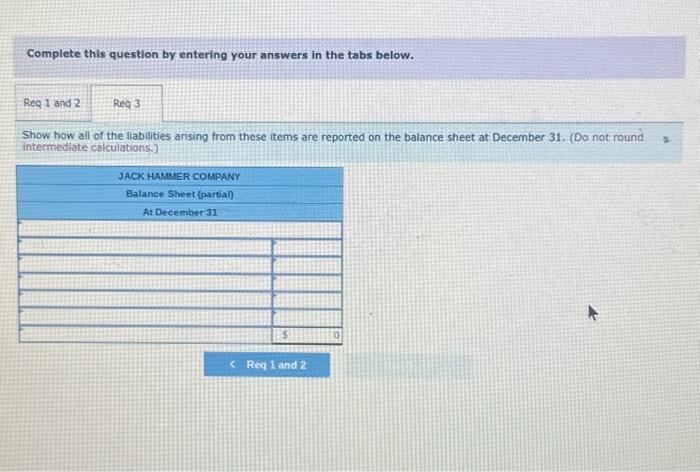

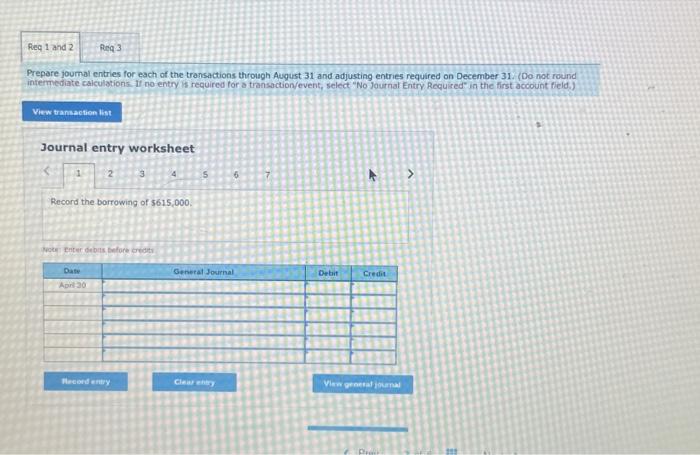

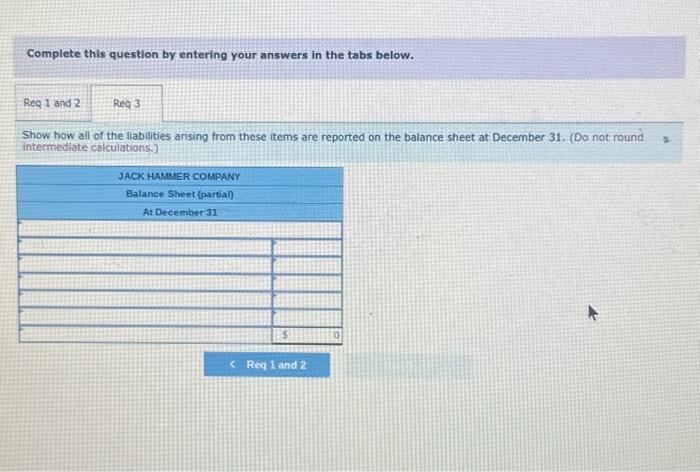

PA10-2 (Algo) Recording and Reporting Current Liabilities with Evaluation of Effects on the Debt-toAssets Ratio [LO 10-2, LO 10-5] Jack Hammer Company completed the following transactions. The annual accounting period ends December 31. April 3e Recelved 5815 , 000 tron Coemerce Bank after signing a 12-month, 7 percent, promissory note. June 6 Purchased merchandise on account at a cost of 576 ,000. (Assune a perpetual inventory systee:) July 15 Paid for the June 5 porchase August 31 Signed a contract to mrovide security service to a sa11 aparthent complex starting an Septenter, and collected 51 manths fees in advance, apounting to 324,690 . Decenber 31 Deternined salary and wages of \$41, 00e were earned but not yer baid as of Decenber 31 (ignore payro11 taxes) Oecrober 31 Adjusted the accounts of year-end, relating to interest. Decenber a1 Adjusted the accounts at year-and, relating to secuejty servace Required: 1. 8 2. Prepare journal entries for each of the transactions thiough August 31 and adjusting entries required on December 31 3. Show how all of the liobities arising from these items are reported on the balance sheet ot December 31 . Complete this question by entering your answers in the tabs below. Prepare joumai entries for exch of the transactions through August 31 and adjusting entries required on December 31 . 600 not round Journal entry worksheet Prepare joumal entries for each of the transactions through Auqust 31 and adjusting entries required on December 31. (Do not round intermediate caiculations. if no entry is required for a transaction/event, select "No Journal Entry Requised" in the first account field.) Journal entry worksheet Complete this question by entering your answers in the tabs below. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31 . (Do not round intermediate calculations.) PA10-2 (Algo) Recording and Reporting Current Liabilities with Evaluation of Effects on the Debt-toAssets Ratio [LO 10-2, LO 10-5] Jack Hammer Company completed the following transactions. The annual accounting period ends December 31. April 3e Recelved 5815 , 000 tron Coemerce Bank after signing a 12-month, 7 percent, promissory note. June 6 Purchased merchandise on account at a cost of 576 ,000. (Assune a perpetual inventory systee:) July 15 Paid for the June 5 porchase August 31 Signed a contract to mrovide security service to a sa11 aparthent complex starting an Septenter, and collected 51 manths fees in advance, apounting to 324,690 . Decenber 31 Deternined salary and wages of \$41, 00e were earned but not yer baid as of Decenber 31 (ignore payro11 taxes) Oecrober 31 Adjusted the accounts of year-end, relating to interest. Decenber a1 Adjusted the accounts at year-and, relating to secuejty servace Required: 1. 8 2. Prepare journal entries for each of the transactions thiough August 31 and adjusting entries required on December 31 3. Show how all of the liobities arising from these items are reported on the balance sheet ot December 31 . Complete this question by entering your answers in the tabs below. Prepare joumai entries for exch of the transactions through August 31 and adjusting entries required on December 31 . 600 not round Journal entry worksheet Prepare joumal entries for each of the transactions through Auqust 31 and adjusting entries required on December 31. (Do not round intermediate caiculations. if no entry is required for a transaction/event, select "No Journal Entry Requised" in the first account field.) Journal entry worksheet Complete this question by entering your answers in the tabs below. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31 . (Do not round intermediate calculations.)