Answered step by step

Verified Expert Solution

Question

1 Approved Answer

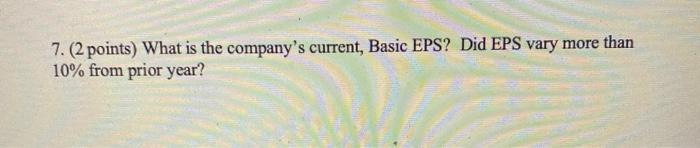

PLEASE ANSWER BOTH QUESTIONS 7 & 8 (a,b,c) AS SOON AS POSSIBLE THANK YOU SO MUCH! all information that may be needed provided below 8.

PLEASE ANSWER BOTH QUESTIONS 7 & 8 (a,b,c) AS SOON AS POSSIBLE THANK YOU SO MUCH!

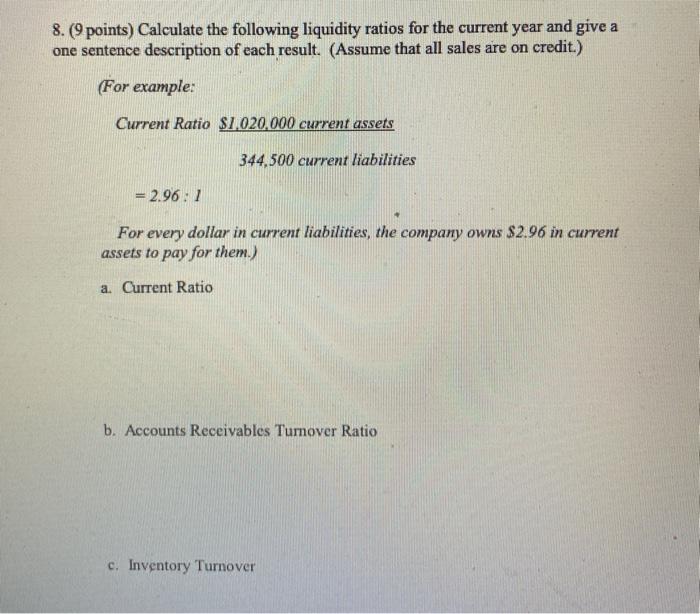

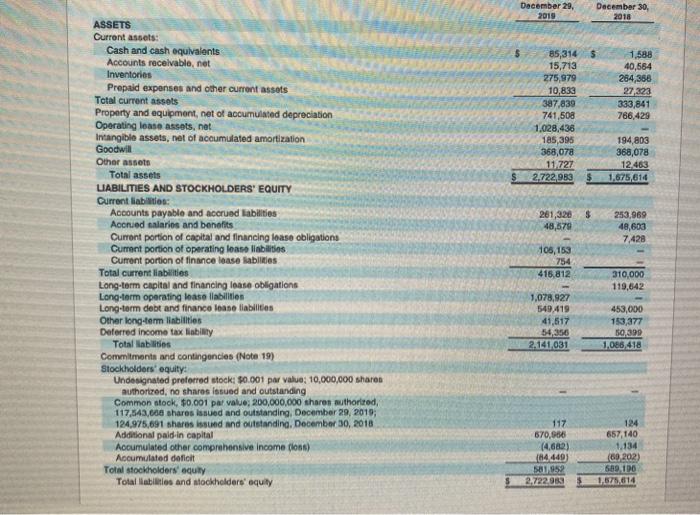

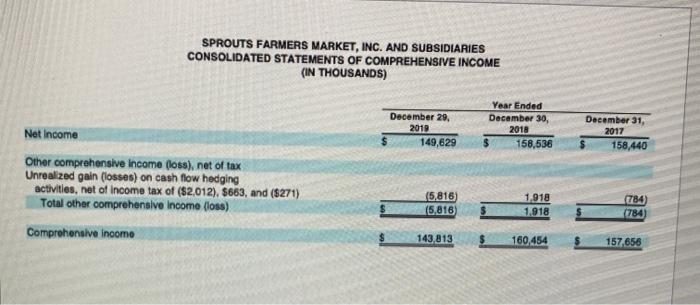

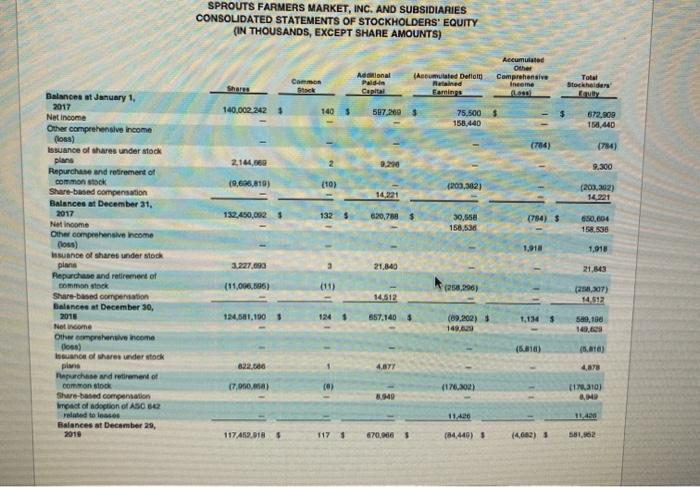

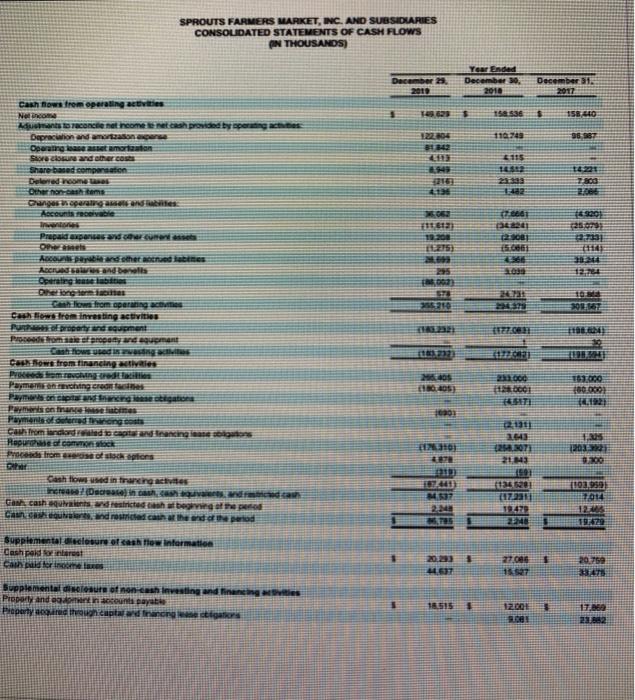

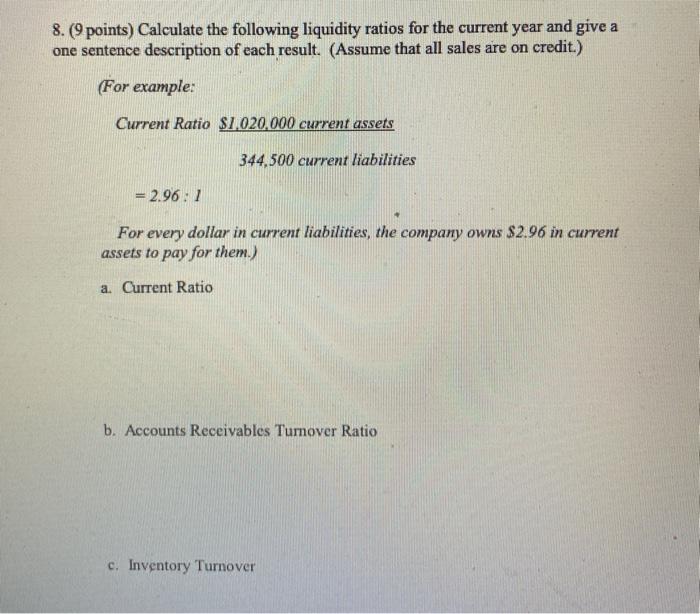

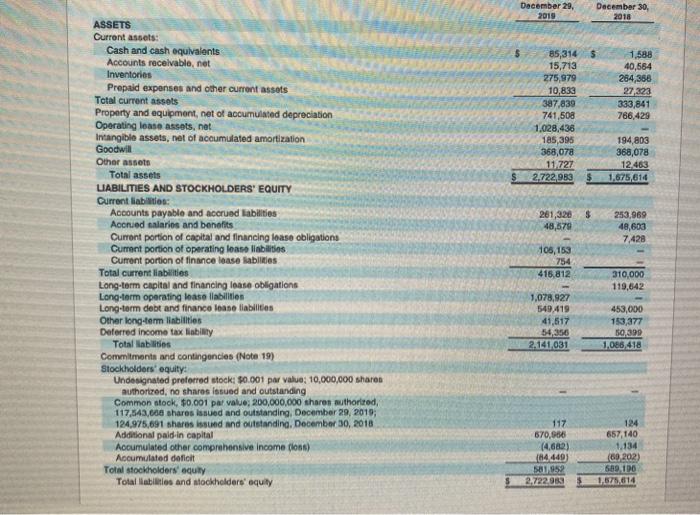

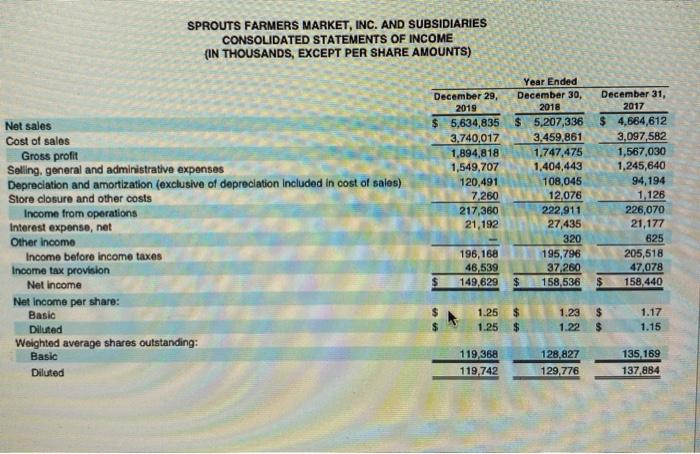

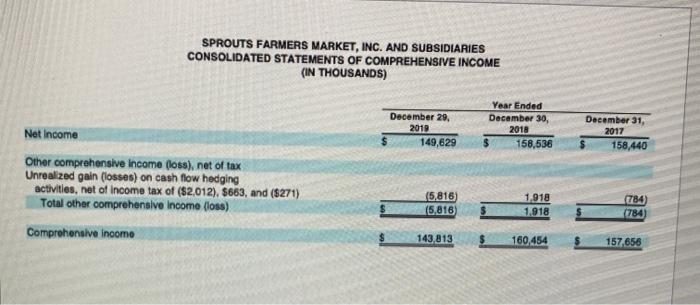

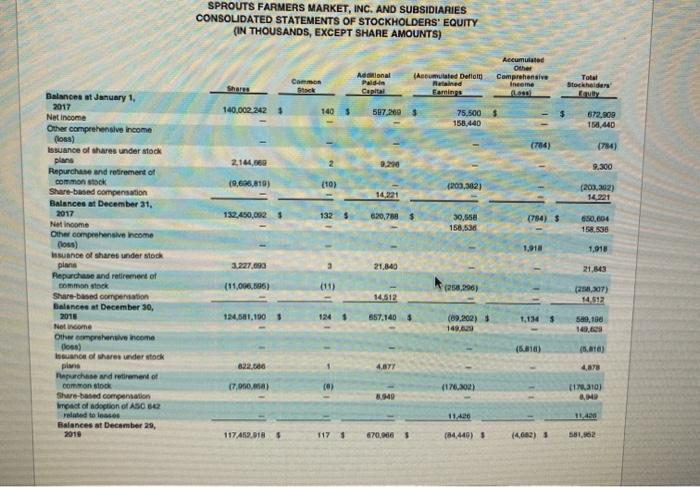

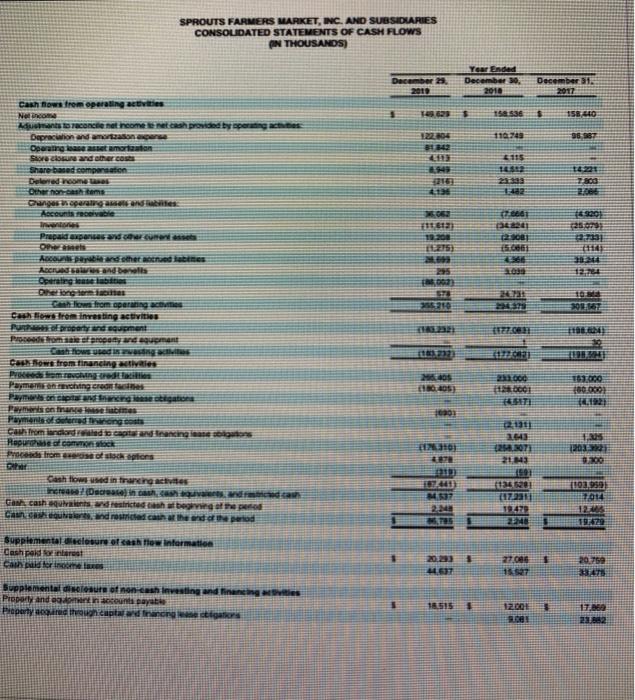

8. (9 points) Calculate the following liquidity ratios for the current year and give a one sentence description of each result. (Assume that all sales are on credit.) (For example: Current Ratio $1,020,000 current assets 344,500 current liabilities = 2.96: 1 For every dollar in current liabilities, the company owns $2.96 in current assets to pay for them.) a. Current Ratio b. Accounts Receivables Turnover Ratio c. Inventory Turnover December 29, 2019 December 30, 2018 85,314 $ 15,713 275,979 10,833 387,839 741,508 1,028,436 185,395 368,078 11727 2,722,983 $ 1.588 40,584 264,366 27,323 333,841 766,429 194.803 368,078 12,463 1.675,614 $ $ 261,320 48,579 253,969 48,603 7,428 ASSETS Current assets: Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net of accumulated depreciation Operating lease assets, net Intangible assets, net of accumulated amortization Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable and accrued abilities Aconued salaries and benefits Curront portion of capital and financing loase obligations Current portion of operating lease liabilities Current portion of finance lease sablities Total current liabilities Long-term capital and financing lease obligations Long-term operating lease liabilities Long-term debt and finance lease liabilities Other long-term linbilities Deferred income tax liability Total abilities Commitments and contingencies (Note 19) Stockholders' equity Undesignated preferred stock: 0.001 par value: 10,000,000 shares authorized, no shares issued and outstanding Common stock, $0.001 par value: 200,000,000 shares authorited, 117,543,600 shares issued and outstanding, December 29, 2019, 124,975,691 shares issued and outstanding, December 30, 2018 Additional paid in capital Accumulated other comprehensive Income dion) Accumulated deficit Total stockholders oqully Total abilities and stockholders' equity 105,153 754 416,812 310,000 119,642 1,078,927 549.419 41,517 54,356 2.141031 453,000 153,377 50,390 1,086,418 117 670.6856 (4.682) (84449) 1952 2.722983 124 657,140 1.134 (60202) 689,190 1,575,614 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) Net sales Cost of sales Gross profit Selling general and administrative expenses Depreciation and amortization (exclusive of depreciation Included in cost of sales) Store closure and other costs Income from operations Interest expense, net Other income Income before income taxes Income tax provision Net income Net Income per share: Basic Diluted Weighted average shares outstanding: Basic Diluted Year Ended December 29, December 30, 2019 2018 $ 5,634,835 $ 5,207,336 3,740,017 3,459,861 1.894,818 1.747,475 1,549,707 1.404,443 120,491 108,045 7.260 12,076 217,360 222,911 21,192 27,435 320 196,168 195,796 46,539 37,260 149,629 $ 158,536 December 31, 2017 $ 4,664,612 3,097,582 1,567,030 1,245,640 94,194 1 126 226,070 21,177 625 205,518 47078 $ 158,440 1.25 1.25 $ $ 1.23 1.22 $ $ 1.17 1.15 119,368 119,742 128,827 129,776 135,169 137,884 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (IN THOUSANDS) Year Ended December 30, 2018 158,536 December 29, 2019 149,629 Net Income December 31, 2017 158.440 Other comprehensive Income (loss), net of tax Unrealized gain (losses) on cash flow hedging activities, net of income tax of ($2,012). $663, and ($271) Total other comprehensive Income (loss) Comprehensive incomo 15,816 (5,816 1,918 1,918 784) (784) 143,813 160, 454 157 656 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (IN THOUSANDS, EXCEPT SHARE AMOUNTS) Additional Palan | Capital Common Accumulated Other Comprehensive Income Acumulated Deflon Nutained Fomins Total Stockholders Share 140.0022242 1405 597,200 75.500 5 158.440 672.909 198,440 (784) 784) 2.144,00 9.300 19,696,810) (10) (209,312) 14,221 (203.302) 14.221 132.450,0025 1325 620,788 $ (754) S 30.550 158.530 650,004 158 53 1,910 1,918 Balances at January 1, 2017 Net Income Other comprehensive income losa) Issuance of shares understock plans Repurchase and retirement of common stock Share-based compensation Balances at December 31, 2017 Net income Other comprehensive Income (los Issuance of shares understock plans Repurchase and retirement of motok Share-based comes Balances at December 30, 2015 Nel come Other comprehensive Income nos olhares understock plane Repurchase and retirement of Common stock Shure-based compensation pect of adoption of ASC related to Balances at December 29, 2010 3.227.000 21.840 21.143 (11.096,696) (11) 258,296) 14 512 (2017) 14 512 124,581,190 657.140 $ (29,202) 148.6 1,134 59,150 140.6 (5.618) (5.00) 622.00 4.GTY 4,878 17.000.000 (170.2012) 1940 (1310) 2.0 11.426 11.40 117462.0185 1171 670,006 (84440) (4,662) 581.862 SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS ON THOUSANOS) December 2010 Year Ended December 30, 2010 December 2017 158 536 $ 158410 110748 96.57 Cash flows from operating activities Nel com Ants contentcome net cash provided by operating acties Depreciation and amanecerse Operating and asset amortation SA and others Share based compensation Deleted me Other cases 84142 115 2.800 2.et Accounts receivable . 11.12 23081 TETS Prepaid expenses and round OP And other dames ABC sonders Operating te mbet EE 355210 301.8 can low from operating actes Casio trem investing activities Po propertrand equipment Promody and equipment Trat Carow from financing activeles Pramogos Paymemancing creates de stations 13.00 180.0001 1405 FOCO SITI 1993 Payment of condong costs Cau Tromlador de captandingane soos Rape common tok from others 1643 0254.2071 2113 120 ta 201 Cash towed interactive (Dedicada Ganh cashion destricted to being of the per Cance and restricted car at the end of period 1102959 1914 19479 1979 Supplemental losure of Cow Informatie Cashpold Rust can cul ferie 3 2021 1 27.08 1527 20.750 48 Supplemental disclosure of non cash investing and financing its Property and encounts ayat Property through capital and financng tigas 1 18.515 3 1200 FI 17.00 23882

all information that may be needed provided below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started