Please answer ASAP, thank you

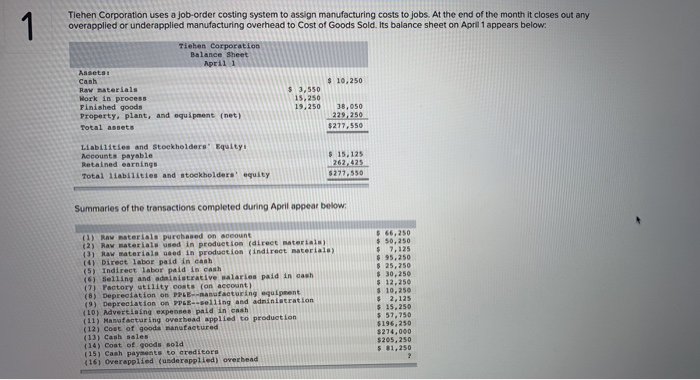

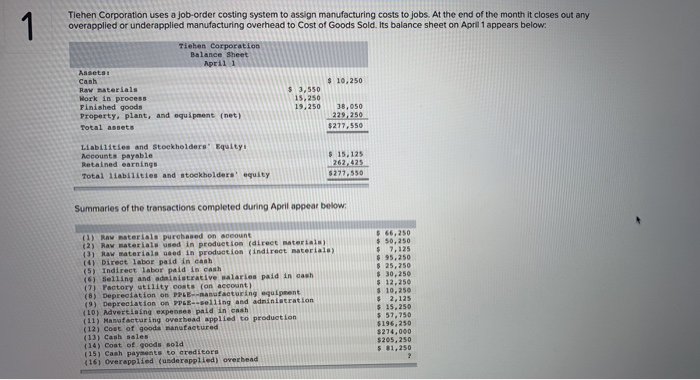

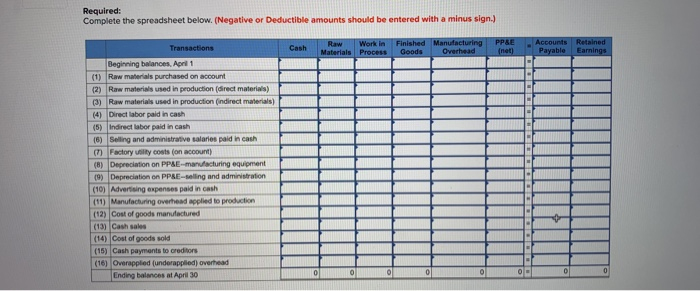

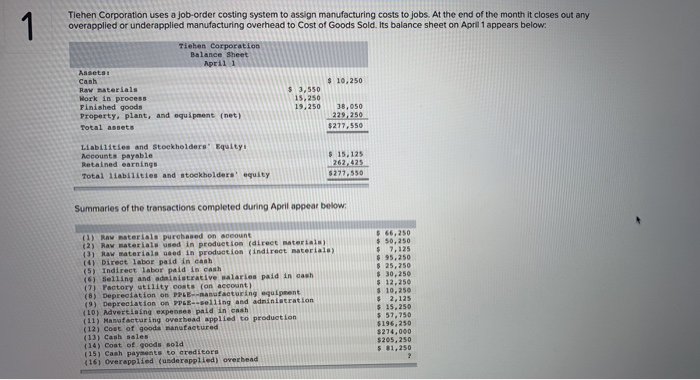

1 Tiehen Corporation uses a job-order costing system to assign manufacturing costs to jobs. At the end of the month it closes out any overapplied or underapplied manufacturing overhead to Cost of Goods Sold. Its balance sheet on April 1 appears below: $ 10.250 Tiehen Corporation Balance Sheet April 1 Assets: Cash Raw materials Work in process Finished goods Property, plant, and equipment (net) Total assets $ 3,550 15,250 19,250 38,050 229.250 $277.550 Liabilities and Stockholders' Equity! Accounts payable Retained earnings Total liabilities and stockholders' equity $ 15,125 262, 425 $277,550 Summaries of the transactions completed during April appear below: (1) Raw materials purchased on account (2) Raw materials used in production (direct materiale (3) Raw materials used in production (indirect materiale) (4) Direct labor paid in cash (5) Indirect labor paid in cash (6) Bielling and administrative salaries paid in cash (7) Factory utility costs (on account) (8) Depreciation on PPLE-ranufacturing equipment (9) Depreciation on PPLE--selling and administration (10) Advertising expenses paid in cash (11) Manufacturing overhead applied to production (12) Cost of good manufactured (13) Cash sales (14) Cost of goods sold (15) Cash payments to creditors (16) Overapplied (underapplied) overhead $ 66,250 $ 50,250 $ 7,125 $ 95,250 $ 25,250 $ 30,250 $ 12,250 $ 10,250 $ $ 57,750 $196,250 $274,000 $205, 250 $ 81,250 $ 2,125 15.250 Required: Complete the spreadsheet below. (Negative or Deductible amounts should be entered with a minus sign.) Cash Raw Work in Materials Process Finished Manufacturing Goods Overhead PP&E (net) Accounts Retained Payable Earnings Transactions Beginning balances, April 1 (1) Raw materials purchased on account (2) Raw materials used in production (direct materials) (3) Raw materials used in production (indirect materials) (4) Direct labor paid in cash (5) Indirect labor paid in cash (6) Selling and administrative salarios paid in cash (7) Factory will costs on account) (8) Depreciation on PP&E-maracturing equipment (9) Depreciation on PPRE-selling and administration (10) Advertising expenses paid in cash (11) Manufacturing overhead applied to production (12) Cost of goods manufactured (13) Cash sales (14) Cost of goods sold (15) Cash payments to creditors (16) Overapplied (underapplied) overhead Ending balances at April 30 0 0 0 0 0 0