Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ASAP. WRONG ANSWERS WILL BE DOWNVOTED. I REALLY MEAN IT 14.1 The following are the statements of financial position of Percie, Robin and

PLEASE ANSWER ASAP. WRONG ANSWERS WILL BE DOWNVOTED. I REALLY MEAN IT

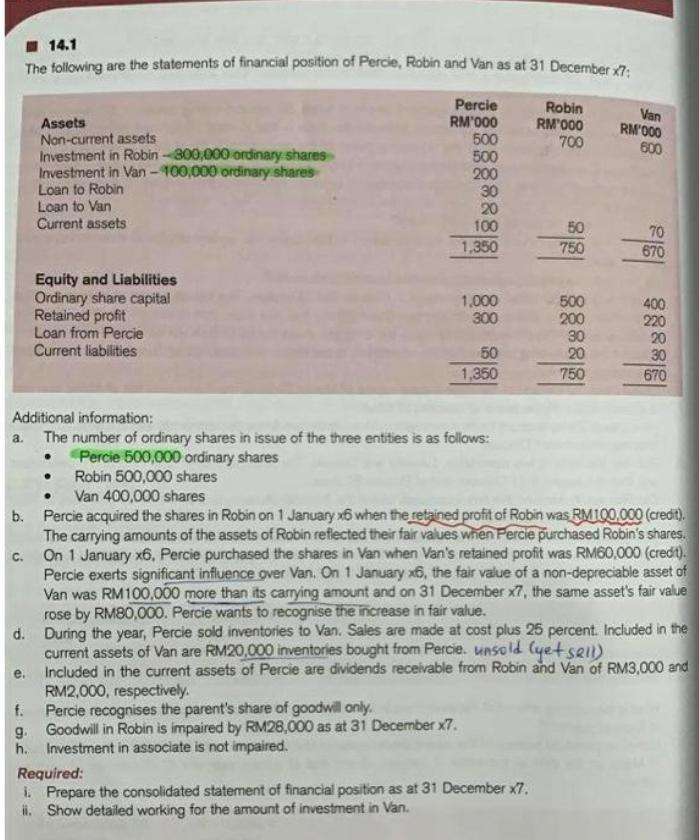

14.1 The following are the statements of financial position of Percie, Robin and Van as at 31 December x7 Robin RM'000 700 Van RM000 Percie RM'000 500 500 200 30 Assets Non-current assets Investment in Robin -- 300,000 ordinary shares Investment in Van - 100,000 ordinary shares Loan to Robin Loan to Van Current assets 600 20 100 1,350 50 750 70 670 Equity and Liabilities Ordinary share capital Retained profit Loan from Percie Current liabilities 1,000 300 500 200 30 20 750 400 220 20 30 670 50 1,350 Additional information: a. The number of ordinary shares in issue of the three entities is as follows: Percie 500,000 ordinary shares Robin 500,000 shares Van 400,000 shares b. Percie acquired the shares in Robin on 1 January 26 when the retained profit of Robin was RM100.000 (credit). The carrying amounts of the assets of Robin reflected their fair values when Percie purchased Robin's shares. C. On 1 January x6, Percie purchased the shares in Van when Van's retained profit was RM60,000 (credt). Percie exerts significant influence over Van On 1 January 26, the fair value of a non-depreciable asset of Van was RM100,000 more than its carrying amount and on 31 December x7, the same asset's fair value rose by RM80,000. Percie wants to recognise the increase in fair value. d. During the year, Percie sold inventories to Van. Sales are made at cost plus 25 percent. Included in the current assets of Van are RM20,000 inventories bought from Percie, unsold (yet sell) e. Included in the current assets of Percie are dividends receivable from Robin and Van of RM3,000 and RM2,000, respectively. f. Percie recognises the parent's share of goodwill only. 9. Goodwill in Robin is impaired by RM28,000 as at 31 December x7. h. Investment in associate is not impaired. Required: Prepare the consolidated statement of financial position as at 31 December x7 1. Show detailed working for the amount of investment in VanStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started