Answered step by step

Verified Expert Solution

Question

1 Approved Answer

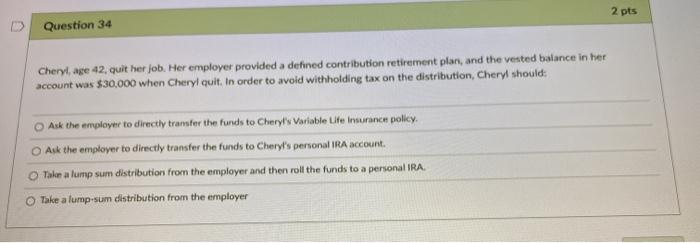

please answer both or i will down vote 2 pts Question 34 Cheryl, age 42. quit her job. Her employer provided a defined contribution retirement

please answer both or i will down vote

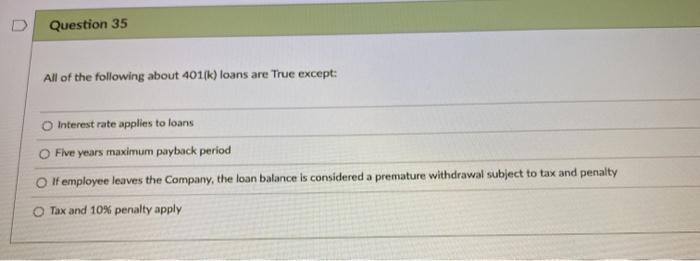

2 pts Question 34 Cheryl, age 42. quit her job. Her employer provided a defined contribution retirement plans, and the vested balance in her account was $30,000 when Cheryl quit. In order to avoid withholding tax on the distribution, Cheryl should: Ask the employer to directly transfer the funds to Cheryl's Varioble Life Insurance policy Ask the employer to directly transfer the funds to Cheryl's personal IRA account Take a lump sum distribution from the employer and then roll the funds to a personal IRA. Take a lump sum distribution from the employer Question 35 All of the following about 401(k) loans are True except: Interest rate applies to loans Five years maximum payback period If employee leaves the Company, the loan balance is considered a premature withdrawal subject to tax and penalty Tax and 10% penalty apply

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started