Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both :))) Maxwell Company has just signed a capitalizable lease contract for equipment that requires rental payments of $6,000 each, to be paid

Please answer both :)))

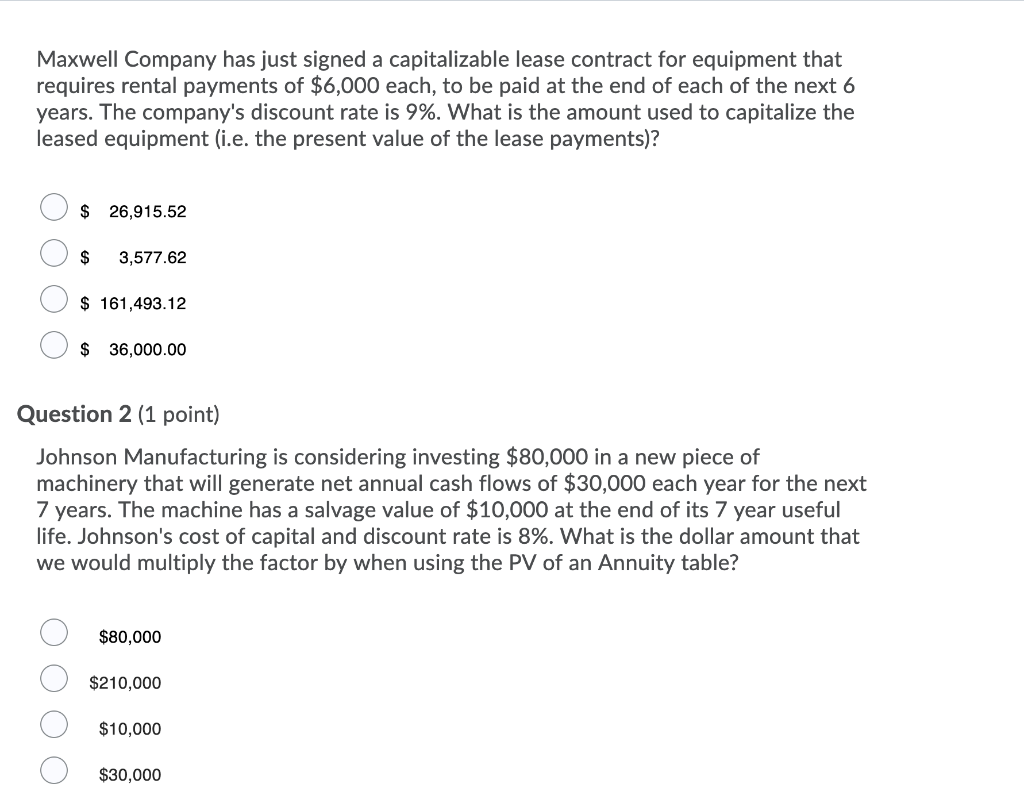

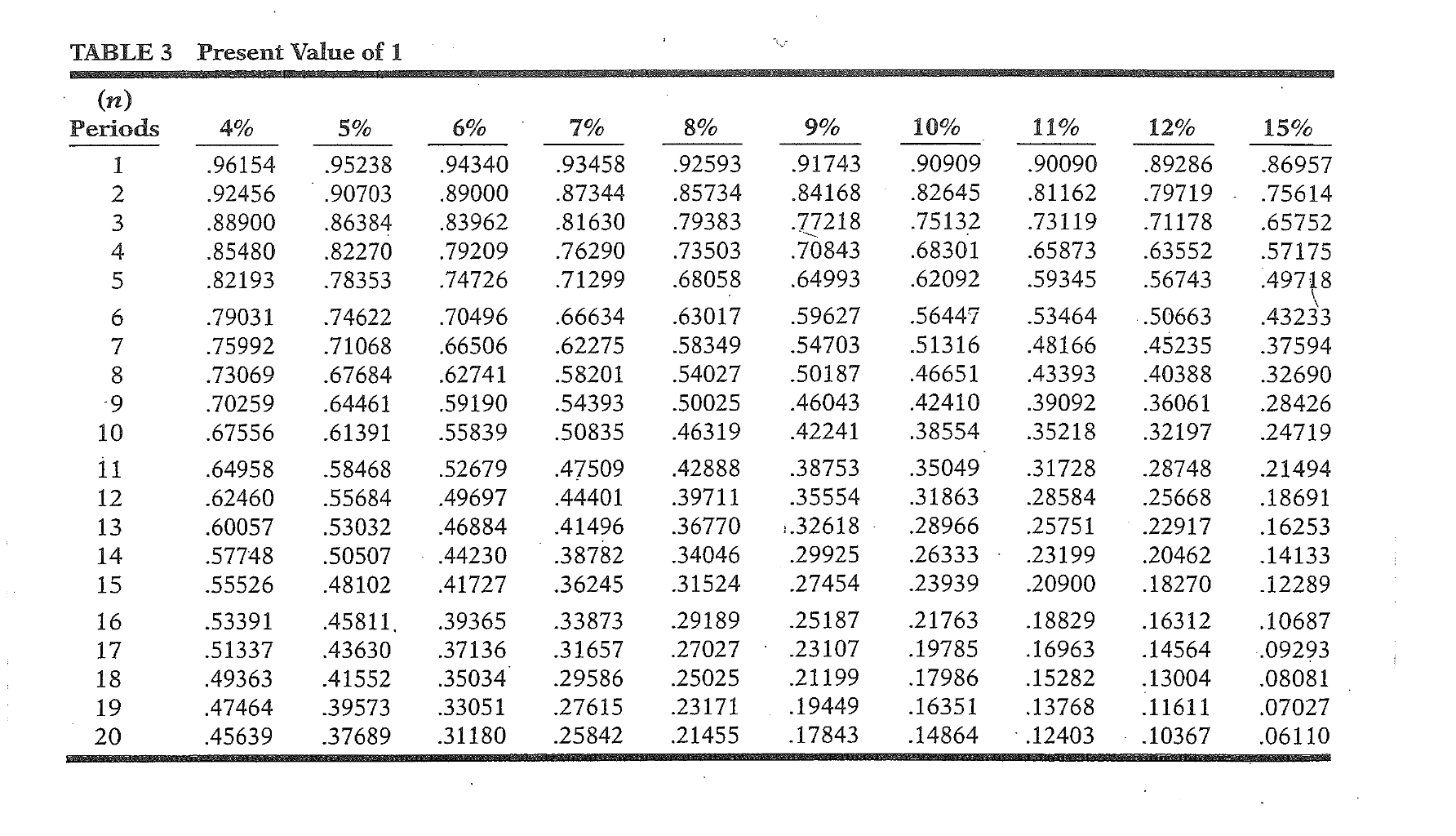

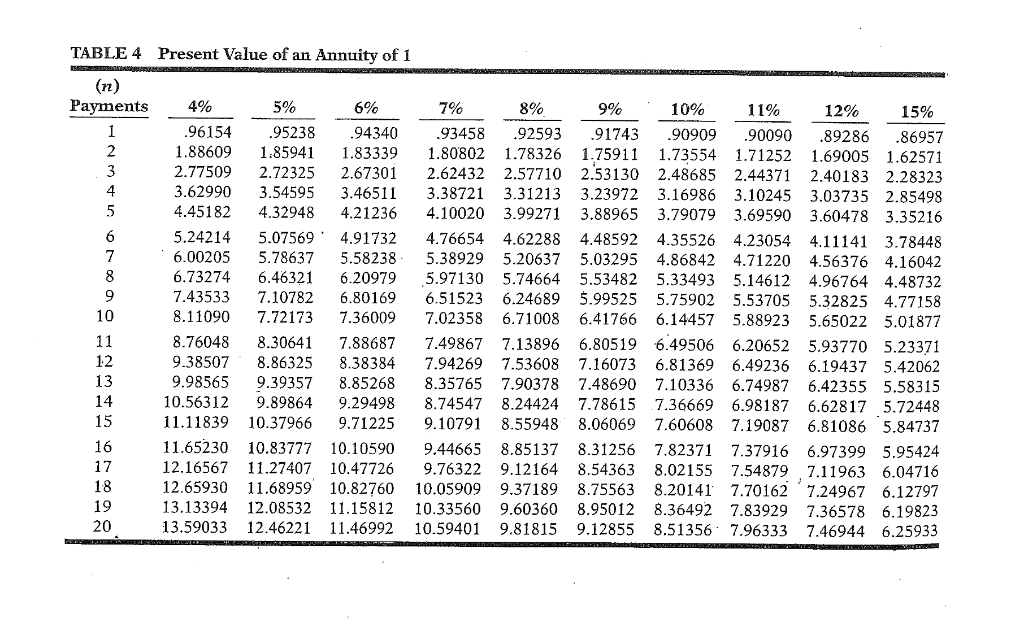

Maxwell Company has just signed a capitalizable lease contract for equipment that requires rental payments of $6,000 each, to be paid at the end of each of the next 6 years. The company's discount rate is 9%. What is the amount used to capitalize the leased equipment (i.e. the present value of the lease payments)? O $ 26,915.52 O $ 3,577.62 O $ 161,493.12 O $ 36,000.00 Question 2 (1 point) Johnson Manufacturing is considering investing $80,000 in a new piece of machinery that will generate net annual cash flows of $30,000 each year for the next 7 years. The machine has a salvage value of $10,000 at the end of its 7 year useful life. Johnson's cost of capital and discount rate is 8%. What is the dollar amount that we would multiply the factor by when using the PV of an Annuity table? $80,000 $210,000 $10,000 $30,000 TABLE 3 Present Value of 1 (n) Periods 4% 5% : 8% 9% 10% 11% 12% 15% Nm 7% .93458 .87344 .81630 .76290 .71299 .90909 .82645 .75132 .68301 .62092 .90090 .81162 .73119 .65873 .59345 .96154 .92456 .88900 .85480 .82193 .79031 .75992 .73069 .70259 .67556 00 Oohet m 95238 .90703 .86384 .82270 .78353 .74622 .71068 .67684 .64461 .61391 .58468 .55684 .53032 .50507 .48102 .45811. 43630 .41552 .39573 37689 6% .94340 .89000 .83962 .79209 .74726 .70496 .66506 .62741 .59190 .55839 .52679 .49697 .46884 44230 .41727 .39365 .37136 .35034 .33051 .31180 .92593 91743 .85734 .84168 .79383 .77218 .73503 .70843 .68058 .64993 .63017 .59627 -58349 .54703 .54027 .50187 .50025 .46043 .46319 .42241 .42888 .38753 .39711 .35554 .36770 1.32618. 34046 .29925 .31524 .27454 .29189 .25187 .27027 .23107 .25025 21199 .23171 19449 21455 17843 .66634 .62275 .58201 .54393 .50835 .47509 44401 .41496 .38782 .36245 .33873 .31657 .29586 .27615 25842 .89286 .79719 .71178 .63552 .56743 ..50663 .45235 40388 .36061 .32197 .28748 .25668 .22917 .20462 .18270 .56447 .53464 .51316 .48166 .46651 .43393 42410 .39092 .38554 35218 .35049 .31728 .31863 .28584 .28966 .25751 .26333 . .23199 .23939 .20900 .21763 .18829 .19785 16963 .17986 .15282 .16351 13768 .14864 ..12403 .86957 .75614 .65752 .57175 49718 .43233 .37594 .32690 .28426 .24719 .21494 .18691 .16253 14133 .12289 .10687 .09293 08081 .07027 .06110 .64958 .62460 .60057 .57748 .55526 .53391 .51337 .49363 .47464 45639 in 18 .16312 .14564 .13004 11611 10367 19 20 TABLE4 Present Value of an Annuity of 1 (n) Payments 4% 5% 6% 7% 8% 9% 10% 11% 12% 15% .96154 95238 9434093458 .92593917439090990090.89286 .86957 1.88609 1.85941 1.83339 1.80802 1.78326 1.75911 1.73554 1.71252 1.69005 1.62571 2.775092.72325 2.67301 2.62432 2.57710 2.53130 2.48685 2.44371 2.40183 2.28323 3.62990 3.54595 3.46511 3.38721 3.31213 3.23972 3.16986 3.10245 3.03735 2.85498 4.45182 4.32948 4.21236 4.10020 3.99271 3.88965 3.79079 3.69590 3.60478 3.35216 5.24214 5.07569' 4.91732 4.76654 4.62288 4.48592 4.35526 4.23054 4.11141 3.78448 6.00205 5.78637 5.58238 5.38929 5.20637 5.03295 4.86842 4.71220 4.56376 4.16042 6.73274 6.463216.20979 5.97130 5.74664 5.53482 5.33493 5.14612 4.96764 4.48732 7.43533 7.10782 6.80169 6.51523 6.24689 5.99525 5.75902 5.53705 5.32825 4.77158 8.11090 7.721737.36009 7.02358 6.71008 6.41766 6.14457 5.88923 5.65022 5.01877 8.76048 8.30641 7.88687 7.49867 7.13896 6.80519 6.49506 6.20652 5.93770 5.23371 9.38507 8.863258.38384 7.94269 7.53608 7.16073 6.81369 6.49236 6.19437 5.42062 9.98565 9.39357 8.85268 8.35765 7.90378 7.48690 7.10336 6.74987 6.42355 5.58315 10.56312 9.89864 9.29498 8.74547 8.24424 7.78615 7.36669 6.98187 6.62817 5.72448 11.11839 10.37966 9.71225 9.10791 8.55948 8.06069 7.60608 7.19087 6.81086 5.84737 11.65230 10.83777 10.10590 9.44665 8.85137 8.31256 7.82371 7.37916 6.97399 5.95424 12.16567 11.27407 10.47726 9.76322 9.12164 8.54363 8.02155 7.54879 7.11963 6.04716 12.65930 11.68959 10.82760 10.05909 9.37189 8.75563 8.20141 7.70162 ' 7.24967 6.12797 13.13394 12.08532 11.15812 10.33560 9.60360 8.95012 8.36492 7.83929 7.36578 6.19823 13.59033 12.46221 11.46992 10.59401 9.81815 9.12855 8.51356 7.96333 7.46944 6.25933 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started