Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer asap ty On January 31 2022 Tyco Lid purchased a factory that consisted of land building and machinery. The purchase costs are listed

please answer asap ty

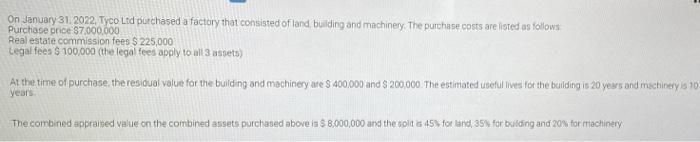

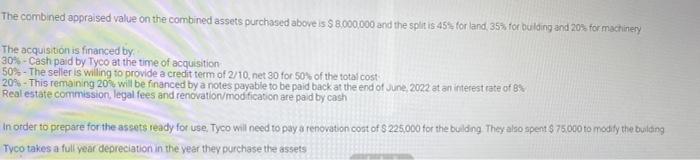

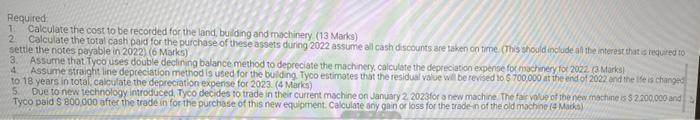

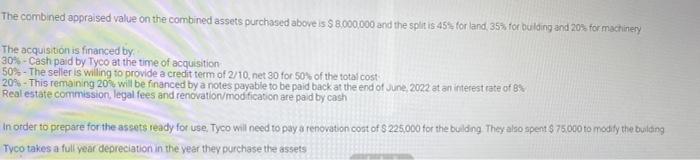

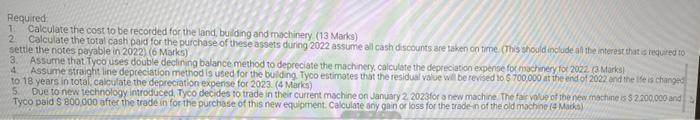

On January 31 2022 Tyco Lid purchased a factory that consisted of land building and machinery. The purchase costs are listed as follows Purchase price $7.000.000 Real estate commission fees $ 225,000 Legal fees $ 100,000 (the legal fees apply to all 3 assets) At the time of purchase the residual value for the building and machinery are $ 400,000 and $ 200.000 The estimated setul lives for the building is 20 years and machinery is 10 years The combined appraised value on the combined assets purchased above is $8,000,000 and the spilt 45for land 35 for building and 20% for machinery The combined appraised value on the combined assets purchased above is $8,000,000 and the split is 45% for land 35% for building and 20% for machinery The acquisition is financed by 30%-Cash paid by Tyco at the time of acquisition 50% - The seller is willing to provide a credit term of 2/10, net 30 for 50% of the total cost 20% - This remaining 207 will be financed by a notes payable to be paid back at the end of June, 2022 at an interest rate of 8% Real estate commission, legal fees and renovation/modification are paid by cash In order to prepare for the assets ready for use. Tyco will need to pay a renovation cost of $225,000 for the building They also spent $ 75,000 to modify the building Tyco takes a full year depreciation in the year they purchase the assets Required 1 Calculate the cost to be recorded for the land, building and machinery (13 Marks) 2. Calculate the total cash paid for the purchase of these assets during 2022 assume all cash discounts are taken on time (This should include all the interest that is required to settle the notes payable in 2022) (6 Marks) 3 Assume that Tyco uses double declining balance method to depreciate the machinery, calculate the depreciation expense for machinery for 2022. (a Marks 4 Assume straight line depreciation method is used for the building Tyco estimates that the residual value will be revised 10 $ 700,000 at the end of 2022 and the fes changed to 18 years in total calculate the depreciation expense for 2023. (4 Marks) 5. Due to new technology introduced, Tyco decides to trade in their current machine on January 2 2023for a new machine. The tale value of the new machine is $2.200,000 and Tyco paid S 800.000 after the trade in for the purchase of this new equipment Calculate any gain or loss for the trade-in of the old machine (4 Mackay On January 31 2022 Tyco Lid purchased a factory that consisted of land building and machinery. The purchase costs are listed as follows Purchase price $7.000.000 Real estate commission fees $ 225,000 Legal fees $ 100,000 (the legal fees apply to all 3 assets) At the time of purchase the residual value for the building and machinery are $ 400,000 and $ 200.000 The estimated setul lives for the building is 20 years and machinery is 10 years The combined appraised value on the combined assets purchased above is $8,000,000 and the spilt 45for land 35 for building and 20% for machinery The combined appraised value on the combined assets purchased above is $8,000,000 and the split is 45% for land 35% for building and 20% for machinery The acquisition is financed by 30%-Cash paid by Tyco at the time of acquisition 50% - The seller is willing to provide a credit term of 2/10, net 30 for 50% of the total cost 20% - This remaining 207 will be financed by a notes payable to be paid back at the end of June, 2022 at an interest rate of 8% Real estate commission, legal fees and renovation/modification are paid by cash In order to prepare for the assets ready for use. Tyco will need to pay a renovation cost of $225,000 for the building They also spent $ 75,000 to modify the building Tyco takes a full year depreciation in the year they purchase the assets Required 1 Calculate the cost to be recorded for the land, building and machinery (13 Marks) 2. Calculate the total cash paid for the purchase of these assets during 2022 assume all cash discounts are taken on time (This should include all the interest that is required to settle the notes payable in 2022) (6 Marks) 3 Assume that Tyco uses double declining balance method to depreciate the machinery, calculate the depreciation expense for machinery for 2022. (a Marks 4 Assume straight line depreciation method is used for the building Tyco estimates that the residual value will be revised 10 $ 700,000 at the end of 2022 and the fes changed to 18 years in total calculate the depreciation expense for 2023. (4 Marks) 5. Due to new technology introduced, Tyco decides to trade in their current machine on January 2 2023for a new machine. The tale value of the new machine is $2.200,000 and Tyco paid S 800.000 after the trade in for the purchase of this new equipment Calculate any gain or loss for the trade-in of the old machine (4 Mackay

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started