Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both questions and label them. ty ^ $ quotations stated in Suppose an American investor is given the current exchange rates in the

please answer both questions and label

them. ty

them. ty

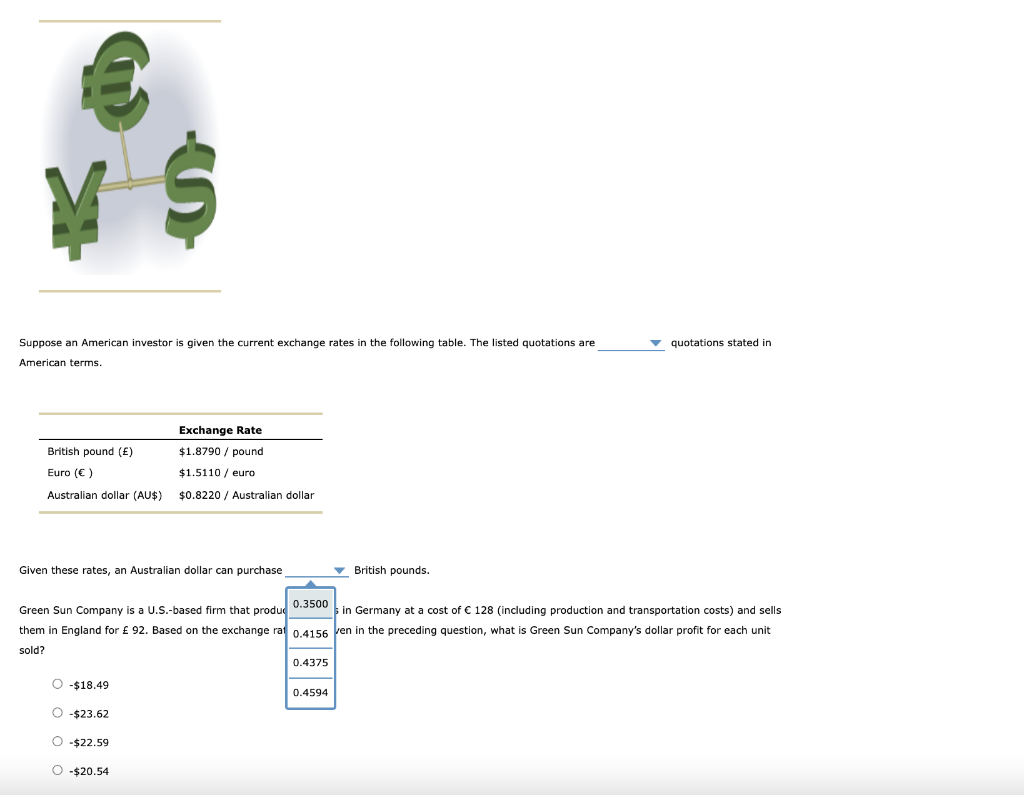

^ $ quotations stated in Suppose an American investor is given the current exchange rates in the following table. The listed quotations are American terms British pound () Euro () Exchange Rate $1.8790 / pound $1.5110 / euro Australian dollar (AU$) $0.8220 / Australian dollar Given these rates, an Australian dollar can purchase British pounds. Green Sun Company is a U.S.-based firm that produd 0.3500 in Germany at a cost of 128 (including production and transportation costs) and sells them in England for 92. Based on the exchange rat 0.4156 ven in the preceding question, what is Green Sun Company's dollar profit for each unit sold? 0.4375 0-$18.49 0.4594 0-$23.62 0-$22.59 0-$20.54 5. Purchasing power parity The law of one price The theory of purchasing power parity (PPP) states that in the long-run exchange rates between two countries adjusts so that the price of an identical good is the same when expressed in the same currency. A television costs 889.35 in England. The spot rate currently $1.8967 per pound. TIUNE 50370 ? 3330370 Assuming that PPP holds true, what is the price of the television in the United States? O $1,349.46 $1,686.83 O $1,433.81 O $468.89 Suppose the price of the television in the United States was actually $1,855.51. Assuming no transaction costs, transportation costs, or import restrictions, what does PPP predict would happen to the demand for the television in the United States? O The demand for the television would decrease in the United States. The demand for the television would increase in the United States

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started