Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer B only - There is an answer available on the site, but it makes no sense at all. I would like an answer

Please answer B only - There is an answer available on the site, but it makes no sense at all. I would like an answer that is more structured please and clear.

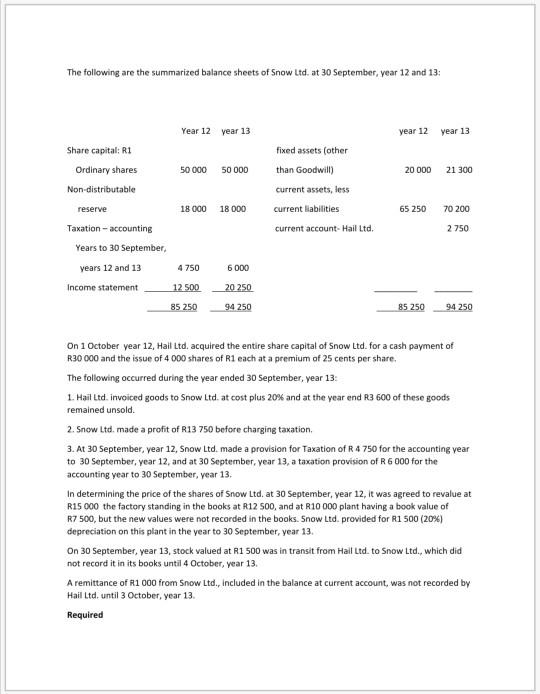

The following are the summarized balance sheets of Snow Ltd. at 30 September, year 12 and 13: Year 12 year 13 year 12 year 13 Share capital: R1 Ordinary shares Non-distributable 50 000 50 000 fixed assets (other than Goodwill) current assets, less 20 000 21 300 18 000 18 000 current liabilities 65 250 70 200 reserve Taxation accounting Years to 30 September, current account. Hail Ltd. 2750 4750 6 000 years 12 and 13 Income statement 12 500 20250 85 250 94 250 85 250 94250 On 1 October year 12, Hail Ltd. acquired the entire share capital of Snow Ltd. for a cash payment of R30 000 and the issue of 4 000 shares of R1 each at a premium of 25 cents per share. The following occurred during the year ended 30 September, year 13: 1. Hail Ltd. invoiced goods to Snow Ltd. at cost plus 20% and at the year end R3 600 of these goods remained unsold. 2. Snow Ltd, made a profit of R13 750 before charging taxation 3. At 30 September, year 12, Snow Ltd. made a provision for Taxation of R4 750 for the accounting year to 30 September, year 12, and at 30 September, year 13, a taxation provision of R6 000 for the accounting year to 30 September, year 13. In determining the price of the shares of Snow Ltd. at 30 September, year 12, it was agreed to revalue at R15 000 the factory standing in the books at R12 500, and at R10 000 plant having a book value of R7 500, but the new values were not recorded in the books. Snow Ltd. provided for R1 500 (20%) depreciation on this plant in the year to 30 September, year 13. On 30 September, year 13, stock valued at R1 500 was in transit from Hail Ltd. to Snow Ltd., which did not record it in its books until 4 October, year 13. A remittance of R1 000 from Snow Ltd., included in the balance at current account was not recorded by Hail Ltd, until 3 October, year 13. Required Prepare the necessary journal entries: (a) To record the acquisition of Snow Ltd. in the books of Hail Ltd., and (b) The pro forma journal entries required to be added to the trial balance of Hail Ltd. so that the consolidated balance sheet can be prepared at 30 September, year 13. You do not have to prepare the actual balance sheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started