Answered step by step

Verified Expert Solution

Question

1 Approved Answer

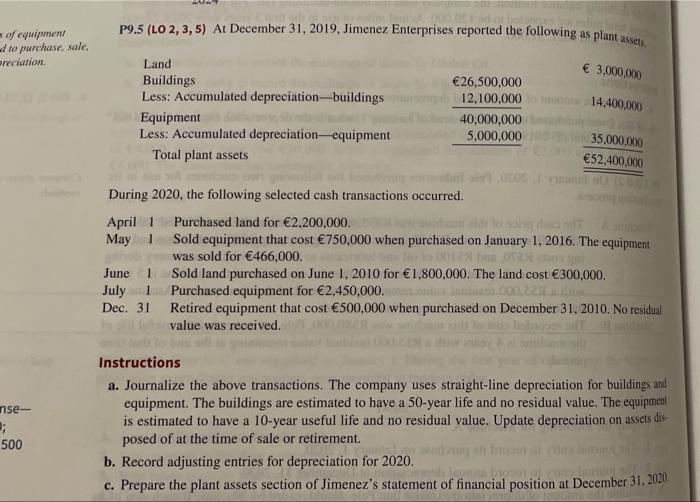

Please answer b and c here, WITH A SPECIFIC EXPLANATION OF WHY. thank you p9.5 (LO 2, 3, 5) At December 31, 2019, Jimenez Enterprises

Please answer b and c here, WITH A SPECIFIC EXPLANATION OF WHY.

p9.5 (LO 2, 3, 5) At December 31, 2019, Jimenez Enterprises reported the following as plant asset of equipment to purchase, sale. preciation. 3.000.000 Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation equipment Total plant assets 26,500,000 12.100,000 14.400,000 40,000,000 5,000,000 52,400,000 35,000,000 During 2020, the following selected cash transactions occurred. April 1 Purchased land for 2.200,000. May 1 Sold equipment that cost 750,000 when purchased on January 1, 2016. The equipment was sold for 466,000. 02 June Sold land purchased on June 1, 2010 for 1,800,000. The land cost 300.000 July Purchased equipment for 2,450,000. Dec. 31 Retired equipment that cost 500,000 when purchased on December 31, 2010. No residual value was received Inst 1 nse- 2; Instructions a. Journalize the above transactions. The company uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 50-year life and no residual value. The equipment is estimated to have a 10-year useful life and no residual value. Update depreciation on assets dis posed of at the time of sale or retirement. og bad b. Record adjusting entries for depreciation for 2020. c. Prepare the plant assets section of Jimenez's statement of financial position at December 31, 2020 500 thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started