Please answer both and show work. will leave thumbs up if it is correct

Please answer both and show work. will leave thumbs up if it is correct

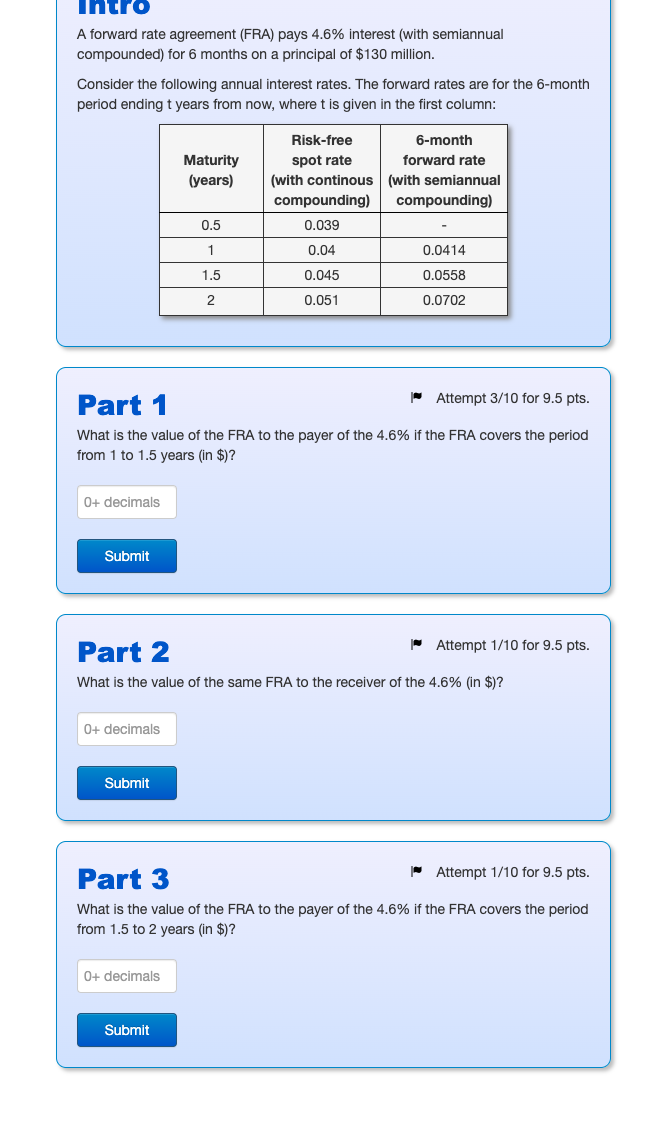

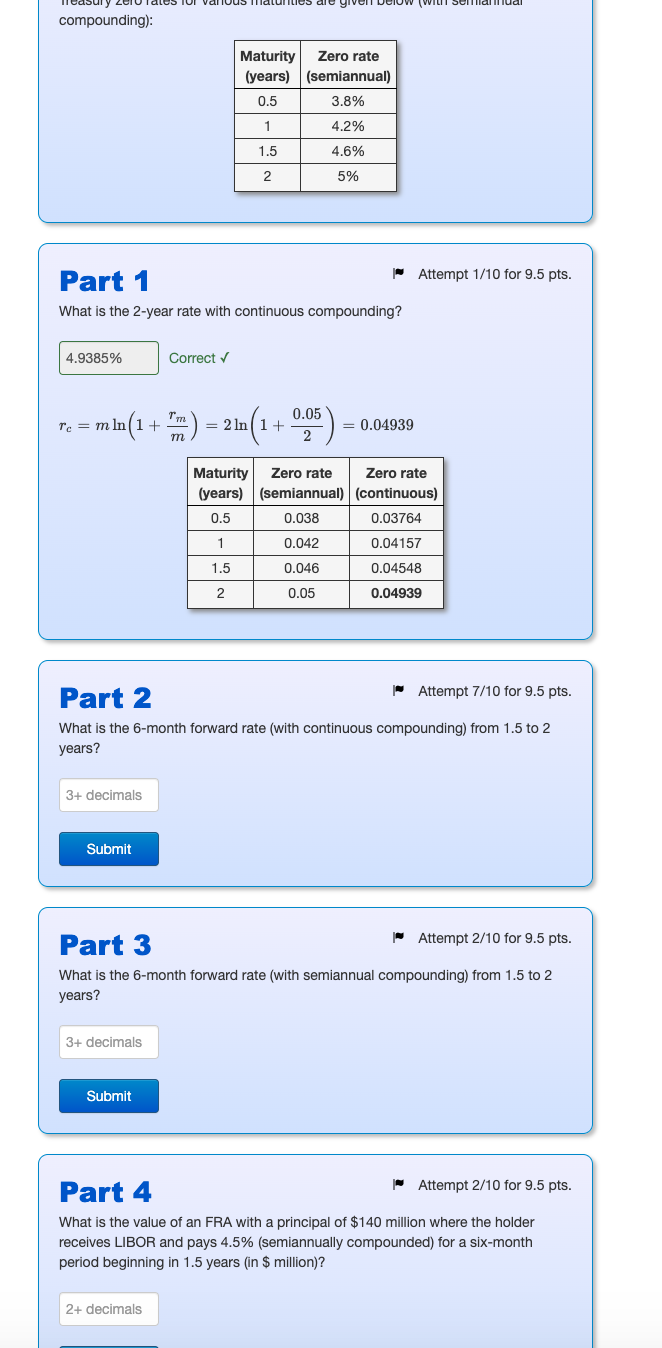

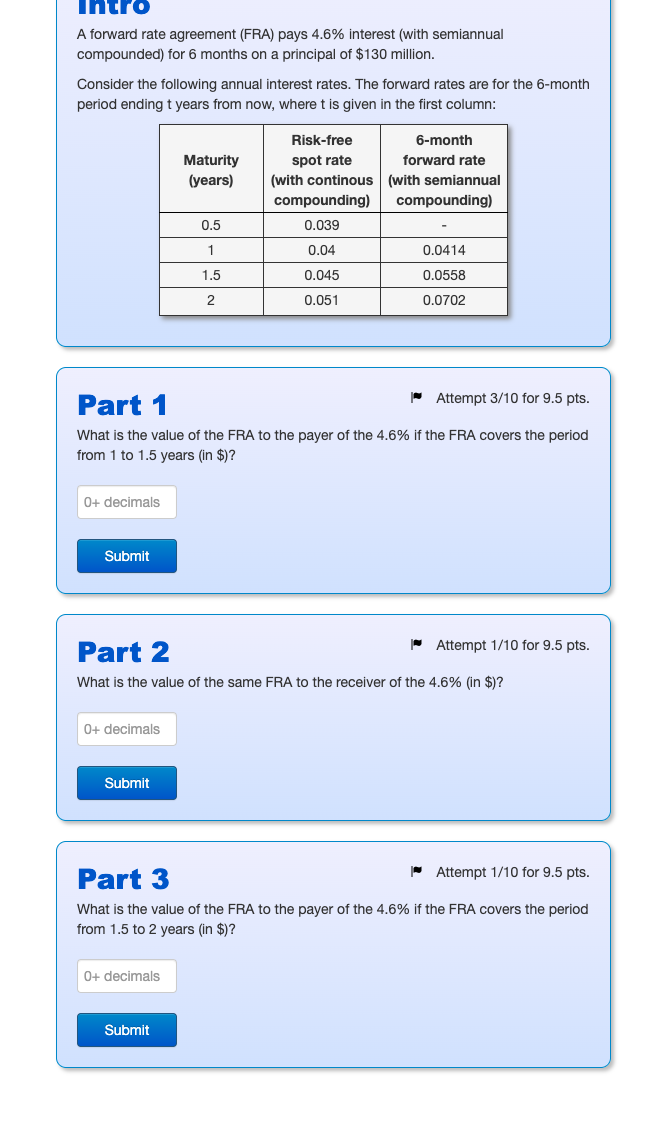

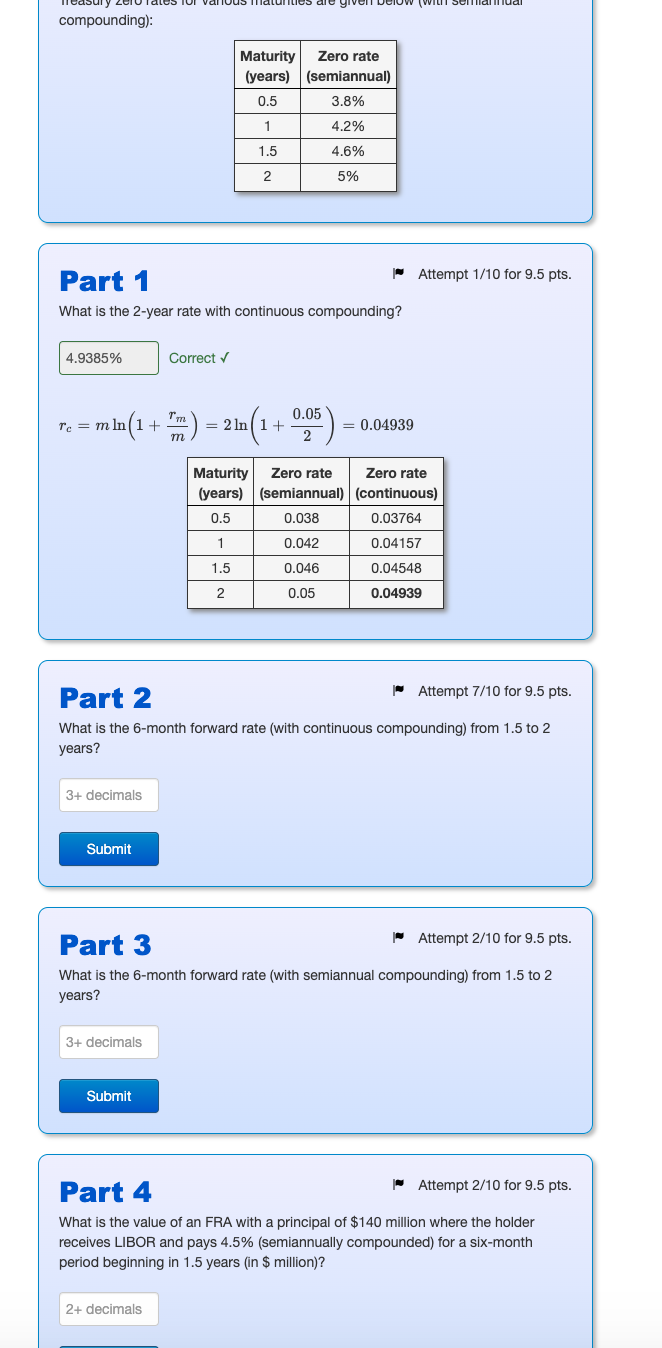

A forward rate agreement (FRA) pays 4.6% interest (with semiannual compounded) for 6 months on a principal of $130 million. Consider the following annual interest rates. The forward rates are for the 6-month period ending t years from now, where t is given in the first column: Maturity (years) Risk-free 6-month spot rate forward rate (with continous (with semiannual compounding) compounding) 0.039 0.5 1 0.04 0.0414 1.5 0.045 0.0558 2 0.051 0.0702 Attempt 3/10 for 9.5 pts. Part 1 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1 to 1.5 years (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 2 What is the value of the same FRA to the receiver of the 4.6% (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 3 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1.5 to 2 years (in $)? 0+ decimals Submit matunities are given compounding): Maturity Zero rate (years) (semiannual) 0.5 3.8% TE 1 4.2% 1.5 4.6% 5% 2 2 Attempt 1/10 for 9.5 pts. Part 1 What is the 2-year rate with continuous compounding? 4.9385% Correct Te = m lr Tc m In n ln(1 + " m) home) = 2ln(1 + = 0.05 2 0.04939 Maturity Zero rate Zero rate (years) (semiannual) (continuous) 0.5 0.038 0.03764 1 0.042 0.04157 1.5 0.046 0.04548 2 0.05 0.04939 Attempt 7/10 for 9.5 pts. Part 2 What is the 6-month forward rate with continuous compounding) from 1.5 to 2 years? 3+ decimals Submit Part 3 Attempt 2/10 for 9.5 pts. What is the 6-month forward rate with semiannual compounding) from 1.5 to 2 years? 3+ decimals Submit Part 4 | Attempt 2/10 for 9.5 pts. What is the value of an FRA with a principal of $140 million where the holder receives LIBOR and pays 4.5% (semiannually compounded) for a six-month period beginning in 1.5 years (in $ million)? 2+ decimals A forward rate agreement (FRA) pays 4.6% interest (with semiannual compounded) for 6 months on a principal of $130 million. Consider the following annual interest rates. The forward rates are for the 6-month period ending t years from now, where t is given in the first column: Maturity (years) Risk-free 6-month spot rate forward rate (with continous (with semiannual compounding) compounding) 0.039 0.5 1 0.04 0.0414 1.5 0.045 0.0558 2 0.051 0.0702 Attempt 3/10 for 9.5 pts. Part 1 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1 to 1.5 years (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 2 What is the value of the same FRA to the receiver of the 4.6% (in $)? 0+ decimals Submit Attempt 1/10 for 9.5 pts. Part 3 What is the value of the FRA to the payer of the 4.6% if the FRA covers the period from 1.5 to 2 years (in $)? 0+ decimals Submit matunities are given compounding): Maturity Zero rate (years) (semiannual) 0.5 3.8% TE 1 4.2% 1.5 4.6% 5% 2 2 Attempt 1/10 for 9.5 pts. Part 1 What is the 2-year rate with continuous compounding? 4.9385% Correct Te = m lr Tc m In n ln(1 + " m) home) = 2ln(1 + = 0.05 2 0.04939 Maturity Zero rate Zero rate (years) (semiannual) (continuous) 0.5 0.038 0.03764 1 0.042 0.04157 1.5 0.046 0.04548 2 0.05 0.04939 Attempt 7/10 for 9.5 pts. Part 2 What is the 6-month forward rate with continuous compounding) from 1.5 to 2 years? 3+ decimals Submit Part 3 Attempt 2/10 for 9.5 pts. What is the 6-month forward rate with semiannual compounding) from 1.5 to 2 years? 3+ decimals Submit Part 4 | Attempt 2/10 for 9.5 pts. What is the value of an FRA with a principal of $140 million where the holder receives LIBOR and pays 4.5% (semiannually compounded) for a six-month period beginning in 1.5 years (in $ million)? 2+ decimals

Please answer both and show work. will leave thumbs up if it is correct

Please answer both and show work. will leave thumbs up if it is correct