please answer both questions #3 & #6

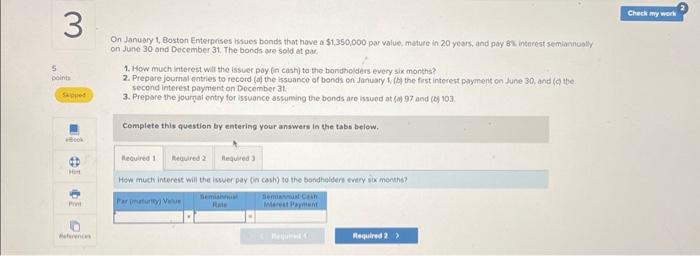

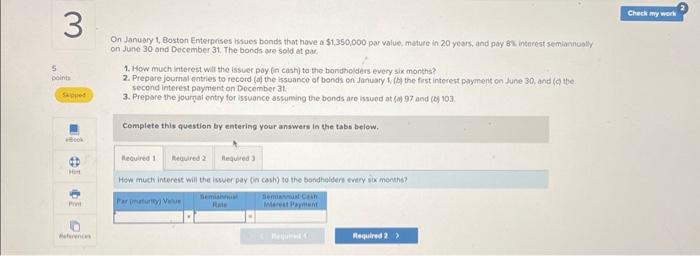

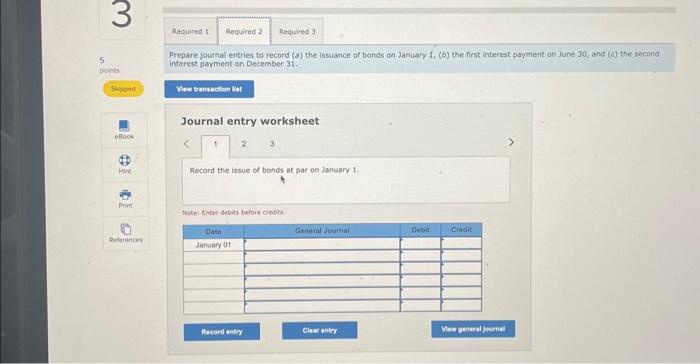

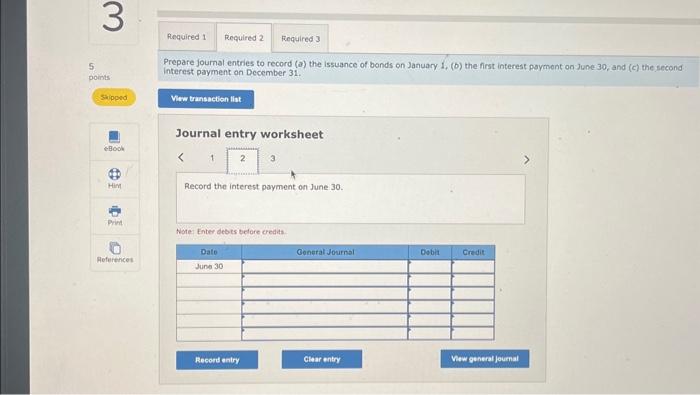

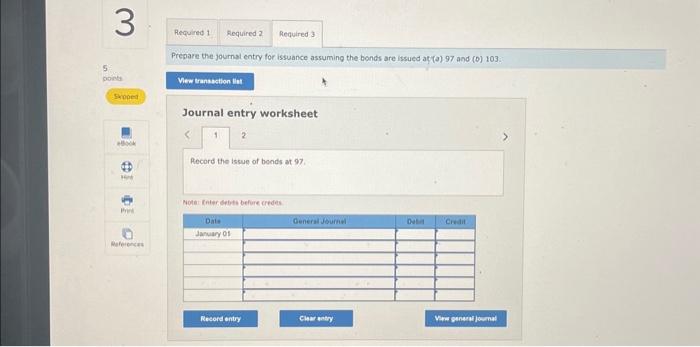

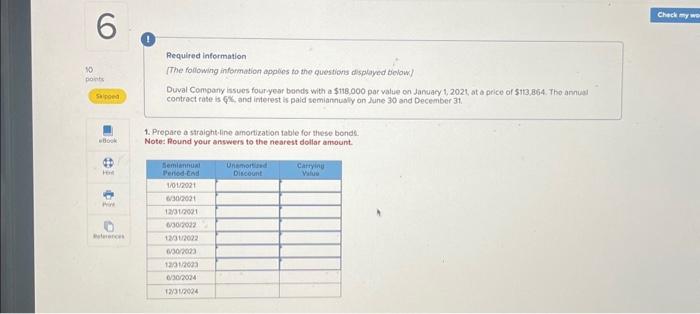

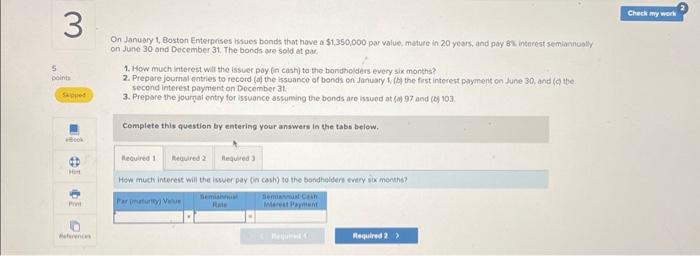

On January 1, Boston Enterprises hsues bonds that have a $1,350,000 par value, mature in 20 years, and pay 8x interest semiannubly on June 30 and Docember 31 , The bonds are sold at par. 1. How much interest wil the issuer pay (in cash) to the bondhideles every six months? second interest payment on Docember 31 . 3. Prepsre the jourgal entry for issuance astuming the bonds are issuod at (a)97 and (0)103. Complete this question by entering your answers in the tabs below. How much interest will the iswer pay (in cash) to the bendhelden every six months? Prepare joumal entries to record (b) the issuance of bands on January 1,(b) the first interest payment on June Jo, and (c) the secand nterest payment on December 31 . Journal entry worksheet Record the issue of bonds at par on January 1. Nutei Enter debits before crests Prepare journal entries to record (a) the issuance of bonds on January 1,(b) the first interest paymont on June 30 , and (c) the second Interest payment on December 31 . Journal entry worksheet Record the interest payment on June 30. Note: Enter debts before creats. Prepare the journat entry for issuance assuming the bonds are issued at (a)97 and (D)103. Journal entry worksheet 2 Record the issue of bonds at 97 . Notet Inier, debes befire credes. Required information The forfowing information apples to the questions displayed biolow) Duval Company issues fouryear bends with a $118,000 por value on Jamuacy 1,2021 at a price of $13,864. Tho annual contract rate is 6%, and interest is paid semiannualy on June 30 and December 31. 1. Prepare a straight-line amortization table for these bonde. Note: Round your answers to the nearest dollar ansount. On January 1, Boston Enterprises hsues bonds that have a $1,350,000 par value, mature in 20 years, and pay 8x interest semiannubly on June 30 and Docember 31 , The bonds are sold at par. 1. How much interest wil the issuer pay (in cash) to the bondhideles every six months? second interest payment on Docember 31 . 3. Prepsre the jourgal entry for issuance astuming the bonds are issuod at (a)97 and (0)103. Complete this question by entering your answers in the tabs below. How much interest will the iswer pay (in cash) to the bendhelden every six months? Prepare joumal entries to record (b) the issuance of bands on January 1,(b) the first interest payment on June Jo, and (c) the secand nterest payment on December 31 . Journal entry worksheet Record the issue of bonds at par on January 1. Nutei Enter debits before crests Prepare journal entries to record (a) the issuance of bonds on January 1,(b) the first interest paymont on June 30 , and (c) the second Interest payment on December 31 . Journal entry worksheet Record the interest payment on June 30. Note: Enter debts before creats. Prepare the journat entry for issuance assuming the bonds are issued at (a)97 and (D)103. Journal entry worksheet 2 Record the issue of bonds at 97 . Notet Inier, debes befire credes. Required information The forfowing information apples to the questions displayed biolow) Duval Company issues fouryear bends with a $118,000 por value on Jamuacy 1,2021 at a price of $13,864. Tho annual contract rate is 6%, and interest is paid semiannualy on June 30 and December 31. 1. Prepare a straight-line amortization table for these bonde. Note: Round your answers to the nearest dollar ansount