please answer both parts and ill leave a thumbs up

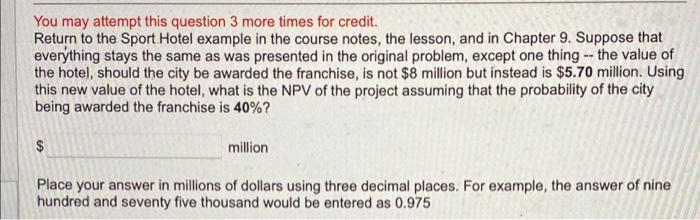

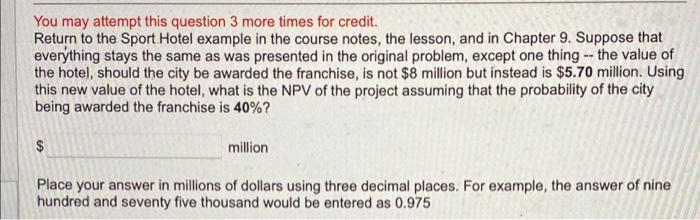

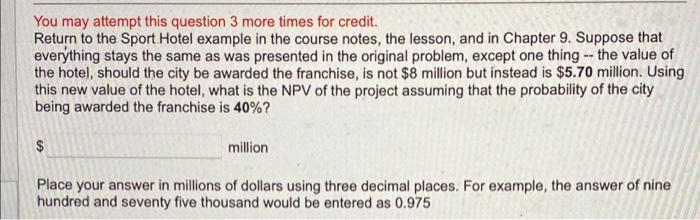

You may attempt this question 3 more times for credit. Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented in the original problem, except one thing -- the value of the hotel, should the city be awarded the franchise, is not $8 million but instead is $5.70 million. Using this new value of the hotel, what is the NPV of the project assuming that the probability of the city being awarded the franchise is 40%? $ million Place your answer in millions of dollars using three decimal places. For example, the answer of nine hundred and seventy five thousand would be entered as 0.975 This question is a variant of the Sport Hotel example that was presented in class, in the class notes, and in the Real Option chapter. Suppose that in the example, the first year expenditures that include the purchase of plans and permits is not $1 million but instead $1.2 million. All other aspects of the problem are the same as originally presented. Incorporating these new values, the probability that the city is awarded the franchise at 50%, and the real option, what is the new NPV df the project? $ million Place your answer in millions of dollars using at least three decimal places. For example, the answer of nine hundred seventy five thousand would be entered as 0.975 and not as 975000. You may attempt this question 3 more times for credit. Return to the Sport Hotel example in the course notes, the lesson, and in Chapter 9. Suppose that everything stays the same as was presented in the original problem, except one thing -- the value of the hotel, should the city be awarded the franchise, is not $8 million but instead is $5.70 million. Using this new value of the hotel, what is the NPV of the project assuming that the probability of the city being awarded the franchise is 40%? $ million Place your answer in millions of dollars using three decimal places. For example, the answer of nine hundred and seventy five thousand would be entered as 0.975 This question is a variant of the Sport Hotel example that was presented in class, in the class notes, and in the Real Option chapter. Suppose that in the example, the first year expenditures that include the purchase of plans and permits is not $1 million but instead $1.2 million. All other aspects of the problem are the same as originally presented. Incorporating these new values, the probability that the city is awarded the franchise at 50%, and the real option, what is the new NPV df the project? $ million Place your answer in millions of dollars using at least three decimal places. For example, the answer of nine hundred seventy five thousand would be entered as 0.975 and not as 975000