Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer b and c only. thank you. Question 2 Jonathan is reviewing the activities for the past year. Sleep Well Inc. rents a small

Please answer b and c only. thank you.

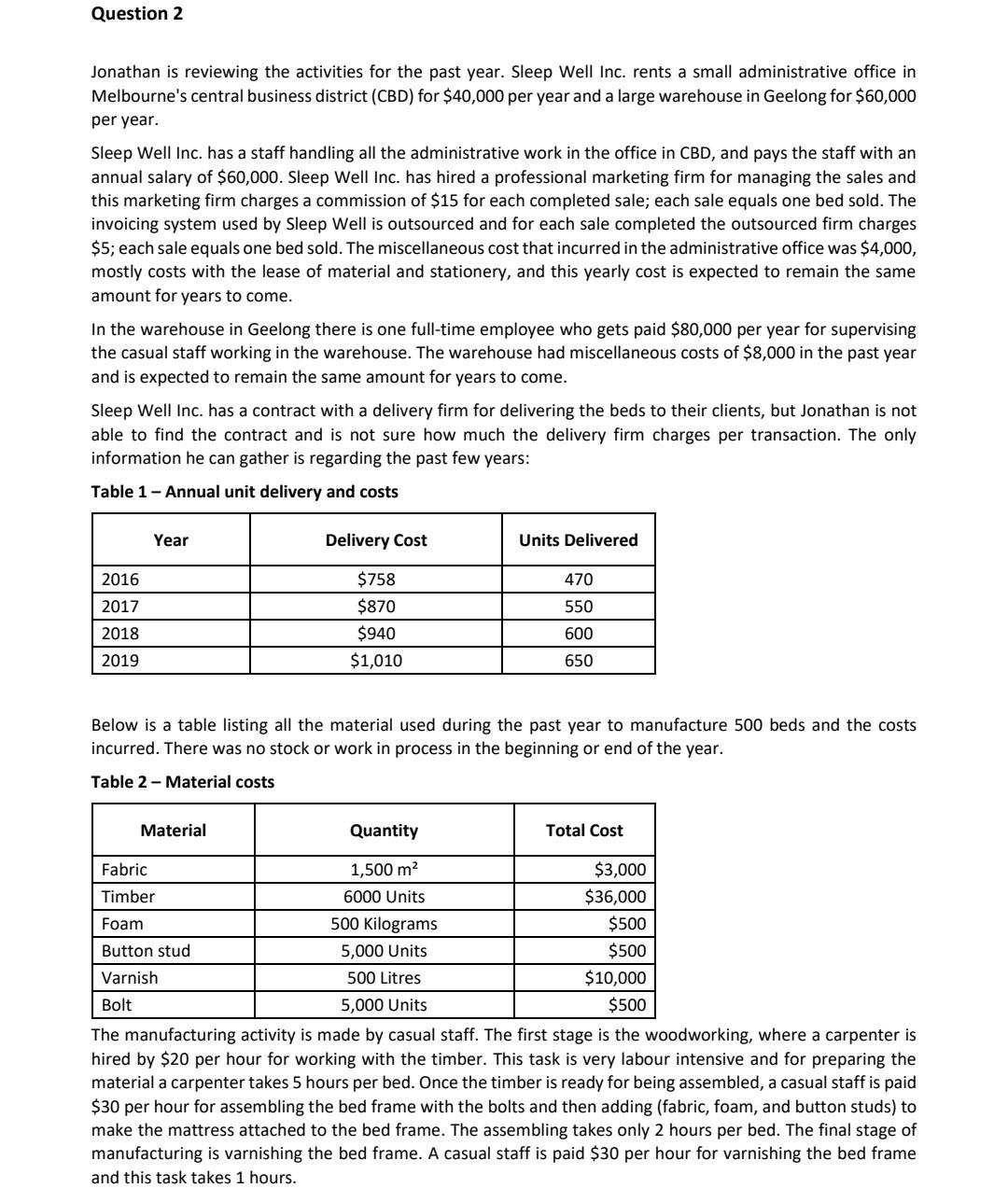

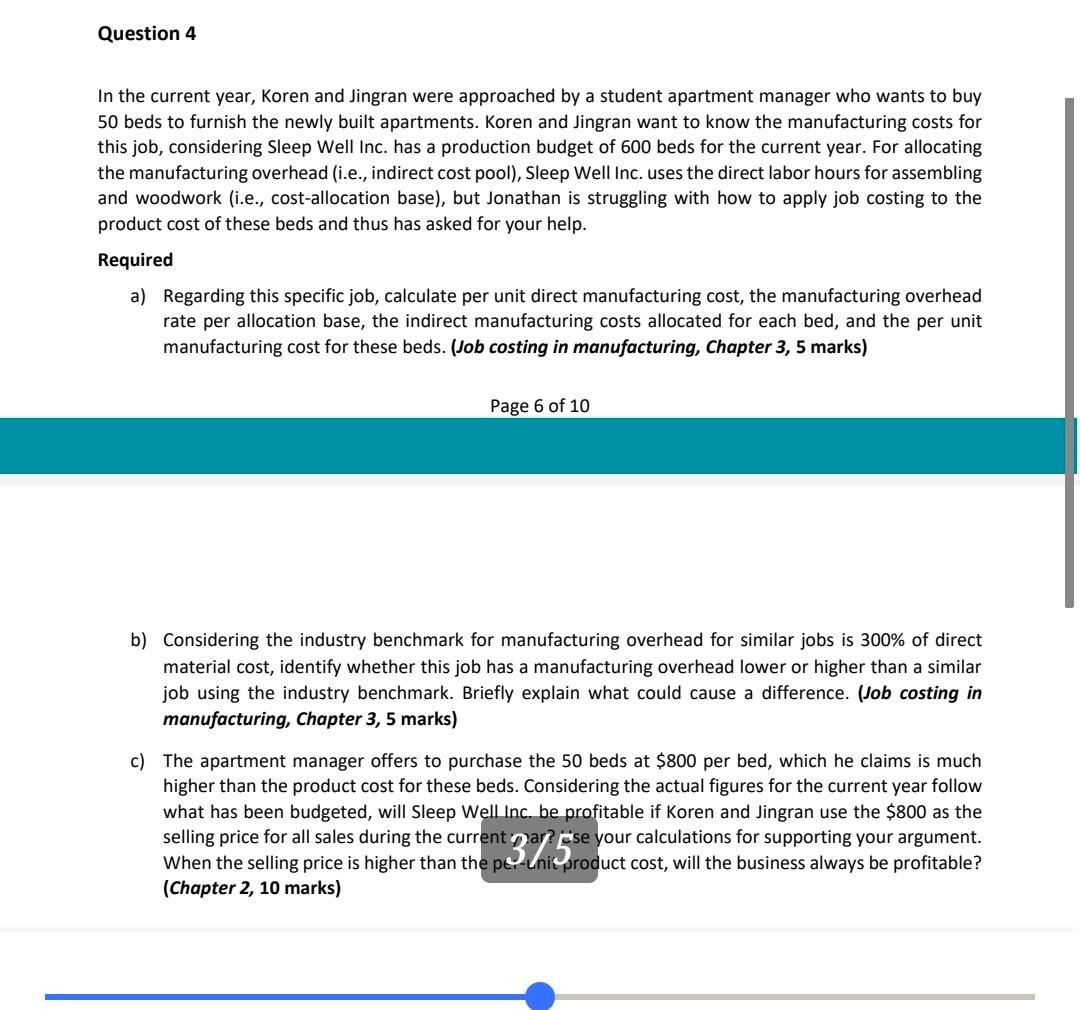

Question 2 Jonathan is reviewing the activities for the past year. Sleep Well Inc. rents a small administrative office in Melbourne's central business district (CBD) for $40,000 per year and a large warehouse in Geelong for $60,000 per year. Sleep Well Inc. has a staff handling all the administrative work in the office in CBD, and pays the staff with an annual salary of $60,000. Sleep Well Inc. has hired a professional marketing firm for managing the sales and this marketing firm charges a commission of $15 for each completed sale; each sale equals one bed sold. The invoicing system used by Sleep Well is outsourced and for each sale completed the outsourced firm charges $5; each sale equals one bed sold. The miscellaneous cost that incurred in the administrative office was $4,000, mostly costs with the lease of material and stationery, and this yearly cost is expected to remain the same amount for years to come. In the warehouse in Geelong there is one full-time employee who gets paid $80,000 per year for supervising the casual staff working in the warehouse. The warehouse had miscellaneous costs of $8,000 in the past year and is expected to remain the same amount for years to come. Sleep Well Inc. has a contract with a delivery firm for delivering the beds to their clients, but Jonathan is not able to find the contract and is not sure how much the delivery firm charges per transaction. The only information he can gather is regarding the past few years: Table 1 - Annual unit delivery and costs Year Delivery Cost Units Delivered 470 2016 2017 550 $758 $870 $940 $1,010 2018 600 2019 650 Below is a table listing all the material used during the past year to manufacture 500 beds and the costs incurred. There was no stock or work in process in the beginning or end of the year. Table 2-Material costs Material Quantity Total Cost Fabric 1,500 m2 $3,000 Timber 6000 Units $36,000 Foam 500 Kilograms $500 Button stud 5,000 Units $500 Varnish 500 Litres $10,000 Bolt 5,000 Units $500 The manufacturing activity is made by casual staff. The first stage is the woodworking, where a carpenter is hired by $20 per hour for working with the timber. This task is very labour intensive and for preparing the material a carpenter takes 5 hours per bed. Once the timber is ready for being assembled, a casual staff is paid $30 per hour for assembling the bed frame with the bolts and then adding (fabric, foam, and button studs) to make the mattress attached to the bed frame. The assembling takes only 2 hours per bed. The final stage of manufacturing is varnishing the bed frame. A casual staff is paid $30 per hour for varnishing the bed frame and this task takes 1 hours. Question 4 In the current year, Koren and Jingran were approached by a student apartment manager who wants to buy 50 beds to furnish the newly built apartments. Koren and Jingran want to know the manufacturing costs for this job, considering Sleep Well Inc. has a production budget of 600 beds for the current year. For allocating the manufacturing overhead (i.e., indirect cost pool), Sleep Well Inc. uses the direct labor hours for assembling and woodwork (i.e., cost-allocation base), but Jonathan is struggling with how to apply job costing to the product cost of these beds and thus has asked for your help. Required a) Regarding this specific job, calculate per unit direct manufacturing cost, the manufacturing overhead rate per allocation base, the indirect manufacturing costs allocated for each bed, and the per unit manufacturing cost for these beds. (Job costing in manufacturing, Chapter 3, 5 marks) Page 6 of 10 b) Considering the industry benchmark for manufacturing overhead for similar jobs is 300% of direct material cost, identify whether this job has a manufacturing overhead lower or higher than a similar job using the industry benchmark. Briefly explain what could cause a difference. (Job costing in manufacturing, Chapter 3,5 marks) c) The apartment manager offers to purchase the 50 beds at $800 per bed, which he claims is much higher than the product cost for these beds. Considering the actual figures for the current year follow what has been budgeted, will Sleep Well Inc. be profitable if Koren and Jingran use the $800 as the selling price for all sales during the current par pse your calculations for supporting your argument. When the selling price is higher than the per-unit product cost, will the business always be profitable? (Chapter 2, 10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started