Answered step by step

Verified Expert Solution

Question

1 Approved Answer

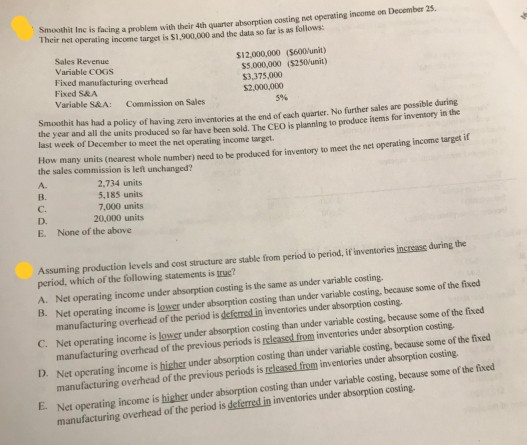

please answer both part of the problems income on December 25. Smoothit Inc is facing a problem with their 4th quaner absorption costing net operating

please answer both part of the problems

income on December 25. Smoothit Inc is facing a problem with their 4th quaner absorption costing net operating Their net operating income target is S1,900,000 and the data so far is as follows: Sales Revenue Variable coGs Fixed manufacturing overhead Fixed S&A S12,000,000 ($600unit) $5,000,000 ($250Vunit) S3,375,000 $2,000,000 Variable S&A: Commission on Sales 5% Smoothit has had a policy of having zero inventories at the end of each quarter. No further sales are possibie the year and lilthe units produced so far have been sold. The CEO is planning to proda ce items for inventory in the last week of December to meet the net operating income target How many units (nearst whole numbr) need to be produced for inventory to mest he net operating income target it the sales commission is left unchanged? A. B. C. D. E. None of the above 2.734 units 5,183 units 7,000 units 20,000 units period, if inventories increass during the Assuming production levels and cost structure are stable from period to period, which of the following statements is truc? A. Net operating income under absorption costing is the same as under variable costing. B. Net operating income is lower under absorption costing than under variable costing, because somie of the fixed C. Net operating income is lower under absorption costing than under variable costing, because some of the fisxed D. Net operating income is higher under absorption costing than under variable costing, because some of the fixed E. Net operating income is higher under absorption costing than under variable costing, because some of the fixed manufacturing overhead of the period is defered in inventories under absorption costing. manufacturing overhead of the previous periods is released from inventories under absorption costing manufacturing overhead of the previous periods is released from inventories under absorption costing manufacturing overhead of the period is deferred in inventories under absorption costingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started