Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both question and state the answer clearly . A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present

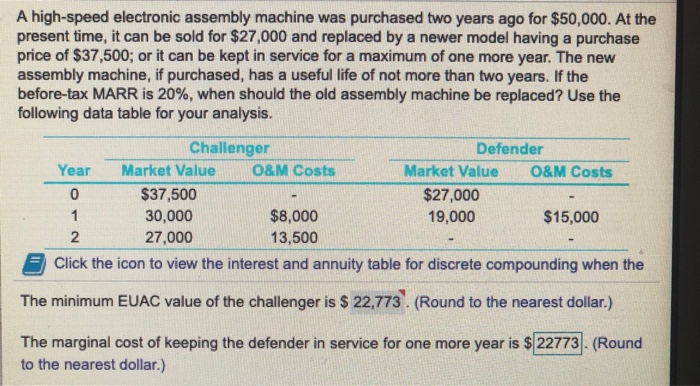

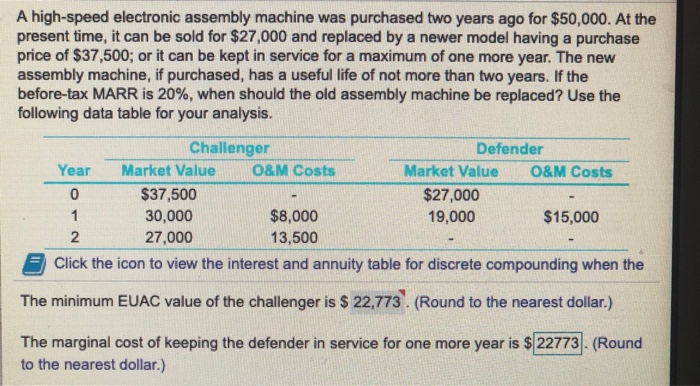

please answer both question and state the answer clearly . A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present time, it can be sold for $27,000 and replaced by a newer model having a purchase price of $37,500; or it can be kept in service for a maximum of one more year. The new assembly machine, if purchased, has a useful life of not more than two years. If the before-tax MARR is 20%, when should the old assembly machine be replaced? Use the following data table for your analysis. Challenger Market ValueO&M Costs Defender Market Value O&M Costs Year 0 $27,000 19,000 $37,500 30,000 27,000 $8,000 13,500 $15,000 2 Click the icon to view the interest and annuity table for discrete compounding when the The minimum EUAC value of the challenger is $ 22,773. (Round to the nearest dollar.) The marginal cost of keeping the defender in service for one more year is $ 22773 (Round to the nearest dollar.)

please answer both question and state the answer clearly . A high-speed electronic assembly machine was purchased two years ago for $50,000. At the present time, it can be sold for $27,000 and replaced by a newer model having a purchase price of $37,500; or it can be kept in service for a maximum of one more year. The new assembly machine, if purchased, has a useful life of not more than two years. If the before-tax MARR is 20%, when should the old assembly machine be replaced? Use the following data table for your analysis. Challenger Market ValueO&M Costs Defender Market Value O&M Costs Year 0 $27,000 19,000 $37,500 30,000 27,000 $8,000 13,500 $15,000 2 Click the icon to view the interest and annuity table for discrete compounding when the The minimum EUAC value of the challenger is $ 22,773. (Round to the nearest dollar.) The marginal cost of keeping the defender in service for one more year is $ 22773 (Round to the nearest dollar.)

please answer both question and state the answer clearly .

please answer both question and state the answer clearly . Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started