Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both questions. 11. Bob needs money and goes to the bank for a $150,000 loan. The bank tells him that he can borrow

Please answer both questions.

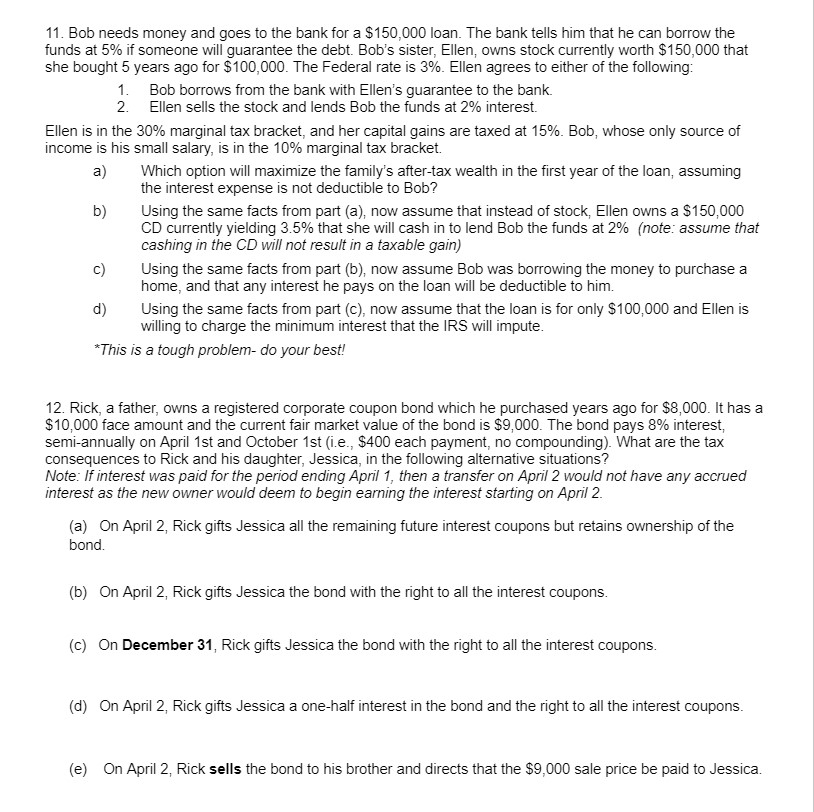

11. Bob needs money and goes to the bank for a $150,000 loan. The bank tells him that he can borrow the funds at 5% if someone will guarantee the debt. Bob's sister, Ellen, owns stock currently worth $150,000 that she bought 5 years ago for $100,000. The Federal rate is 3%. Ellen agrees to either of the following: 1. Bob borrows from the bank with Ellen's guarantee to the bank. 2. Ellen sells the stock and lends Bob the funds at 2% interest. Ellen is in the 30% marginal tax bracket, and her capital gains are taxed at 15%. Bob, whose only source of income is his small salary, is in the 10% marginal tax bracket. a) Which option will maximize the family's after-tax wealth in the first year of the loan, assuming the interest expense is not deductible to Bob? b) Using the same facts from part (a), now assume that instead of stock, Ellen owns a $150,000 CD currently yielding 3.5% that she will cash in to lend Bob the funds at 2% (note: assume that cashing in the CD will not result in a taxable gain) c) Using the same facts from part (b), now assume Bob was borrowing the money to purchase a home, and that any interest he pays on the loan will be deductible to him. d) Using the same facts from part (c), now assume that the loan is for only $100,000 and Ellen is willing to charge the minimum interest that the IRS will impute. *This is a tough problem- do your best! 12. Rick, a father, owns a registered corporate coupon bond which he purchased years ago for $8,000. It has a $10,000 face amount and the current fair market value of the bond is $9,000. The bond pays 8% interest, semi-annually on April 1st and October 1st (i.e., $400 each payment, no compounding). What are the tax consequences to Rick and his daughter, Jessica, in the following alternative situations? Note: If interest was paid for the period ending April 1, then a transfer on April 2 would not have any accrued interest as the new owner would deem to begin earning the interest starting on April 2. (a) On April 2, Rick gifts Jessica all the remaining future interest coupons but retains ownership of the bond. (b) On April 2, Rick gifts Jessica the bond with the right to all the interest coupons. (c) On December 31, Rick gifts Jessica the bond with the right to all the interest coupons. (d) On April 2, Rick gifts Jessica a one-half interest in the bond and the right to all the interest coupons. (e) On April 2, Rick sells the bond to his brother and directs that the $9,000 sale price be paid to JessicaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started