Answered step by step

Verified Expert Solution

Question

1 Approved Answer

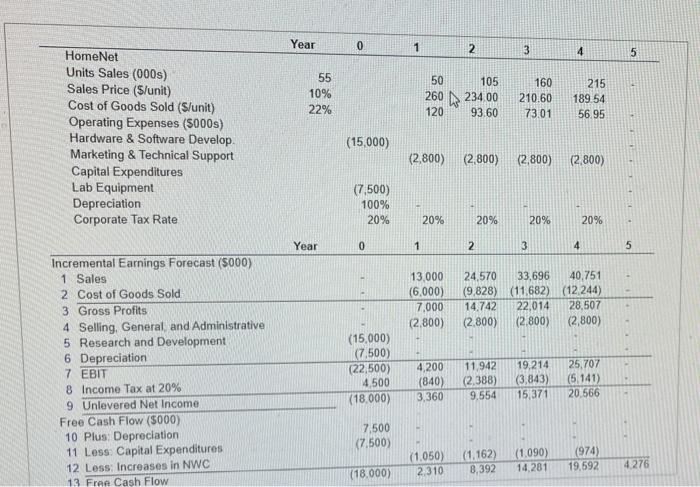

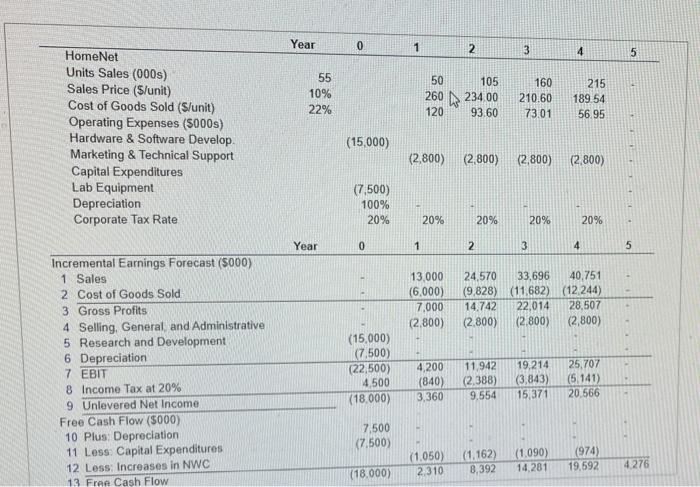

please answer both a and b please! You are evaluating the HomeNet project under the following assumptions, new tax laws allow 100% bonus depreciation (all

please answer both a and b please!

You are evaluating the HomeNet project under the following assumptions, new tax laws allow 100% bonus depreciation (all the depreciation exponse, 5120 million, occurs when the asset is put into use in this case immediately). Sales of 50,000 units in year 1 increasing by 66,000 units per year over the life of the project a year 1 sales price of $260/unit decreasing by 10% annually and a year 1 cost of $120/unit decreasing by 22% annually. In addition now tax laws allow 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately Research and development expenditures total 515 milion In year 0 and selling, general, and administrative expenses are $2.8 million per year (assuming there is no cannibalization) Also assume HomeNet will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers) However, receivablos related to HomeNet are expected to account for 15% of annual sales and payables are expected to be 15% of the annual cost of goods sold Under these assumptions the unlevered net income networking capital requirements and free cash flow are shown in the Table Vuing the FCF projections given a. Calculate the NPV of the HomeNet project assuming a cost of capital of 10%, 12% and 14% b. What in the IRR of the project in this case? a. Calculate the NPV of the HomeNet project assuming a cost of capital of 10%, 125 and 14% The NPV of the FCF's of the HomeNet project assuming a cost of capital of 10% SW Roved to the nearest thousand dollar Year 0 1 2 3 4 5 55 10% 22% 50 105 260 234 00 120 93.60 160 210.60 73.01 215 189.54 56.95 HomeNet Units Sales (000s) Sales Price (S/unit) Cost of Goods Sold (S/unit) Operating Expenses (5000s) Hardware & Software Develop Marketing & Technical Support Capital Expenditures Lab Equipment Depreciation Corporate Tax Rate (15,000) (2,800) (2.800) (2,800) 2.800) (7,500) 100% 20% 20% 20% 20% 20% Year 0 1 2 3 4 5 5 - 13,000 (6.000) 7,000 (2.800) 24,570 33,696 40,751 (9.828) (11.682) (12.244) 14.742 22,014 28,507 (2.800) (2.800) (2,800) Incremental Earnings Forecast (5000) 1 Sales 2 Cost of Goods Sold 3 Gross Profits 4 Selling, General and Administrative 5 Research and Development 6 Depreciation 7 EBIT 8 Income Tax at 20% 9 Unlevered Net Income Free Cash Flow (5000) 10 Plus Depreciation 11 Less Capital Expenditures 12 Less: Increases in NWC 13 Free Cash Flow (15,000) (7,500) (22,500) 4,500 (18,000) 4,200 (840) 3,360 11.942 (2.388) 9,554 19,214 (3,843) 15,371 25,707 (5.141) 20.566 7,500 (7,500) (1.050) 2.310 (1.162) 8,392 (1.090) 14281 (974) 19,592 4276 (18.000)

You are evaluating the HomeNet project under the following assumptions, new tax laws allow 100% bonus depreciation (all the depreciation exponse, 5120 million, occurs when the asset is put into use in this case immediately). Sales of 50,000 units in year 1 increasing by 66,000 units per year over the life of the project a year 1 sales price of $260/unit decreasing by 10% annually and a year 1 cost of $120/unit decreasing by 22% annually. In addition now tax laws allow 100% bonus depreciation (all the depreciation expense occurs when the asset is put into use, in this case immediately Research and development expenditures total 515 milion In year 0 and selling, general, and administrative expenses are $2.8 million per year (assuming there is no cannibalization) Also assume HomeNet will have no incremental cash or inventory requirements (products will be shipped directly from the contract manufacturer to customers) However, receivablos related to HomeNet are expected to account for 15% of annual sales and payables are expected to be 15% of the annual cost of goods sold Under these assumptions the unlevered net income networking capital requirements and free cash flow are shown in the Table Vuing the FCF projections given a. Calculate the NPV of the HomeNet project assuming a cost of capital of 10%, 12% and 14% b. What in the IRR of the project in this case? a. Calculate the NPV of the HomeNet project assuming a cost of capital of 10%, 125 and 14% The NPV of the FCF's of the HomeNet project assuming a cost of capital of 10% SW Roved to the nearest thousand dollar Year 0 1 2 3 4 5 55 10% 22% 50 105 260 234 00 120 93.60 160 210.60 73.01 215 189.54 56.95 HomeNet Units Sales (000s) Sales Price (S/unit) Cost of Goods Sold (S/unit) Operating Expenses (5000s) Hardware & Software Develop Marketing & Technical Support Capital Expenditures Lab Equipment Depreciation Corporate Tax Rate (15,000) (2,800) (2.800) (2,800) 2.800) (7,500) 100% 20% 20% 20% 20% 20% Year 0 1 2 3 4 5 5 - 13,000 (6.000) 7,000 (2.800) 24,570 33,696 40,751 (9.828) (11.682) (12.244) 14.742 22,014 28,507 (2.800) (2.800) (2,800) Incremental Earnings Forecast (5000) 1 Sales 2 Cost of Goods Sold 3 Gross Profits 4 Selling, General and Administrative 5 Research and Development 6 Depreciation 7 EBIT 8 Income Tax at 20% 9 Unlevered Net Income Free Cash Flow (5000) 10 Plus Depreciation 11 Less Capital Expenditures 12 Less: Increases in NWC 13 Free Cash Flow (15,000) (7,500) (22,500) 4,500 (18,000) 4,200 (840) 3,360 11.942 (2.388) 9,554 19,214 (3,843) 15,371 25,707 (5.141) 20.566 7,500 (7,500) (1.050) 2.310 (1.162) 8,392 (1.090) 14281 (974) 19,592 4276 (18.000)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started