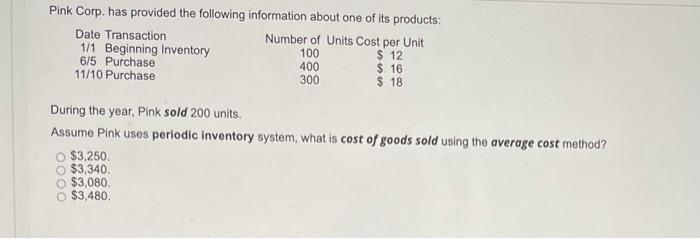

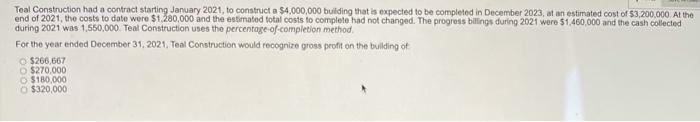

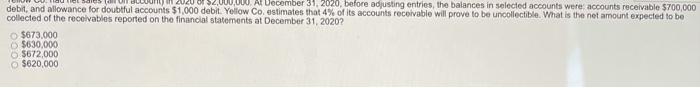

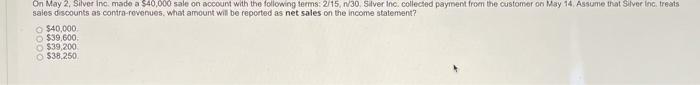

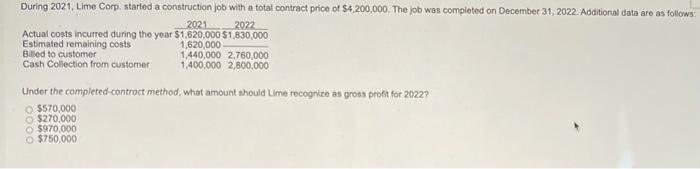

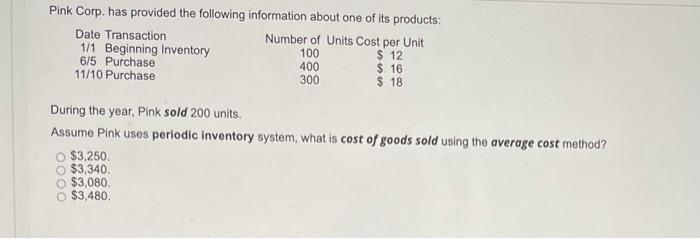

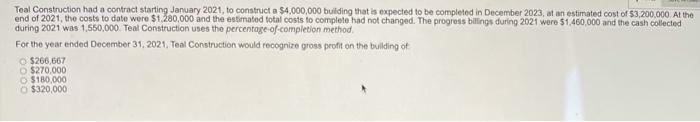

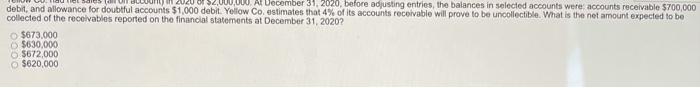

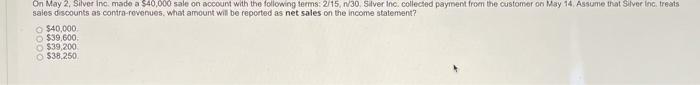

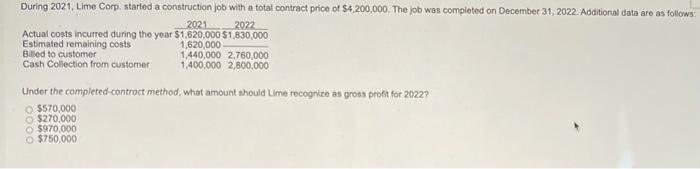

Pink Corp. has provided the following information about one of its products: Date Transaction Number of Units Cost per Unit 1/1 Beginning Inventory 100 $ 12 6/5 Purchase 400 $ 16 11/10 Purchase 300 $ 18 During the year, Pink sold 200 units. Assume Pink uses periodic Inventory system, what is cost of goods sold using the average cost method? $3,250 o $3,340 $3,080 $3,480 Teal Construction had a contract starting January 2021, to construct a $4,000,000 building that is expected to be completed in December 2023, at an estimated cost of $3,200,000. At the end of 2021, the costs to date were $1.280,000 and the estimated total costs to complete had not changed. The progress billings during 2021 were 51,460,000 and the cash collected during 2021 was 1,550,000. Teal Construction uses the percentage of completion method. For the year ended December 31, 2021. Teal Construction would recognize gross profit on the building of $266,667 O $270,000 $180,000 $320,000 m debit, and allowance for doubtful accounts $1,000 debit. Yellow Co. estimates that 4% of its accounts receivable will prove to be uncollectible. What is the net amount expected to be $2,000,000. Al December 31, 2020, before adjusting entries, the balances in selected accounts were accounts receivable $700,000 collected of the receivables reported on the financial statements at December 31, 20202 $673.000 $630,000 $672,000 $620,000 On May 2. Silver Inc. made a $40,000 sale on account with the following terms: 2/15 n/30. Silver Inc. collected payment from the customer on May 14. Assume that Silver Inc treats sales discounts as contra-revenues. What amount will be reported as net sales on the income statement? $40,000 $39.600 $39 200 $38.250 During 2021, Lime Corp, started a construction job with a total contract price of $4,200,000. The job was completed on December 31, 2022. Additional data are as follows 2021 2022 Actual costs incurred during the year $1,620,000 $1,830,000 Estimated remaining costs 1,620,000 Bed to customer 1.440,000 2.760,000 Cash Collection from customer 1,400,000 2,800,000 Under the completed contract method, what amount should Lime recognize as gross profit for 20227 $570,000 $270,000 $970,000 $750,000