Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both of them Question 8 (1 point) You are employed by a company that does not offer a Registered Pension Plan or a

please answer both of them

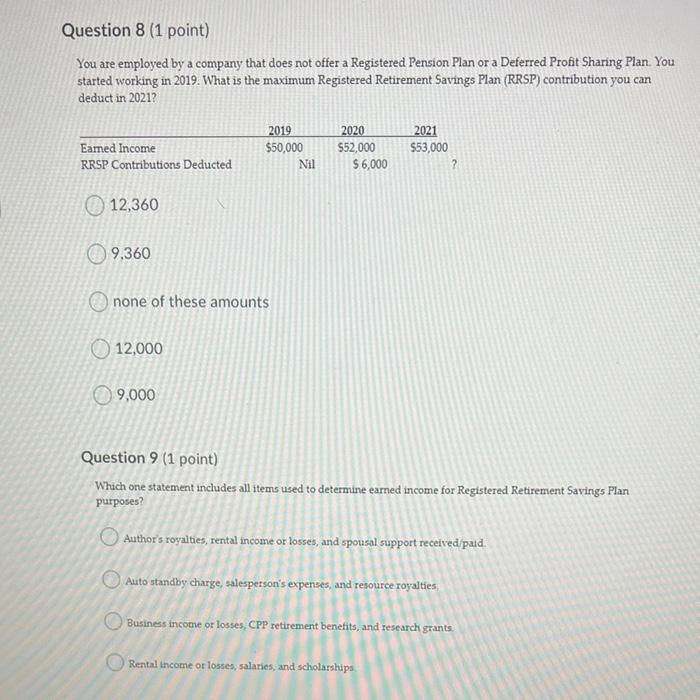

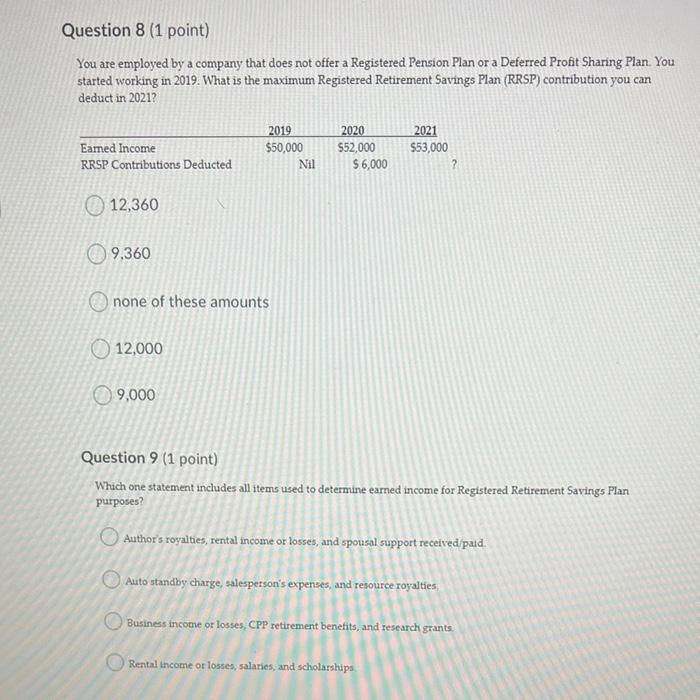

Question 8 (1 point) You are employed by a company that does not offer a Registered Pension Plan or a Deferred Profit Sharing Plan You started working in 2019. What is the maximum Registered Retirement Savings Plan (RRSP) contribution you can deduct in 2021? 2019 $50,000 2020 S52,000 $ 6,000 2021 $53,000 Eamed Income RRSP Contributions Deducted Nil ? 12,360 9.360 none of these amounts 12,000 9,000 Question 9 (1 point) Which one statement includes all items used to determine earned income for Registered Retirement Savings Plan purposes? Author's royalties, rental income or losses, and spousal support received/paid Auto standby charge, salesperson's expenses, and resource royalties, Business income or losses, CPP retirement benefits and research grants Rental income or losses, salaries, and scholarships

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started