Answered step by step

Verified Expert Solution

Question

1 Approved Answer

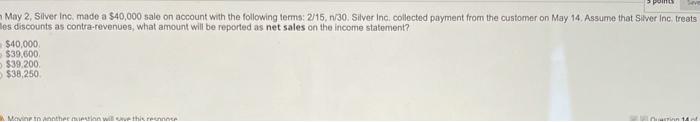

PLEASE ANSWER ASAP Pom May 2, Silver Inc, made a $40,000 sale on account with the following terms: 215, n/30. Silver Inc. collected payment from

PLEASE ANSWER ASAP

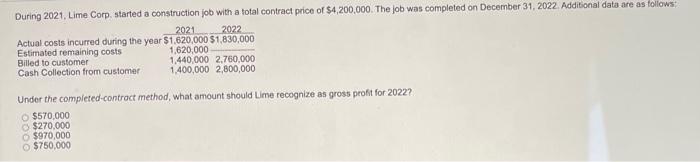

Pom May 2, Silver Inc, made a $40,000 sale on account with the following terms: 215, n/30. Silver Inc. collected payment from the customer on May 14. Assume that siver Inc. treats les discounts as contra-revenues, what amount will be reported as net sales on the income statement? $40,000 $39,600 $39.200 $38,250 Maven them this 12 2022 During 2021, Lime Corp. started a construction job with a total contract price of $4,200,000. The job was completed on December 31, 2022. Additional data are as follows: 2021 Actual costs incurred during the year $1,620,000 $1,830,000 Estimated remaining costs 1,620,000 Billed to customer 1.440,000 2.760,000 Cash Collection from customer 1,400,000 2,800,000 Under the completed-contract method, what amount should Lime recognize as gross profit for 2022? $570,000 $270.000 $970,000 $750,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started