Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer ASAP! Thank you so much (Determining a firm's capital budge) Newcomb Vending Company manages soft drink dispensing machines in western Tennessee for several

please answer ASAP! Thank you so much

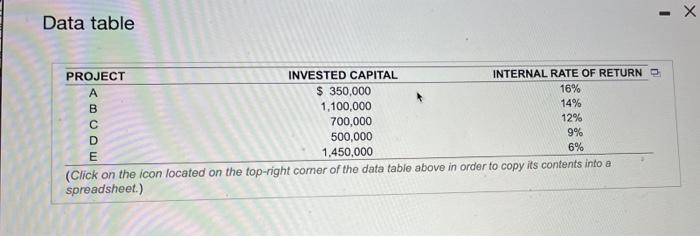

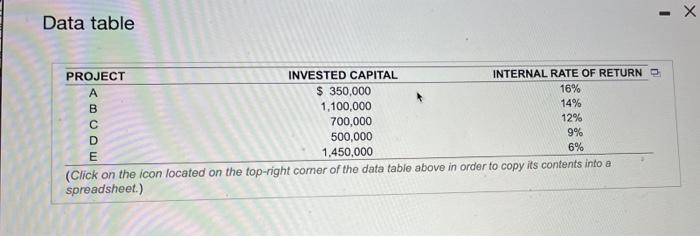

(Determining a firm's capital budge) Newcomb Vending Company manages soft drink dispensing machines in western Tennessee for several of the major bomling companies in the area. When a machine malfunctions the company sends out a repair technician, and it he cannot repair it on the spot he puts in a replacement machine so that the broken one can be taken to the firm's repair facility in Murfreesboro, Tennessee Betsy Newcomb recently completed her BBA from a nearby university and has been trying to incorporate as much of what she leamed as possible into the an operations of her family business. Specifically, Betsy recently reviewed the firm's capital structure and estimated that the firm's weighted average cost of capital is approximately 13%. She hopes to help her father determine which of several major capital expenditures he should make in the current year based on a comparison of the rates of return she estimated for each project (that is, thu internal rate of retum) and the firm's cost of capital. Specifically, the firm is considering the following projects (ranked by their internal rate of retum all five of the investments being considered by Newcomb are of similar risk and that risk is very similar to that of the company as a whole, which project() should Betsy recommend them undertake? You may assume that the firm can raise all the capital it needs to fund its investments at the cost of capital of 13% Explain your answer of the form can raise all the capital it needs to fund its investments at the cost of capital of 13%, which projects should Betsy recommend the firm undertake? (Select the best choice below) A Projects C, D, and because they offer the rates of return that are less than the firm's 13% cost of capital OB. There is not enough information to make the investment decision OC Projects A and B because they offer the rates of return that exceed the firm's 13% cost of capital OD Project A only because it offers the highest rate of return OE Project E only because it offers the lowest rate of return Data table PROJECT INVESTED CAPITAL INTERNAL RATE OF RETURN $ 350,000 16% B 1,100,000 14% 700,000 12% D 500,000 9% E 1.450,000 6% (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) mo0 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started