Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer asap, thank you The condensed, adjusted trial balance of the David and Richard Partnership as at December 31,2024, appears below: The partnership agreement

please answer asap, thank you

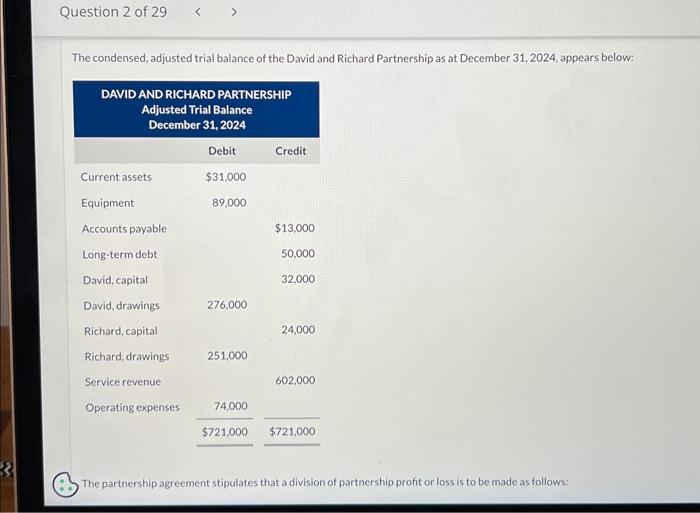

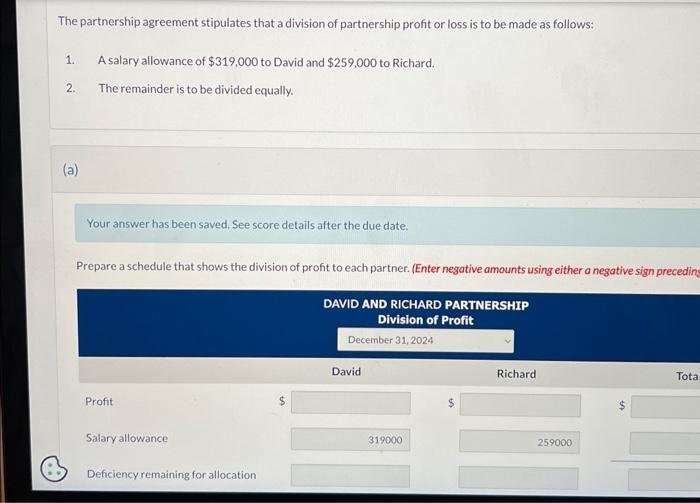

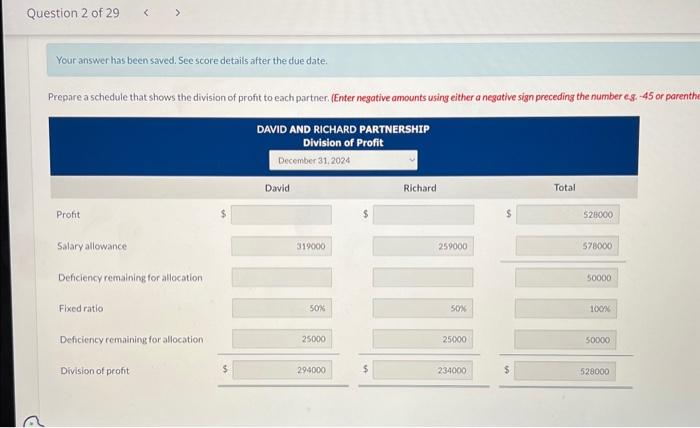

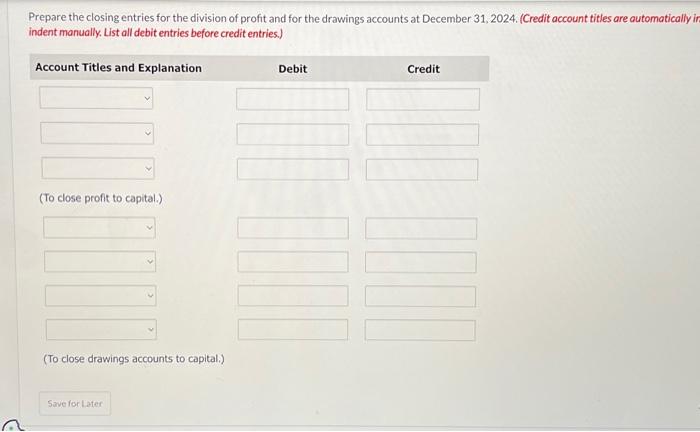

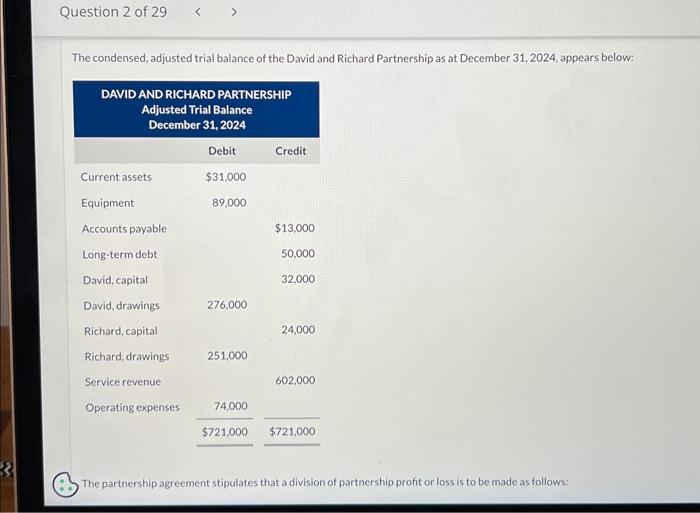

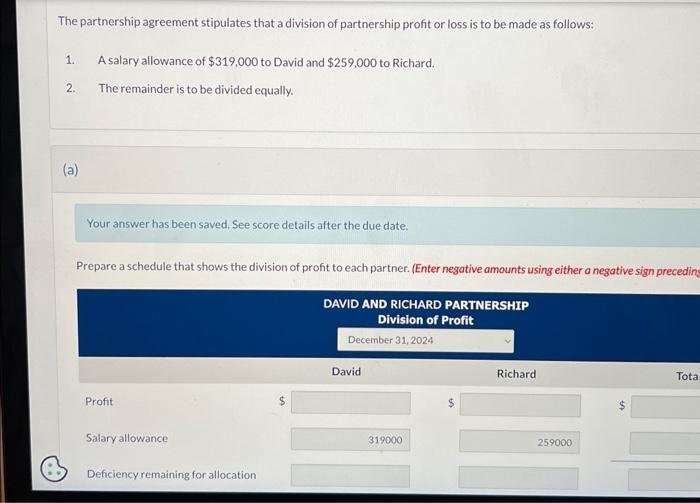

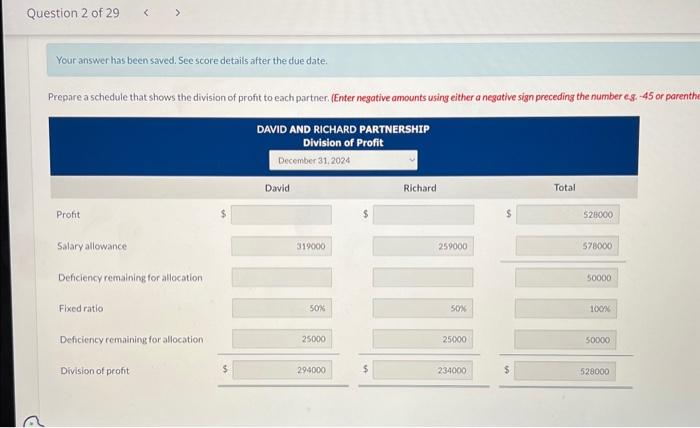

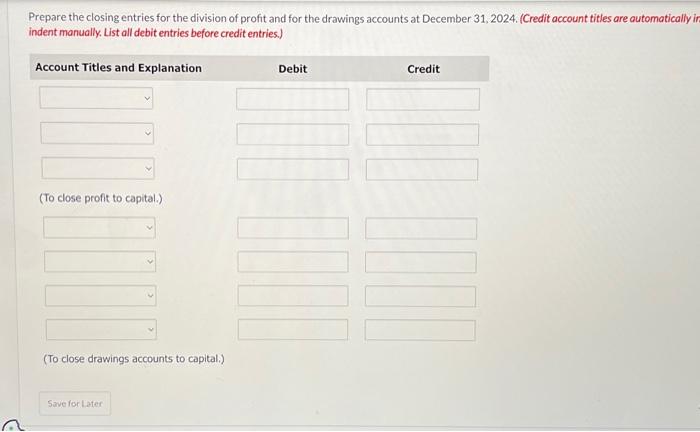

The condensed, adjusted trial balance of the David and Richard Partnership as at December 31,2024, appears below: The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows: The partnership agreement stipulates that a division of partnership profit or loss is to be made as follows: 1. A salary allowance of $319,000 to David and $259,000 to Richard. 2. The remainder is to be divided equally. (a) Your answer has been saved. See score details after the due date. Prepare a schedule that shows the division of profit to each partner. (Enter negative amounts using either a negative sign precedin Your answerhas been saved. See score details after the due date. Prepare the closing entries for the division of profit and for the drawings accounts at December 31, 2024. (Credit account titles are automatically indent manually. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started