Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both of them Question 6 (1 point) A sole proprietor is required to make a 2021 CPP contribution of 56,332 [(2)(53,166)]. How will

please answer both of them

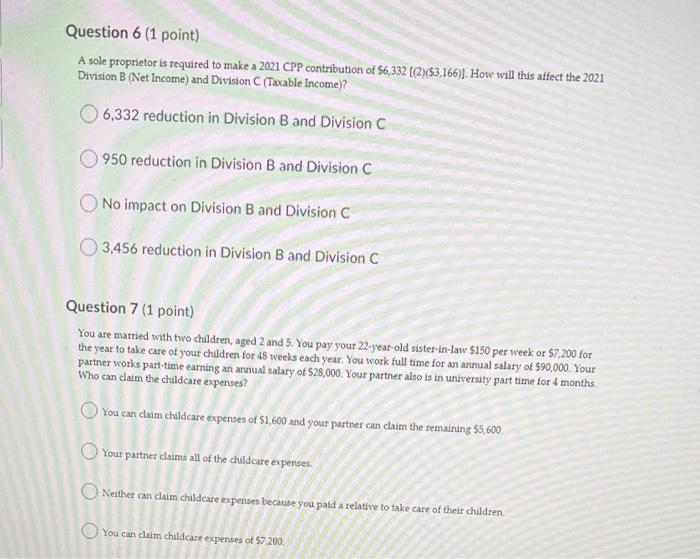

Question 6 (1 point) A sole proprietor is required to make a 2021 CPP contribution of 56,332 [(2)(53,166)]. How will this affect the 2021 Division B (Net Income) and Division (Taxable income)? 6,332 reduction in Division B and Division C 950 reduction in Division B and Division C O No impact on Division B and Division C 3,456 reduction in Division B and Division C Question 7 (1 point) You are married with two children, aged 2 and 5. You pay your 22-year-old sister-in-law $150 per week or 57,200 for the year to take care of your children for 45 weeks each year. You work full time for an annual salary of $90,000. Your partner works part-time earning an annual salary of $28,000. Your partner also is in university part time for 4 months, Who can claim the childcare expenses? You can claim childcare expenses of 51,600 and your partner can claim the remaining $5,600 Your partner claims all of the childcare expenses. Neither can daim childcare expenses because you paid a relative to take care of their children. You can daim childcare expenses of S7 200 Question 6 (1 point) A sole proprietor is required to make a 2021 CPP contribution of 56,332 [(2)(53,166)]. How will this affect the 2021 Division B (Net Income) and Division (Taxable income)? 6,332 reduction in Division B and Division C 950 reduction in Division B and Division C O No impact on Division B and Division C 3,456 reduction in Division B and Division C Question 7 (1 point) You are married with two children, aged 2 and 5. You pay your 22-year-old sister-in-law $150 per week or 57,200 for the year to take care of your children for 45 weeks each year. You work full time for an annual salary of $90,000. Your partner works part-time earning an annual salary of $28,000. Your partner also is in university part time for 4 months, Who can claim the childcare expenses? You can claim childcare expenses of 51,600 and your partner can claim the remaining $5,600 Your partner claims all of the childcare expenses. Neither can daim childcare expenses because you paid a relative to take care of their children. You can daim childcare expenses of S7 200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started