Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both as they are linked thank you so much Assume that the corporate tax rate is zero, there are no transaction costs for

please answer both as they are linked thank you so much

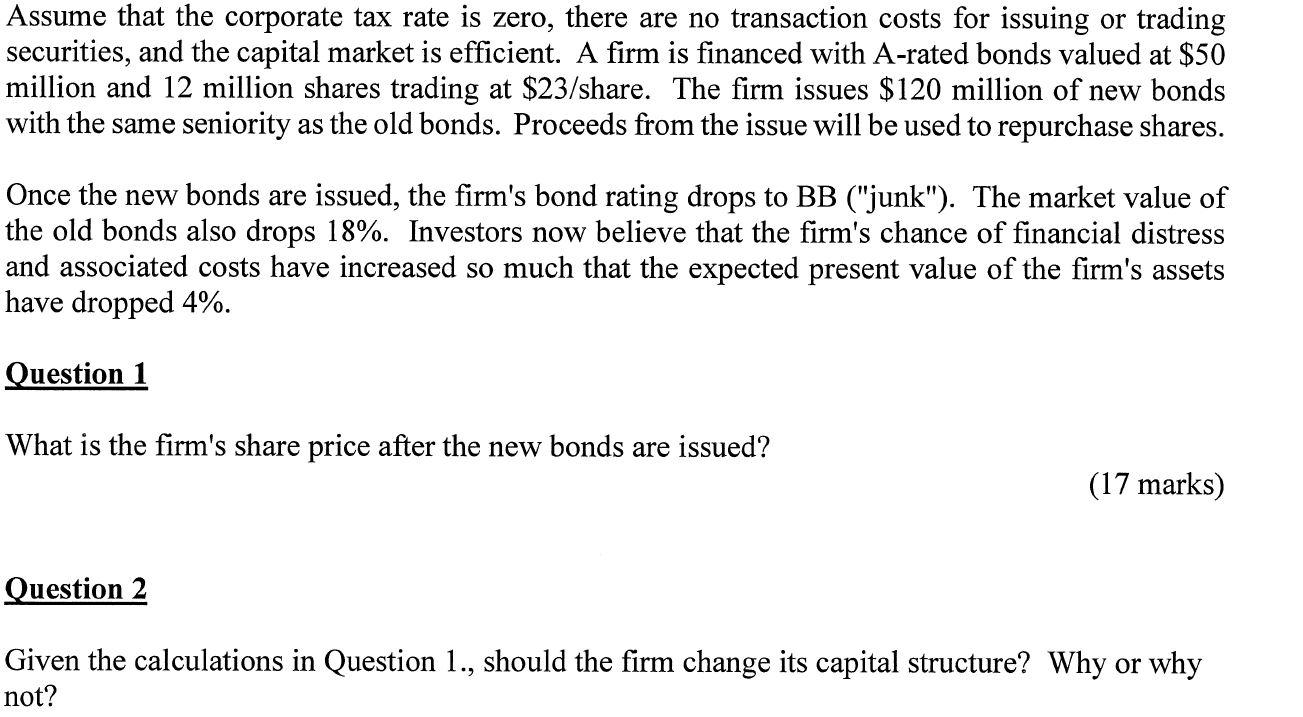

Assume that the corporate tax rate is zero, there are no transaction costs for issuing or trading securities, and the capital market is efficient. A firm is financed with A-rated bonds valued at $50 million and 12 million shares trading at $23/share. The firm issues $120 million of new bonds with the same seniority as the old bonds. Proceeds from the issue will be used to repurchase shares. Once the new bonds are issued, the firm's bond rating drops to BB ("junk"). The market value of the old bonds also drops 18%. Investors now believe that the firm's chance of financial distress and associated costs have increased so much that the expected present value of the firm's assets have dropped 4%. Question 1 What is the firm's share price after the new bonds are issued? (17 marks) Question 2 Given the calculations in Question 1., should the firm change its capital structure? Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started