Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer b, i and h EXERCISE 1.18 1.18 H. Hughes inherited R100 000 and on 1 January 2015 established a business called Hughes Properties

please answer b, i and h

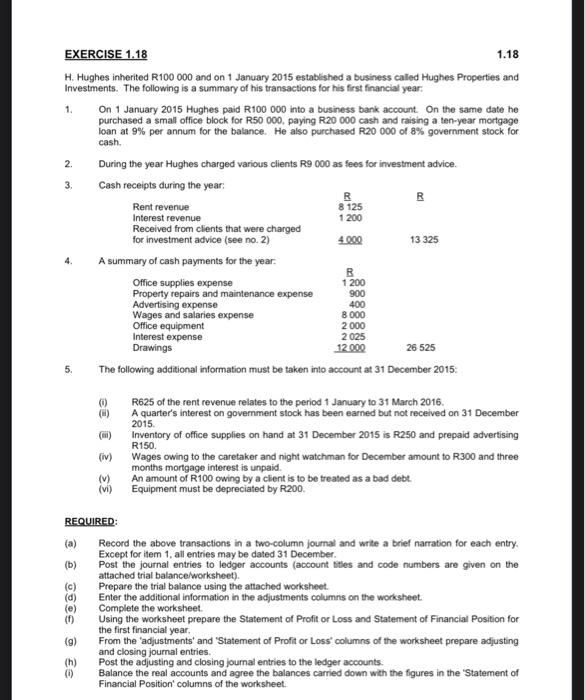

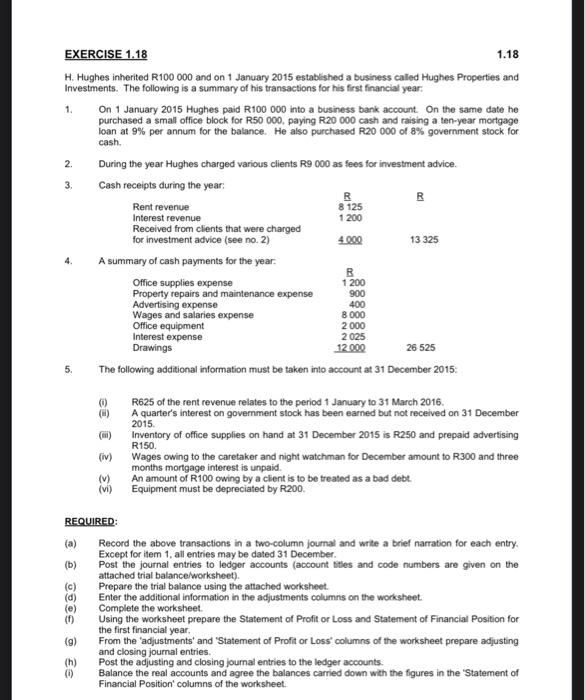

EXERCISE 1.18 1.18 H. Hughes inherited R100 000 and on 1 January 2015 established a business called Hughes Properties and Investments. The following is a summary of his transactions for his first financial year: 1. On 1 January 2015 Hughes paid R100 000 into a business bank account. On the same date he purchased a small office block for R50 000, paying R20 000 cash and raising a ten-year mortgage loan at 9% per annum for the balance. He also purchased R20 000 of 8% government stock for cash. 2. During the year Hughes charged various clients R9 000 as fees for investment advice. 3. Cash receipts during the year R B Rent revenue 8 125 Interest revenue 1 200 Received from clients that were charged for investment advice (see no. 2) 4.000 13 325 A summary of cash payments for the year. B Office supplies expense 1 200 Property repairs and maintenance expense 900 Advertising expense 400 Wages and salaries expense 8 000 Office equipment 2000 Interest expense 2025 Drawings 12.000 26 525 The following additional information must be taken into account at 31 December 2015: 4. 5. et ) () R150 R625 of the rent revenue relates to the period 1 January to 31 March 2016 A quarter's interest on government stock has been earned but not received on 31 December 2015 Inventory of office supplies on hand at 31 December 2015 is R250 and prepaid advertising Wages owing to the caretaker and night watchman for December amount to R300 and three months mortgage interest is unpaid. An amount of R100 cwing by a client is to be treated as a bad debt Equipment must be depreciated by R200. (iv) (v) (vi) REQUIRED Record the above transactions in a two-column journal and write a brief narration for each entry Except for item 1. all entries may be dated 31 December (b) Post the journal entries to ledger accounts (account sities and code numbers are given on the attached trial balance worksheet). (c) Prepare the trial balance using the attached worksheet. (d) Enter the additional information in the adjustments columns on the worksheet Complete the worksheet. (0) Using the worksheet prepare the Statement of Profit or Loss and Statement of Financial Position for the first financial year. (9) From the adjustments and Statement of Profit or Loss' columns of the worksheet prepare adjusting and closing journal entries. (h) Post the adjusting and closing journal entries to the ledger accounts. Balance the real accounts and agree the balances carried down with the figures in the Statement of Financial Position' columns of the worksheet EXERCISE 1.18 1.18 H. Hughes inherited R100 000 and on 1 January 2015 established a business called Hughes Properties and Investments. The following is a summary of his transactions for his first financial year: 1. On 1 January 2015 Hughes paid R100 000 into a business bank account. On the same date he purchased a small office block for R50 000, paying R20 000 cash and raising a ten-year mortgage loan at 9% per annum for the balance. He also purchased R20 000 of 8% government stock for cash. 2. During the year Hughes charged various clients R9 000 as fees for investment advice. 3. Cash receipts during the year R B Rent revenue 8 125 Interest revenue 1 200 Received from clients that were charged for investment advice (see no. 2) 4.000 13 325 A summary of cash payments for the year. B Office supplies expense 1 200 Property repairs and maintenance expense 900 Advertising expense 400 Wages and salaries expense 8 000 Office equipment 2000 Interest expense 2025 Drawings 12.000 26 525 The following additional information must be taken into account at 31 December 2015: 4. 5. et ) () R150 R625 of the rent revenue relates to the period 1 January to 31 March 2016 A quarter's interest on government stock has been earned but not received on 31 December 2015 Inventory of office supplies on hand at 31 December 2015 is R250 and prepaid advertising Wages owing to the caretaker and night watchman for December amount to R300 and three months mortgage interest is unpaid. An amount of R100 cwing by a client is to be treated as a bad debt Equipment must be depreciated by R200. (iv) (v) (vi) REQUIRED Record the above transactions in a two-column journal and write a brief narration for each entry Except for item 1. all entries may be dated 31 December (b) Post the journal entries to ledger accounts (account sities and code numbers are given on the attached trial balance worksheet). (c) Prepare the trial balance using the attached worksheet. (d) Enter the additional information in the adjustments columns on the worksheet Complete the worksheet. (0) Using the worksheet prepare the Statement of Profit or Loss and Statement of Financial Position for the first financial year. (9) From the adjustments and Statement of Profit or Loss' columns of the worksheet prepare adjusting and closing journal entries. (h) Post the adjusting and closing journal entries to the ledger accounts. Balance the real accounts and agree the balances carried down with the figures in the Statement of Financial Position' columns of the worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started