Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both parts of this question. upvote for sure. NWP Anuntelep X Com/w/assessment playetindechtuncd-4be5e9054-0077440055/ston Question 2 of 4 5.24/25 Show Attempt History Current Attempt

please answer both parts of this question. upvote for sure.

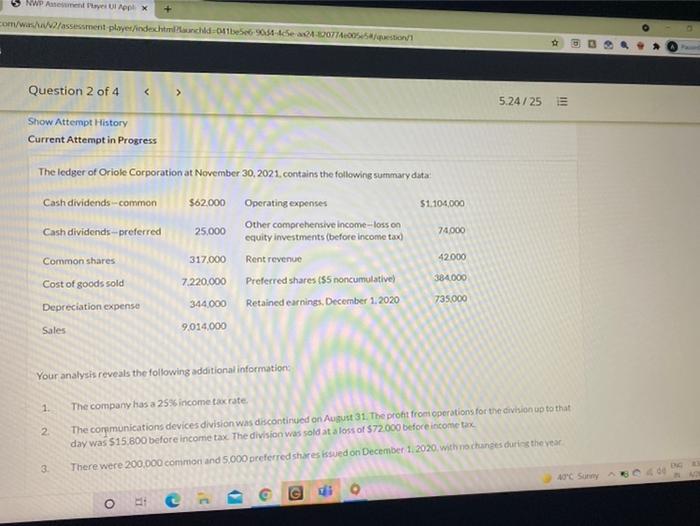

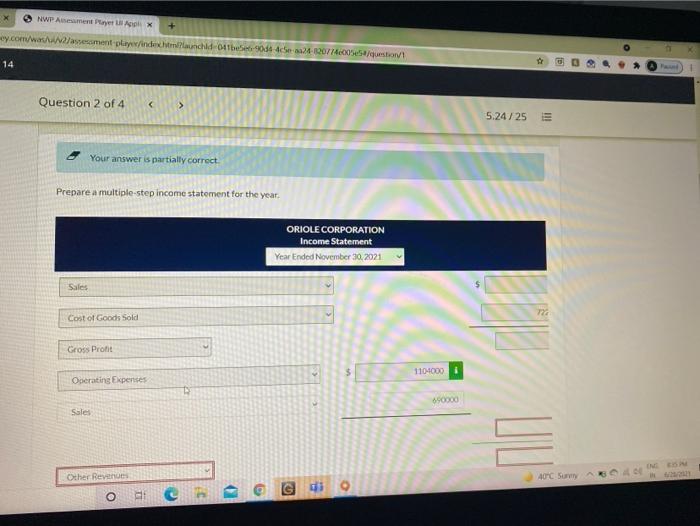

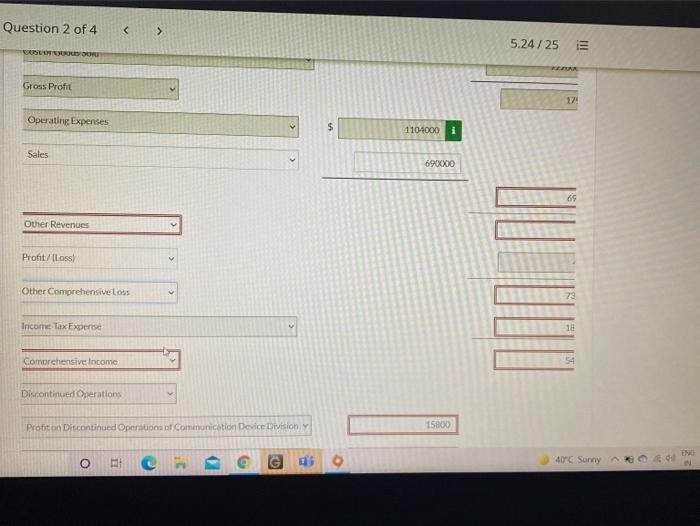

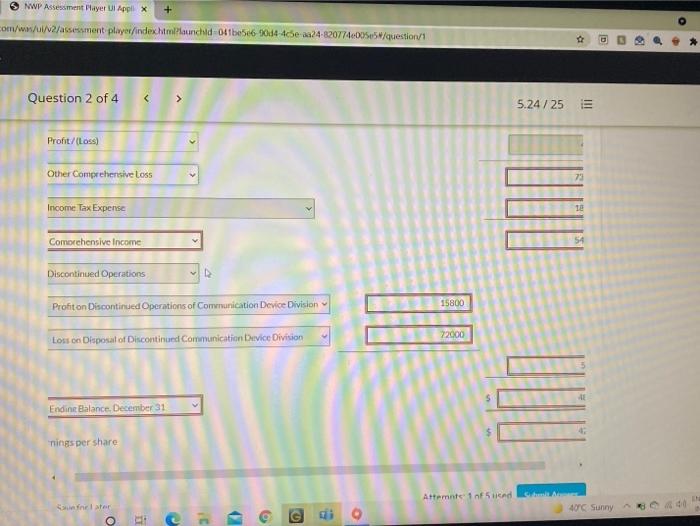

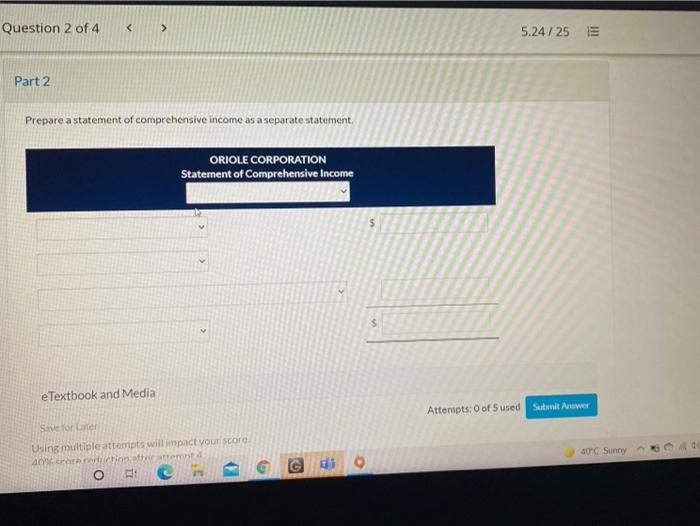

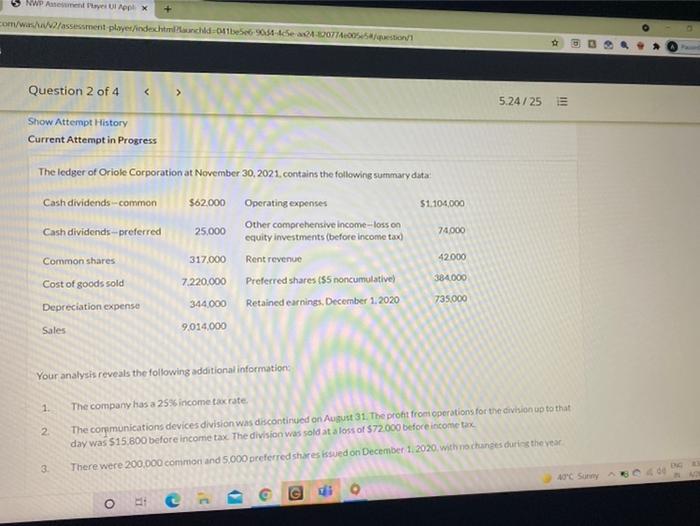

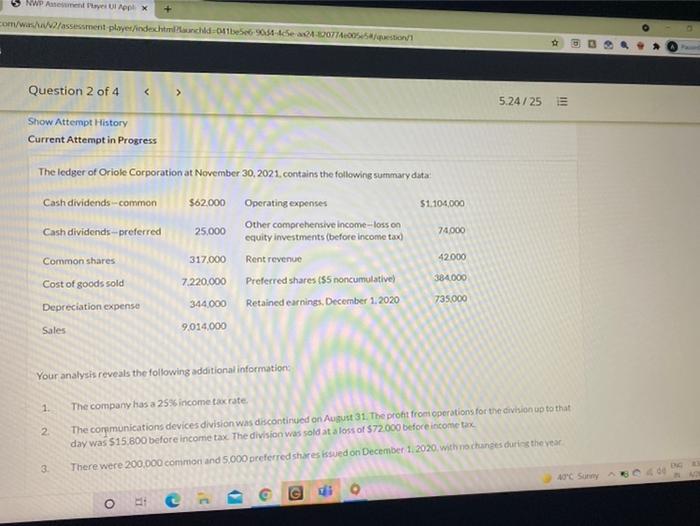

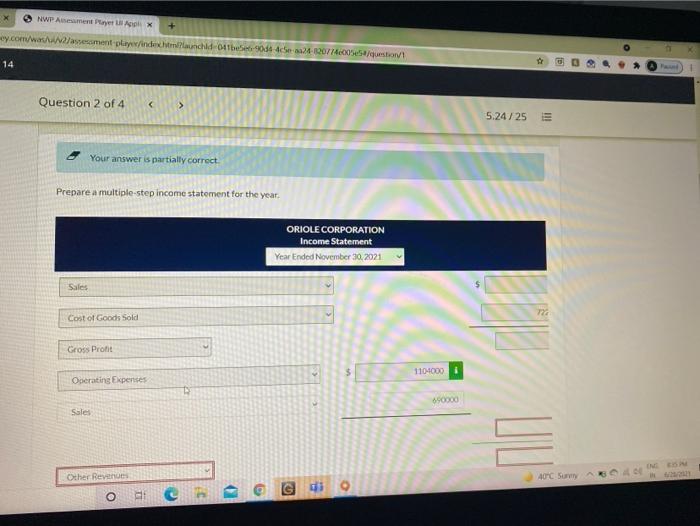

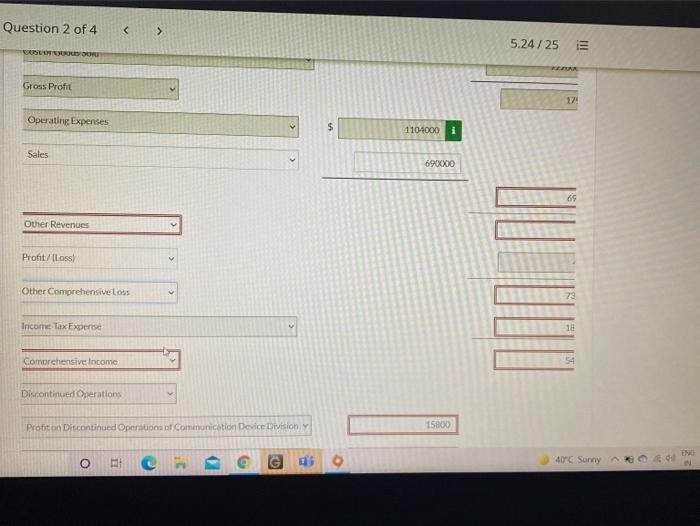

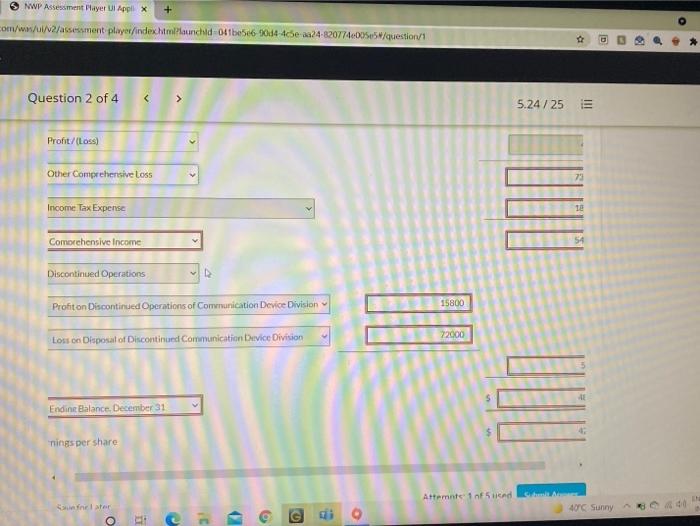

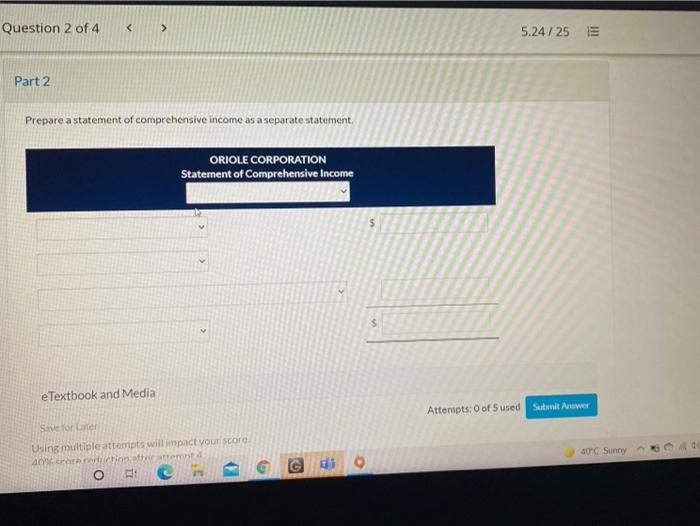

NWP Anuntelep X Com/w/assessment playetindechtuncd-4be5e9054-0077440055/ston Question 2 of 4 5.24/25 Show Attempt History Current Attempt in Progress $1.104,000 74000 The ledger of Oriote Corporation at November 30, 2021, contains the following summary data Cash dividends-common $62000 Operating expenses Cash dividends-preferred Other comprehensive income-loss on 25,000 equity investments (before income tax) 317.000 Rent revenue Cost of goods sold 7.220.000 Preferred shares (55 noncumulative) Depreciation expense Retained earnings December 1,2020 Sales 9.014,000 Common shares 42000 384.000 344000 735.000 Your analysis reveals the following additional information 1. 2 The company has a 256 income tax rate The corpmunications devices division was discontinued on August 31. The profit from operations for the division up to that day was 515.800 before income tax The division was sold at a loss of $72.000 before income tax There were 200 000 common and 5,000 preferred shares issued on December 1, 2020, with no changes during the year 3 40C Sunny G dio NWP Anment Pell + wy.com/assessment.pl/indeschluchd-4be908420774.0055/question 14 Question 2 of 4 5.24/25 III Your answer is partially correct. Prepare a multiple-step income statement for the year. ORIOLE CORPORATION Income Statement Year Ended November 30, 2021 Sales 720 Cost of Goods Sold Gross Proht $ 1104000 Oberating Expenses 90000 Sales Other Revine 40-C Smy 6 o a - 3 Question 2 of 4 > 5.24/25 III USLUULOURI ER Gross Profit 12 Operating Expenses $ 1104000 Sales 690000 69 Other Revenues Proh/(Loss) Other Comprehensive Loss 23 Income Tax Experts 18 Comorchensive Income Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 ENO 0 (2 G 40C Sunny 3 NWP Assessment Payer Ul Appll X o com/www/ui/v2/assessment player/index.htmlPlaunchid 041be56 1004-4e-224-8207740055W/question/1 Question 2 of 4 5.24/25 Proh/(Loss) Other Comprehensive Loss 73 Income Tax Expense Comprehensive Income 54 Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 22000 Loss on Disposal of Discontinued Communication Device Division Endine Balance. December 31 nings per share Attente 15cd. elter 40 Sunny o dio 3 Question 2 of 4 5.24/25 E Part 2 Prepare a statement of comprehensive income as a separate statement ORIOLE CORPORATION Statement of Comprehensive Income e Textbook and Media Attempts: 0 of 5 used Sutanit Auwer Savor Lancer Using multiple attempts will impact your score Ordonstettem o 40C Sunny . 0 NWP Anuntelep X Com/w/assessment playetindechtuncd-4be5e9054-0077440055/ston Question 2 of 4 5.24/25 Show Attempt History Current Attempt in Progress $1.104,000 74000 The ledger of Oriote Corporation at November 30, 2021, contains the following summary data Cash dividends-common $62000 Operating expenses Cash dividends-preferred Other comprehensive income-loss on 25,000 equity investments (before income tax) 317.000 Rent revenue Cost of goods sold 7.220.000 Preferred shares (55 noncumulative) Depreciation expense Retained earnings December 1,2020 Sales 9.014,000 Common shares 42000 384.000 344000 735.000 Your analysis reveals the following additional information 1. 2 The company has a 256 income tax rate The corpmunications devices division was discontinued on August 31. The profit from operations for the division up to that day was 515.800 before income tax The division was sold at a loss of $72.000 before income tax There were 200 000 common and 5,000 preferred shares issued on December 1, 2020, with no changes during the year 3 40C Sunny G dio NWP Anment Pell + wy.com/assessment.pl/indeschluchd-4be908420774.0055/question 14 Question 2 of 4 5.24/25 III Your answer is partially correct. Prepare a multiple-step income statement for the year. ORIOLE CORPORATION Income Statement Year Ended November 30, 2021 Sales 720 Cost of Goods Sold Gross Proht $ 1104000 Oberating Expenses 90000 Sales Other Revine 40-C Smy 6 o a - 3 Question 2 of 4 > 5.24/25 III USLUULOURI ER Gross Profit 12 Operating Expenses $ 1104000 Sales 690000 69 Other Revenues Proh/(Loss) Other Comprehensive Loss 23 Income Tax Experts 18 Comorchensive Income Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 ENO 0 (2 G 40C Sunny 3 NWP Assessment Payer Ul Appll X o com/www/ui/v2/assessment player/index.htmlPlaunchid 041be56 1004-4e-224-8207740055W/question/1 Question 2 of 4 5.24/25 Proh/(Loss) Other Comprehensive Loss 73 Income Tax Expense Comprehensive Income 54 Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 22000 Loss on Disposal of Discontinued Communication Device Division Endine Balance. December 31 nings per share Attente 15cd. elter 40 Sunny o dio 3 Question 2 of 4 5.24/25 E Part 2 Prepare a statement of comprehensive income as a separate statement ORIOLE CORPORATION Statement of Comprehensive Income e Textbook and Media Attempts: 0 of 5 used Sutanit Auwer Savor Lancer Using multiple attempts will impact your score Ordonstettem o 40C Sunny . 0

NWP Anuntelep X Com/w/assessment playetindechtuncd-4be5e9054-0077440055/ston Question 2 of 4 5.24/25 Show Attempt History Current Attempt in Progress $1.104,000 74000 The ledger of Oriote Corporation at November 30, 2021, contains the following summary data Cash dividends-common $62000 Operating expenses Cash dividends-preferred Other comprehensive income-loss on 25,000 equity investments (before income tax) 317.000 Rent revenue Cost of goods sold 7.220.000 Preferred shares (55 noncumulative) Depreciation expense Retained earnings December 1,2020 Sales 9.014,000 Common shares 42000 384.000 344000 735.000 Your analysis reveals the following additional information 1. 2 The company has a 256 income tax rate The corpmunications devices division was discontinued on August 31. The profit from operations for the division up to that day was 515.800 before income tax The division was sold at a loss of $72.000 before income tax There were 200 000 common and 5,000 preferred shares issued on December 1, 2020, with no changes during the year 3 40C Sunny G dio NWP Anment Pell + wy.com/assessment.pl/indeschluchd-4be908420774.0055/question 14 Question 2 of 4 5.24/25 III Your answer is partially correct. Prepare a multiple-step income statement for the year. ORIOLE CORPORATION Income Statement Year Ended November 30, 2021 Sales 720 Cost of Goods Sold Gross Proht $ 1104000 Oberating Expenses 90000 Sales Other Revine 40-C Smy 6 o a - 3 Question 2 of 4 > 5.24/25 III USLUULOURI ER Gross Profit 12 Operating Expenses $ 1104000 Sales 690000 69 Other Revenues Proh/(Loss) Other Comprehensive Loss 23 Income Tax Experts 18 Comorchensive Income Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 ENO 0 (2 G 40C Sunny 3 NWP Assessment Payer Ul Appll X o com/www/ui/v2/assessment player/index.htmlPlaunchid 041be56 1004-4e-224-8207740055W/question/1 Question 2 of 4 5.24/25 Proh/(Loss) Other Comprehensive Loss 73 Income Tax Expense Comprehensive Income 54 Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 22000 Loss on Disposal of Discontinued Communication Device Division Endine Balance. December 31 nings per share Attente 15cd. elter 40 Sunny o dio 3 Question 2 of 4 5.24/25 E Part 2 Prepare a statement of comprehensive income as a separate statement ORIOLE CORPORATION Statement of Comprehensive Income e Textbook and Media Attempts: 0 of 5 used Sutanit Auwer Savor Lancer Using multiple attempts will impact your score Ordonstettem o 40C Sunny . 0 NWP Anuntelep X Com/w/assessment playetindechtuncd-4be5e9054-0077440055/ston Question 2 of 4 5.24/25 Show Attempt History Current Attempt in Progress $1.104,000 74000 The ledger of Oriote Corporation at November 30, 2021, contains the following summary data Cash dividends-common $62000 Operating expenses Cash dividends-preferred Other comprehensive income-loss on 25,000 equity investments (before income tax) 317.000 Rent revenue Cost of goods sold 7.220.000 Preferred shares (55 noncumulative) Depreciation expense Retained earnings December 1,2020 Sales 9.014,000 Common shares 42000 384.000 344000 735.000 Your analysis reveals the following additional information 1. 2 The company has a 256 income tax rate The corpmunications devices division was discontinued on August 31. The profit from operations for the division up to that day was 515.800 before income tax The division was sold at a loss of $72.000 before income tax There were 200 000 common and 5,000 preferred shares issued on December 1, 2020, with no changes during the year 3 40C Sunny G dio NWP Anment Pell + wy.com/assessment.pl/indeschluchd-4be908420774.0055/question 14 Question 2 of 4 5.24/25 III Your answer is partially correct. Prepare a multiple-step income statement for the year. ORIOLE CORPORATION Income Statement Year Ended November 30, 2021 Sales 720 Cost of Goods Sold Gross Proht $ 1104000 Oberating Expenses 90000 Sales Other Revine 40-C Smy 6 o a - 3 Question 2 of 4 > 5.24/25 III USLUULOURI ER Gross Profit 12 Operating Expenses $ 1104000 Sales 690000 69 Other Revenues Proh/(Loss) Other Comprehensive Loss 23 Income Tax Experts 18 Comorchensive Income Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 ENO 0 (2 G 40C Sunny 3 NWP Assessment Payer Ul Appll X o com/www/ui/v2/assessment player/index.htmlPlaunchid 041be56 1004-4e-224-8207740055W/question/1 Question 2 of 4 5.24/25 Proh/(Loss) Other Comprehensive Loss 73 Income Tax Expense Comprehensive Income 54 Discontinued Operations Profit on Discontinued Operations of Communication Device Division 15800 22000 Loss on Disposal of Discontinued Communication Device Division Endine Balance. December 31 nings per share Attente 15cd. elter 40 Sunny o dio 3 Question 2 of 4 5.24/25 E Part 2 Prepare a statement of comprehensive income as a separate statement ORIOLE CORPORATION Statement of Comprehensive Income e Textbook and Media Attempts: 0 of 5 used Sutanit Auwer Savor Lancer Using multiple attempts will impact your score Ordonstettem o 40C Sunny . 0

please answer both parts of this question. upvote for sure.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started