please answer BOTH questions

2nd part of #1

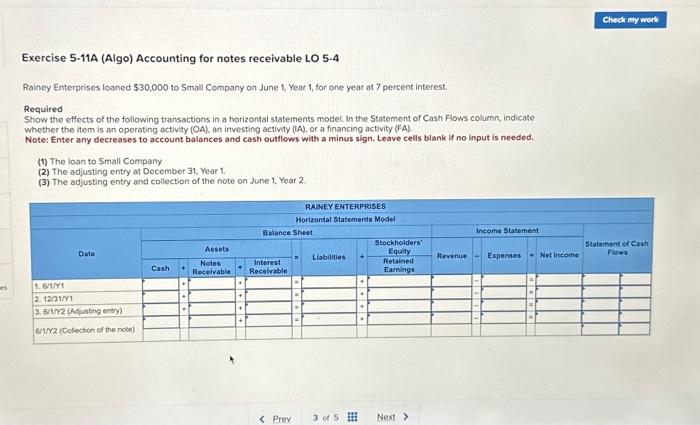

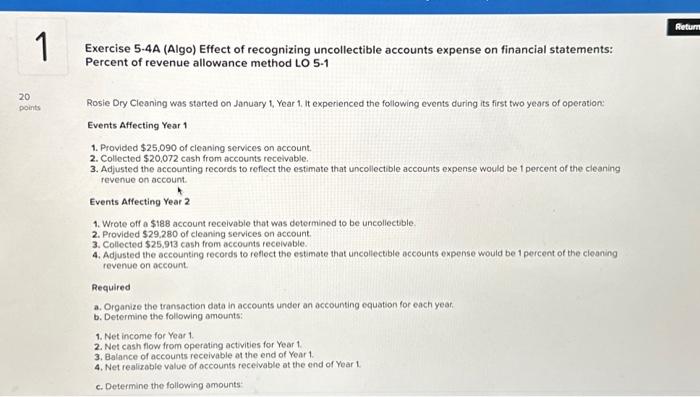

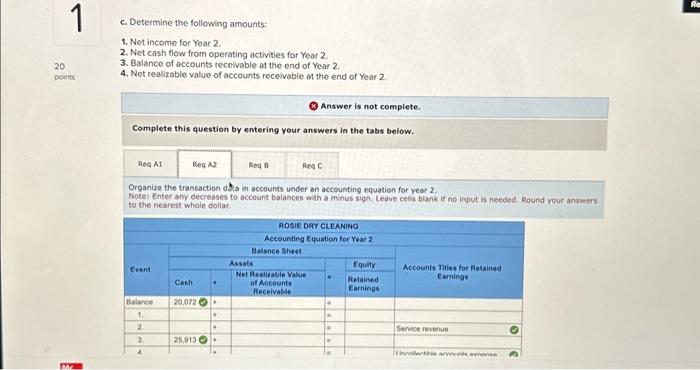

Exercise 5-11A (Algo) Accounting for notes receivable LO 5-4 Rainey Enterprises loaned $30,000 to Small Company on June 1, Year 1, for one year at 7 percent interest. Required Show the effects of the following transactions in a horizontal statements model. In the Statement of Cash Flows column, indicote whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). Note: Enter any decreases to account balances and cash outflows with a minus sign. Leave cells blank if no input is needed. (1) The loan to Small Company (2) The adjusting entry at December 31 , Year 1 , (3) The adjusting entry and collection of the note on June 1, Year 2 Exercise 5.4A (Algo) Effect of recognizing uncollectible accounts expense on financial statements: Percent of revenue allowance method LO 5-1 Rosie Dry Cleaning was started on January 1, Year 1. It experienced the following events during its first two years of operation: Events Affecting Year 1 1. Provided $25,090 of cleaning services on account. 2. Collected $20,072 cash from accounts receivable. 3. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on account. Events Affecting Vear 2 1. Wrote off a $188 account receivable that was determined to be uncollectible. 2. Provided $29.280 of cleaning services on account. 3. Collected $25,913 cash from accounts receivable. 4. Adjusted the accounting records to reflect the estimate that uncollectible accounts expense would be 1 percent of the cleaning revenue on occount. Required a. Organize the transection dota in accounts under an occounting equation for each yeat. b. Determine the following omounts: 1. Net income for Year 1. 2. Net cash flow from operating activities for Year 1. 3. Balance of accounts receivable ot the end of Year 1. 3. Net realizable value of accounts receivable at the end of Year 1. c. Determine the following amounts c. Determine the following amounts: 1. Net income for Year 2. 2. Net cash flow from operating activities for Year 2. 3. Balance of accounts recelvable ot the end of Year 2. 4. Net realizable value of accounts recelvable ot the end of Year 2. Answer is not complete. Complete this question by entering your answers in the tabs below. Organize the transaction dba in accounts under an accounting equation for year 2. Note: Enter any decreases to account balances with a minus sign. Leave celli blank if no input is needed. Round your answers to the nearest whole doliar