Answered step by step

Verified Expert Solution

Question

1 Approved Answer

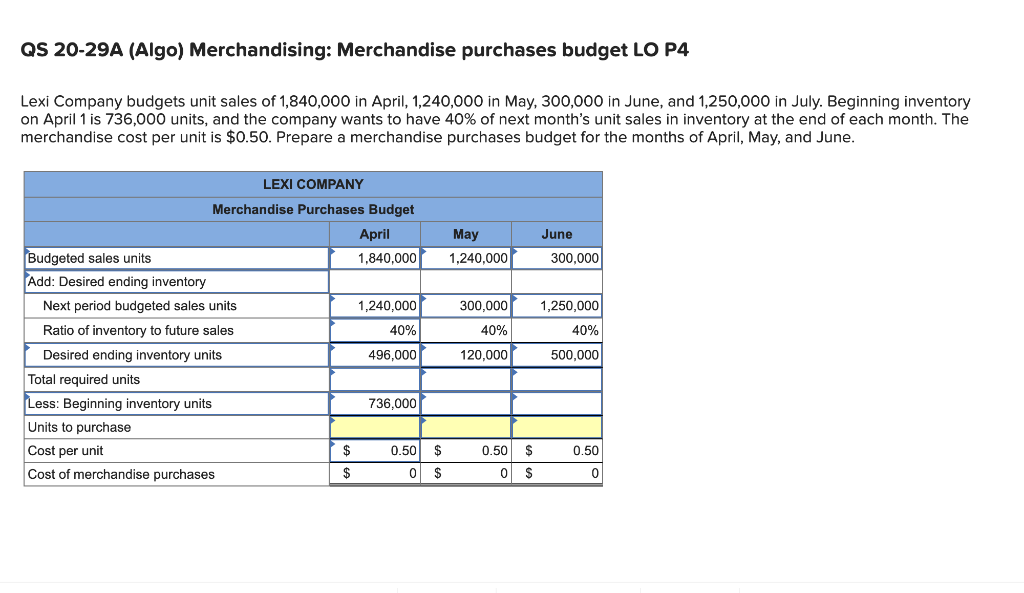

Please answer both question!!! QS 20-29A (Algo) Merchandising: Merchandise purchases budget LO P4 Lexi Company budgets unit sales of 1,840,000 in April, 1,240,000 in May,

Please answer both question!!!

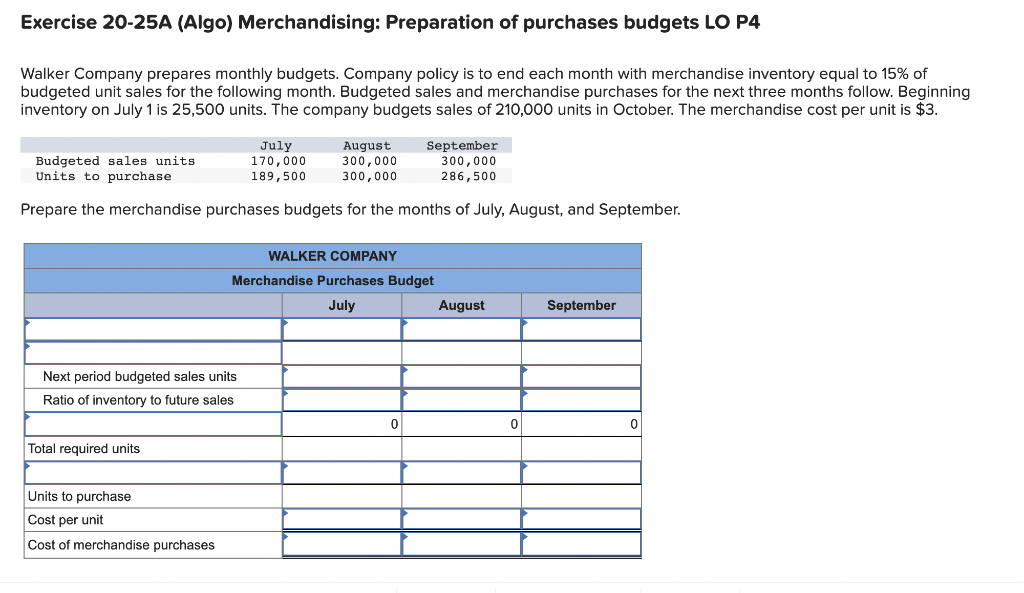

QS 20-29A (Algo) Merchandising: Merchandise purchases budget LO P4 Lexi Company budgets unit sales of 1,840,000 in April, 1,240,000 in May, 300,000 in June, and 1,250,000 in July. Beginning inventory on April 1 is 736,000 units, and the company wants to have 40% of next month's unit sales in inventory at the end of each month. The merchandise cost per unit is $0.50. Prepare a merchandise purchases budget for the months of April, May, and June. June May 1,240,000 300,000 300,000 1,250,000 LEXI COMPANY Merchandise Purchases Budget April Budgeted sales units 1,840,000 Add: Desired ending inventory Next period budgeted sales units 1,240,000 Ratio of inventory to future sales 40% Desired ending inventory units 496,000 Total required units Less: Beginning inventory units 736,000 Units to purchase Cost per unit $ 0.50 $ Cost of merchandise purchases $ 0 $ 40% 40% 120.000 500,000 0.50 0.50 $ 0 S 0 Exercise 20-25A (Algo) Merchandising: Preparation of purchases budgets LO P4 Walker Company prepares monthly budgets. Company policy is to end each month with merchandise inventory equal to 15% of budgeted unit sales for the following month. Budgeted sales and merchandise purchases for the next three months follow. Beginning inventory on July 1 is 25,500 units. The company budgets sales of 210,000 units in October. The merchandise cost per unit is $3. Budgeted sales units Units to purchase July 170,000 189,500 August 300,000 300,000 September 300,000 286,500 Prepare the merchandise purchases budgets for the months of July, August, and September. WALKER COMPANY Merchandise Purchases Budget July August September Next period budgeted sales units Ratio of inventory to future sales 0 0 0 Total required units Units to purchase Cost per unit Cost of merchandise purchasesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started