Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer B Airayal, scoffe mag producer, senerally conducts over half of its business in the last month of the calendar year due to holldy

please answer B

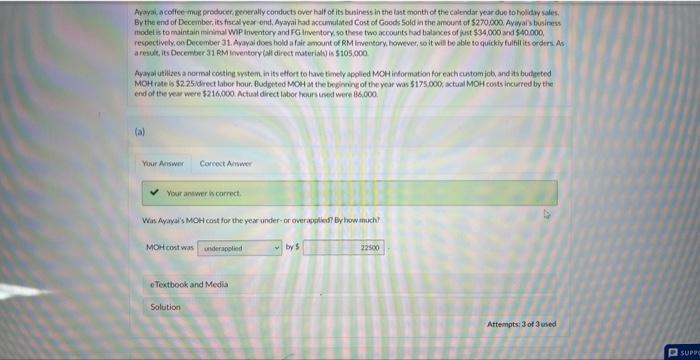

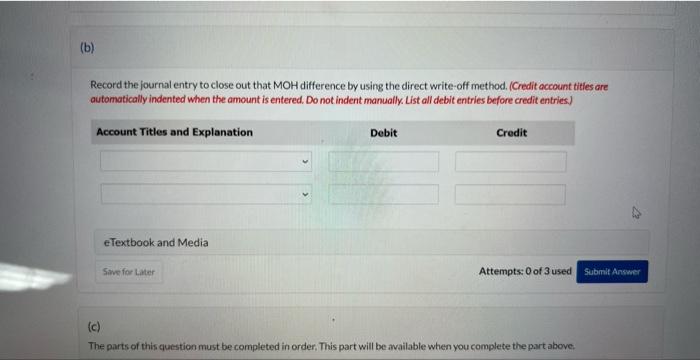

Airayal, scoffe mag producer, senerally conducts over half of its business in the last month of the calendar year due to holldy sales. model is to maintain minimal WaP Irventory and FG inventory so these two accounts had balances of fust $34,000 and 540.000 . recpectively, on December 31. Avayai does hold a fair amount of RM Inventary however, so it will be able to quickly fulfill its ordens As a result. its December 31 RM inventory (ali direct materials is $105.000 Ayayal utilizes a normal costing wstem in its effort to have timely applied MOH irformation for eacheustomjob and its budfeted MOH rate is $2.25 direct labor hour. Dudgeted MOH at the begining of the year was $175.000, actial MOH conts incired by the end of the vea were $216,000. Actual direct labor hours uned were 86,000 (a) Vour anwer in carrect. Was Ayaval's MOH cost for the year ander-or overapplicaf By how much? MOHcost was bys Record the journal entry to close out that MOH difference by using the direct write-off method. (Credit account tities are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) eTextbook and Media Attempts: 0 of 3 used (c) The parts of this question must be completed in order, This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started