Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer ASAP. PART I: INTRA-ENTITY INVENTORY TRANSFER (8 POINTS) Pit Corporation owns 90% of Stap Company's autstandine comman stock. On 08/28/22, Pit sold inventary

please answer ASAP.

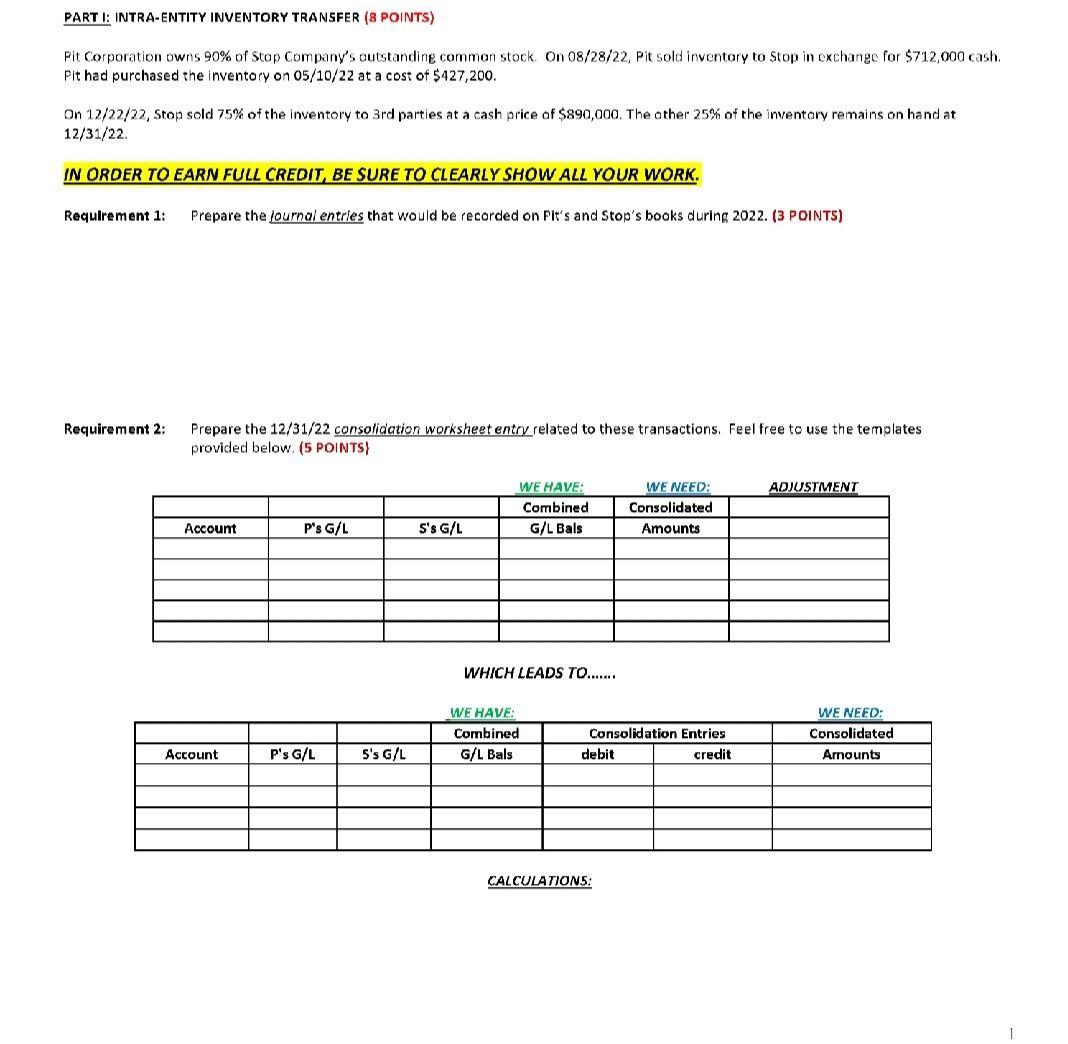

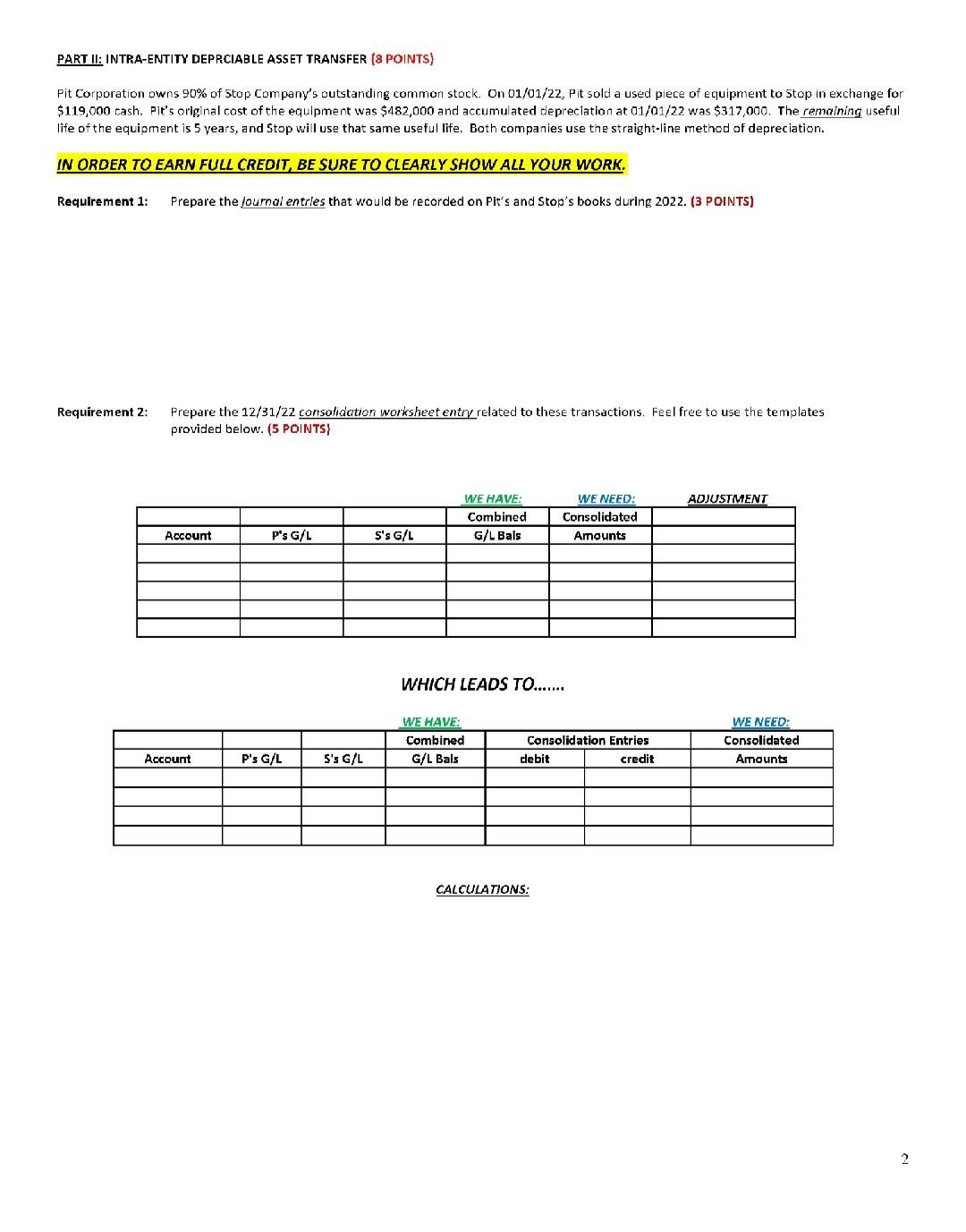

PART I: INTRA-ENTITY INVENTORY TRANSFER (8 POINTS) Pit Corporation owns 90% of Stap Company's autstandine comman stock. On 08/28/22, Pit sold inventary to Stop in exchange for $712,000 cash. Pit had purchased the inventory on 05/10/22 at a cost of $427,200. On 12/22/22, Stop sold 75% of the inventory to 3 rd parties at a cash price of $890,000. The other 25% of the inventory remains on hand at 12/31/22. IN OROER TO EARN FULL CREOIT, BE SURE TO CLEARLY SHOW ALL YOUR WORK. Requirement 1: Prepare the lournal entrles that would be recorded on Fit's and Stop's books during 2022. (3 P0INTS) Requirement 2: Prepare the 12/31/22 consolidation worksheet entry related to these transactions. Feel free to use the templates provided below. (5 POINTS\} WHICH LEADS TO...... CALCULATIONS: PART II: INTRA-ENTITY DEPRCIABLE ASSET TRANSFER (\$ POINTS) Pit Corporation owns 90% of Stop Company's outstanding common stock. On 01/01/22, Pit sold a used piece of equipment to Stop in exchange for $119,000 cash. Plt's original cost of the equipment was $482,000 and accumulated depreciation at 01/01/22 was $317,000, The remaining useful life of the equipment is 5 vears, and Stop will use that same useful life. Both companies use the straight-line method of depreciation. IN OROER TO EARN FULL CREOIT, BE SURE TO CLEARLY SHOW ALL YOUR WORK. Requirement 1: Prepare the lournal entrles that would be recorded on Pit's and Stop's books during 2022. (3 POINTS) Requirement 2: Prepare the 12/31/22 consolidation worksheet entru related to these transactions. Feel free to use the templates provided below. (5 POINTS) WHICH LEADS TO...... CALCULATIONS: PART I: INTRA-ENTITY INVENTORY TRANSFER (8 POINTS) Pit Corporation owns 90% of Stap Company's autstandine comman stock. On 08/28/22, Pit sold inventary to Stop in exchange for $712,000 cash. Pit had purchased the inventory on 05/10/22 at a cost of $427,200. On 12/22/22, Stop sold 75% of the inventory to 3 rd parties at a cash price of $890,000. The other 25% of the inventory remains on hand at 12/31/22. IN OROER TO EARN FULL CREOIT, BE SURE TO CLEARLY SHOW ALL YOUR WORK. Requirement 1: Prepare the lournal entrles that would be recorded on Fit's and Stop's books during 2022. (3 P0INTS) Requirement 2: Prepare the 12/31/22 consolidation worksheet entry related to these transactions. Feel free to use the templates provided below. (5 POINTS\} WHICH LEADS TO...... CALCULATIONS: PART II: INTRA-ENTITY DEPRCIABLE ASSET TRANSFER (\$ POINTS) Pit Corporation owns 90% of Stop Company's outstanding common stock. On 01/01/22, Pit sold a used piece of equipment to Stop in exchange for $119,000 cash. Plt's original cost of the equipment was $482,000 and accumulated depreciation at 01/01/22 was $317,000, The remaining useful life of the equipment is 5 vears, and Stop will use that same useful life. Both companies use the straight-line method of depreciation. IN OROER TO EARN FULL CREOIT, BE SURE TO CLEARLY SHOW ALL YOUR WORK. Requirement 1: Prepare the lournal entrles that would be recorded on Pit's and Stop's books during 2022. (3 POINTS) Requirement 2: Prepare the 12/31/22 consolidation worksheet entru related to these transactions. Feel free to use the templates provided below. (5 POINTS) WHICH LEADS TO...... CALCULATIONSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started