please answer asap

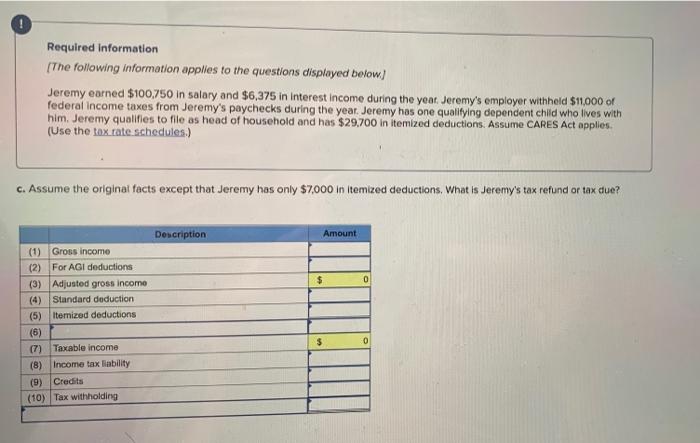

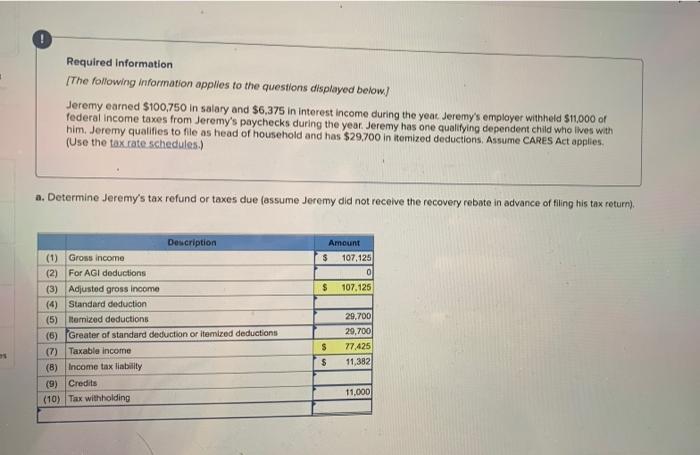

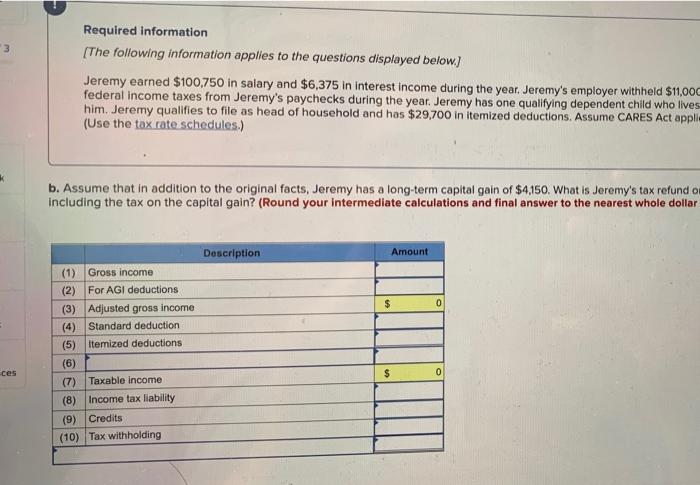

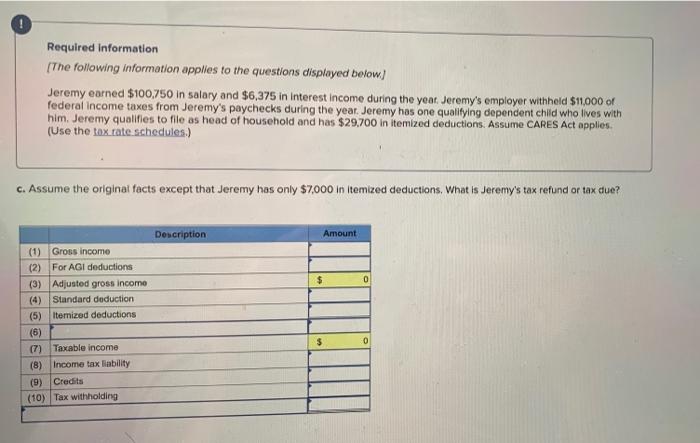

! Required Information [The following information applies to the questions displayed below.) Jeremy earned $100,750 in salary and $6,375 in interest income during the year. Jeremy's employer withheld S11,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $29.700 in itemized deductions. Assume CARES Act applies (Use the tax rate schedules.) a. Determine Jeremy's tax refund or taxes due (assume Jeremy did not receive the recovery rebote in advance of filing his tax return). Description Amount $ 107,125 0 $ 107.125 (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) tomized deductions (6) Greater of standard deduction or itemized deductions (7) Taxable income (8) Income tax liability (9) Credits (10) Tax withholding 29.700 29,700 77.425 11,382 $ $ 11,000 Required information [The following information applies to the questions displayed below.) 3 Jeremy earned $100,750 in salary and $6,375 in interest Income during the year. Jeremy's employer withheld $11,000 federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child who lives him. Jeremy qualifies to file as head of household and has $29,700 in itemized deductions. Assume CARES Act appli (Use the tax rate schedules.) k b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $4,150. What is Jeremy's tax refund o including the tax on the capital gain? (Round your intermediate calculations and final answer to the nearest whole dollar Description Amount $ 0 (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) (7) Taxable income (8) Income tax liability (9) Credits (10) Tax withholding ces $ 0 Required information [The following information applies to the questions displayed below) Jeremy earned $100,750 in salary and $6,375 in Interest income during the year. Jeremy's employer withheld $11,000 of federal income taxes from Jeremy's paychecks during the year. Jeremy has one qualifying dependent child who lives with him. Jeremy qualifies to file as head of household and has $29.700 in itemized deductions. Assume CARES Act opples. (Use the tax rate schedules.) c. Assume the original facts except that Jeremy has only $7,000 in Itemized deductions. What is Jeremy's tax refund or tax cue? Description Amount $ 0 (1) Gross income (2) For AGI deductions (3) Adjusted gross incomo (4) Standard deduction (5) itemized deductions (6) (7) Taxable income (8) Income tax liability (9) Credits (10) Tax withholding $ 0

please answer asap

please answer asap