Answered step by step

Verified Expert Solution

Question

1 Approved Answer

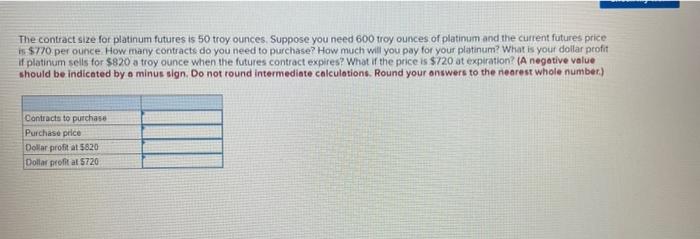

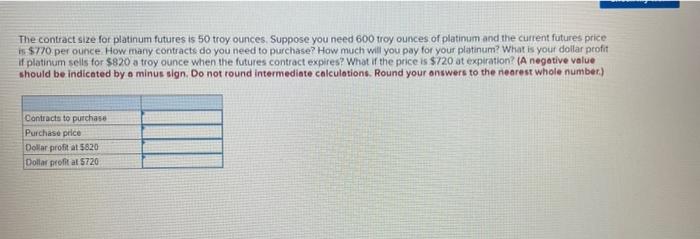

Please Answer Both I will Rate Answer :) The contract size for platinum futures is 50 troy ounces Suppose you need 600 troy ounces of

Please Answer Both

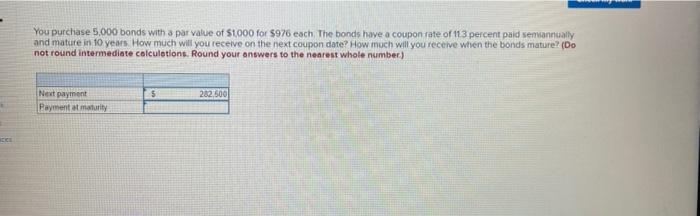

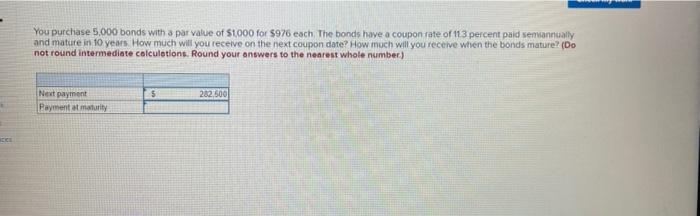

The contract size for platinum futures is 50 troy ounces Suppose you need 600 troy ounces of platinum and the current futures price is $770 per ounce How many contracts do you need to purchase? How much will you pay for your platinum? What is your dollar profit if platinum sells for $820 a troy ounce when the futures contract expires? What if the price is $720 at expiration? (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest whole number) Contracts to purchase Purchase price Dollar profit at 5820 Dollar profit at 5720 You purchase 5,000 bonds with a par value of $1000 for $976 each The bonds have a coupon rate of 113 percent paid semiannually and mature in 10 years. How much will you receive on the next coupon date? How much will you receive when the bonds mature? (Do not round Intermediate calculations. Round your answers to the nearest whole number) 5 282,500 Next payment Payment at maturity I will Rate Answer :)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started