PLEASE ANSWER ASAP WILL UPVOTE

PLEASE ANSWER ALLLL QUESTIONS THANK YOU!!

5

6

7

REUPLOADED IMAGES PLEASE ANSWER ASAP!!!!!

5

6

7

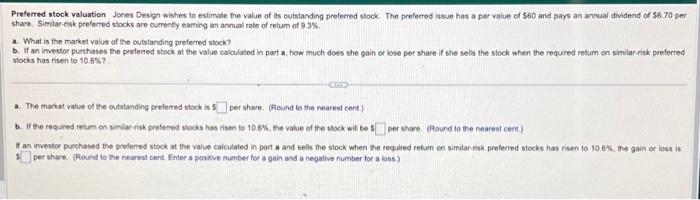

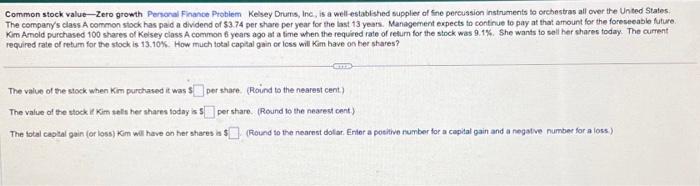

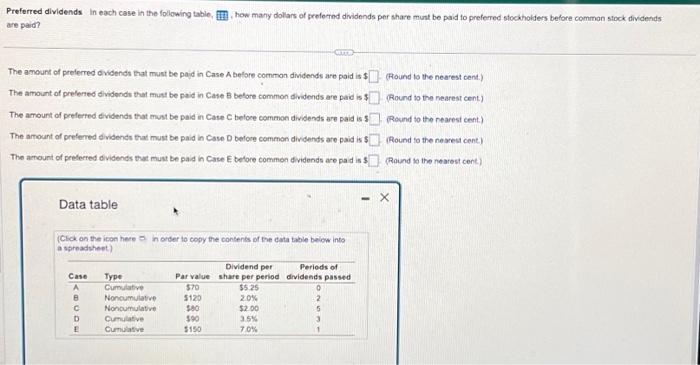

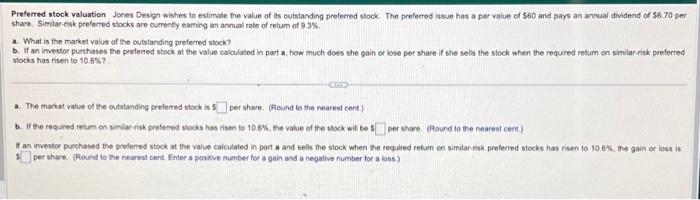

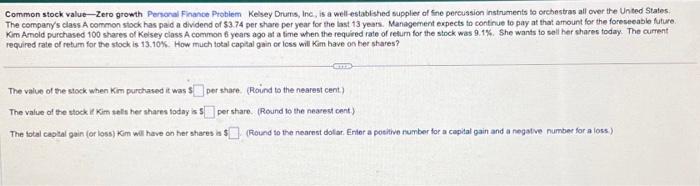

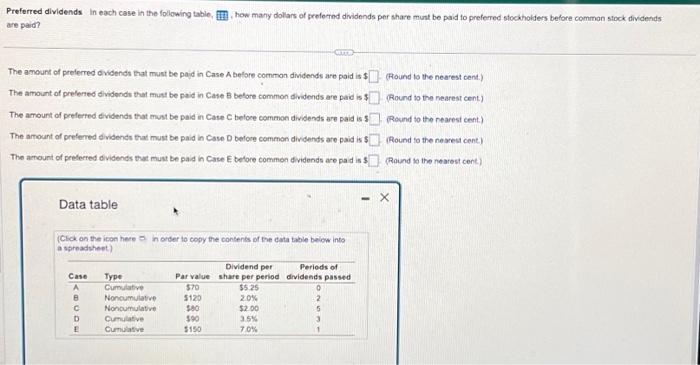

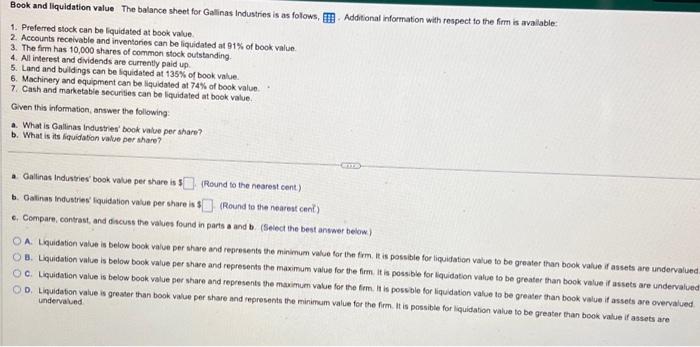

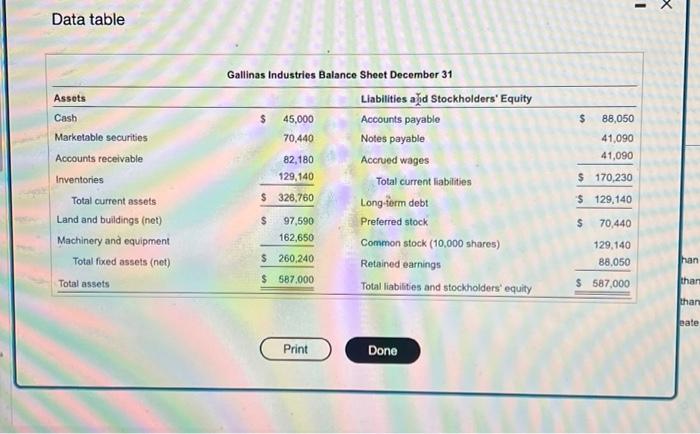

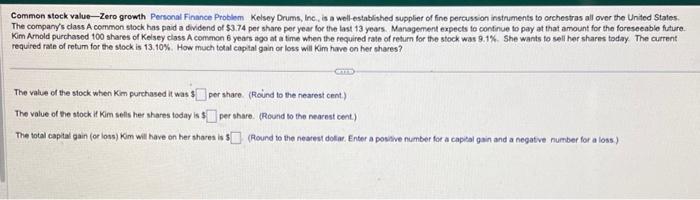

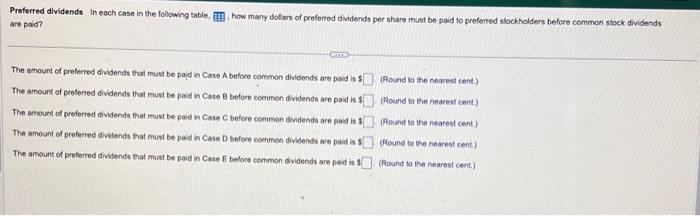

Preferred stock valuation Jones Design wiahes to estimate the value of is cutstanding prefered stock. The preferred issue has a par value of $60 and pays an annual dividend of $6.70 per share. Simlar-risk prelerted slocks are cumenty eaming an annual rate of retum of 93%. a. What is the market value of the eutstanding preferted stock? b. If an imestor purchases the preferred shock at the value calculated in part a, how much does the gain or lose per share if she sels the stock when the required retum on similar-nisk preferred stocks has risen to 10.5% ? a. The mariot vilue of the outstanding prolered stock is: per shase. (flound to the nearnst cont) b. If the required ratum on simlar risk prefeced atocks has risen to 10.6%, the value of the stock wit tes per share. (Round to the nearest cent.) If an invettor purchased the prefered stock at the value calculated in part a and sells the stock when the requined rotum on sirilar-fisk preferred stocks has risen to to.6\%, the gain or loss is per share. (Round to the nearest cent Enter a positve mumber for a gain and a negative number for a loss.) Common stock value-Zero growth Personal Finance Problem Kelsey Drums, Inc, is a well-established suppler of fine percussion instruments to orchestras all over the Unted States. The company's class. A common stock has pad a dividend of $3.74 per share per year for the last 13 years. Mandigement expects to continue to pay at that amount for the foreseeable future. Kim Amoid purchased 100 shares of Keisey class A common 6 years ago at a time when the required rate of retum for the stock was 9.1 . required rate of retum for the stock is 13.10\%. How much total capital gain or less will KGm have on her shares? The value of the stock when Kim purchased it was 1 per share. (Roind to the nearest cent.) The value of the stock Kim sels her shares foday is 1 per share. (Rovind to the nearest cent) The fotal captal gain (or loss) Kim will have on her shares is : (Round to the nearest dolar. Enior a poeitive number for a capital gain and a negatve number for a loss) The amount of prelened dividonds that muat be paid in Case B belore common dividends are paid is 4 (Round to the nearest cent) The amount of preferred dividends that must be paid in Case C beloce common dividends are paid is ? (Round to the nearest cent.) The amount of prefered elvidends that must be paid in Csse D before common dividends are paid is 4 (Round to the nearest cent) The arnount of preferred dividends that munt be paid in Case E belore common dividends are pad is 1 (Round to the nearost cent) Data table (Clck on the icon here = in order to copy the contents of the data table below into a spreadshect) Book and liquidation value. The balance sheet for Gallinas Industrios is as folows, Additional information with respect to the firm is avallable: 1. Preferred stock can be liquidated at book value 2. Accounts recelvable and inventorios can be liquidated at 91% of book value. 3. The firm has 10,000 shares of common stock outstanding. 4. All interest and dividends are currently paid up 5. Land and buldings can be lquidated at 135% of book value. 6. Machinery and equipment can be liquidaled at 74% of book value. 7. Cash and marketabie securities can be liquidated at book value. Given this information, answer the following: a. What is Gallinas industries' book value per share? b. What is its fquidation value per ahare? a. Gallinas industres' book value per share is $ (Round to the nearest cent) b. Oallinas industries' lquidation value per share is 1 (Round to the nearest cent) c. Compare, contrast, and discuss the values found in parts a and b. (Select the best answer below) c. Liquidation value is below book value per share and represents the maximum value for the firm it is possible for lquidation value to be greater than book value if assets are undervaluec D. Liquidation value is greater than book value per share and represents the minimum vale the ferm. It is possble for liquidation value to be greater than book value if assets are overvalued undervalued Data table Common stock value-Zero growh Personal Finance Problom Kelsey Drums, Inc, is a well-establithed supplier of fine percussion instruments to orchestras all over the United States. The company's dass A common slock has poid a dividend of $3.74 per share per year for the last 13 years. Management expects fe continue to pay at that amount for the foreseeable future. Kim Amold purchased 100 shares of Keisey class A common 6 years ago at a time when the pequired rate of retum lor the stock was 9.1%. She wants to sell her shares today. The current required rate of retum for the slock is 13.10%. How much total copital gain of loss will Kim hwe on her shares? The value of the slock when Kim purchased it was ? per share. (Round to the nearest cent.) The value of the stock it Kim sells her shares today is $ per share. (Round to the nearest cent) The total capial gain (or lons) Kom wil have on her shares is 4 (Round to the nesrest dotar. Enter a possive number for a capical gain and a negatve number for a loss) Preferred dlvidends In each case in the following table, , how many dollars of preforred dividends per share must be paid to preferred stockholders before cemmon stock dividends are psid? The amount of prefered dividends that must be pad in Case A belore comman dividends are paid is 5 (Round lo the nearest cent.) (Rent The ampount of prelened dividends that must be paid in Case B before common dividends are pad is $ (Round to the nearest cent.) (Rhe amout of prest The amount of preferred dividends that must be paid in Case C before common didends are paid is 5 (Round to the nearest cent) The amount d prefered divends that must be pad in Cave D before common dividends wre poid is 5 (Round to the nearnst cent) The amount of proforred divibends that must be padd in Case E belore common dividends are paid is : (Round to the nearest cent) Preferred stock valuation Jones Design wiahes to estimate the value of is cutstanding prefered stock. The preferred issue has a par value of $60 and pays an annual dividend of $6.70 per share. Simlar-risk prelerted slocks are cumenty eaming an annual rate of retum of 93%. a. What is the market value of the eutstanding preferted stock? b. If an imestor purchases the preferred shock at the value calculated in part a, how much does the gain or lose per share if she sels the stock when the required retum on similar-nisk preferred stocks has risen to 10.5% ? a. The mariot vilue of the outstanding prolered stock is: per shase. (flound to the nearnst cont) b. If the required ratum on simlar risk prefeced atocks has risen to 10.6%, the value of the stock wit tes per share. (Round to the nearest cent.) If an invettor purchased the prefered stock at the value calculated in part a and sells the stock when the requined rotum on sirilar-fisk preferred stocks has risen to to.6\%, the gain or loss is per share. (Round to the nearest cent Enter a positve mumber for a gain and a negative number for a loss.) Common stock value-Zero growth Personal Finance Problem Kelsey Drums, Inc, is a well-established suppler of fine percussion instruments to orchestras all over the Unted States. The company's class. A common stock has pad a dividend of $3.74 per share per year for the last 13 years. Mandigement expects to continue to pay at that amount for the foreseeable future. Kim Amoid purchased 100 shares of Keisey class A common 6 years ago at a time when the required rate of retum for the stock was 9.1 . required rate of retum for the stock is 13.10\%. How much total capital gain or less will KGm have on her shares? The value of the stock when Kim purchased it was 1 per share. (Roind to the nearest cent.) The value of the stock Kim sels her shares foday is 1 per share. (Rovind to the nearest cent) The fotal captal gain (or loss) Kim will have on her shares is : (Round to the nearest dolar. Enior a poeitive number for a capital gain and a negatve number for a loss) The amount of prelened dividonds that muat be paid in Case B belore common dividends are paid is 4 (Round to the nearest cent) The amount of preferred dividends that must be paid in Case C beloce common dividends are paid is ? (Round to the nearest cent.) The amount of prefered elvidends that must be paid in Csse D before common dividends are paid is 4 (Round to the nearest cent) The arnount of preferred dividends that munt be paid in Case E belore common dividends are pad is 1 (Round to the nearost cent) Data table (Clck on the icon here = in order to copy the contents of the data table below into a spreadshect) Book and liquidation value. The balance sheet for Gallinas Industrios is as folows, Additional information with respect to the firm is avallable: 1. Preferred stock can be liquidated at book value 2. Accounts recelvable and inventorios can be liquidated at 91% of book value. 3. The firm has 10,000 shares of common stock outstanding. 4. All interest and dividends are currently paid up 5. Land and buldings can be lquidated at 135% of book value. 6. Machinery and equipment can be liquidaled at 74% of book value. 7. Cash and marketabie securities can be liquidated at book value. Given this information, answer the following: a. What is Gallinas industries' book value per share? b. What is its fquidation value per ahare? a. Gallinas industres' book value per share is $ (Round to the nearest cent) b. Oallinas industries' lquidation value per share is 1 (Round to the nearest cent) c. Compare, contrast, and discuss the values found in parts a and b. (Select the best answer below) c. Liquidation value is below book value per share and represents the maximum value for the firm it is possible for lquidation value to be greater than book value if assets are undervaluec D. Liquidation value is greater than book value per share and represents the minimum vale the ferm. It is possble for liquidation value to be greater than book value if assets are overvalued undervalued Data table Common stock value-Zero growh Personal Finance Problom Kelsey Drums, Inc, is a well-establithed supplier of fine percussion instruments to orchestras all over the United States. The company's dass A common slock has poid a dividend of $3.74 per share per year for the last 13 years. Management expects fe continue to pay at that amount for the foreseeable future. Kim Amold purchased 100 shares of Keisey class A common 6 years ago at a time when the pequired rate of retum lor the stock was 9.1%. She wants to sell her shares today. The current required rate of retum for the slock is 13.10%. How much total copital gain of loss will Kim hwe on her shares? The value of the slock when Kim purchased it was ? per share. (Round to the nearest cent.) The value of the stock it Kim sells her shares today is $ per share. (Round to the nearest cent) The total capial gain (or lons) Kom wil have on her shares is 4 (Round to the nesrest dotar. Enter a possive number for a capical gain and a negatve number for a loss) Preferred dlvidends In each case in the following table, , how many dollars of preforred dividends per share must be paid to preferred stockholders before cemmon stock dividends are psid? The amount of prefered dividends that must be pad in Case A belore comman dividends are paid is 5 (Round lo the nearest cent.) (Rent The ampount of prelened dividends that must be paid in Case B before common dividends are pad is $ (Round to the nearest cent.) (Rhe amout of prest The amount of preferred dividends that must be paid in Case C before common didends are paid is 5 (Round to the nearest cent) The amount d prefered divends that must be pad in Cave D before common dividends wre poid is 5 (Round to the nearnst cent) The amount of proforred divibends that must be padd in Case E belore common dividends are paid is : (Round to the nearest cent)