please answer both questions for a big thumbs up and a good rating.

please answer only part 5 for the second question thanks.

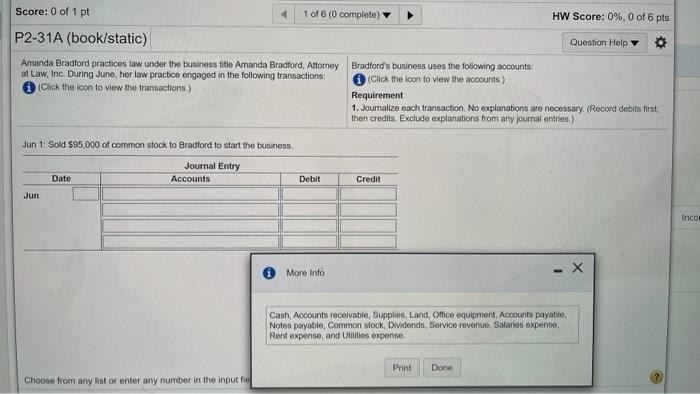

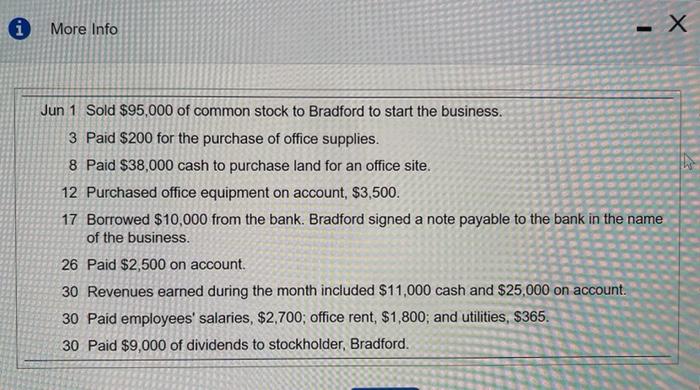

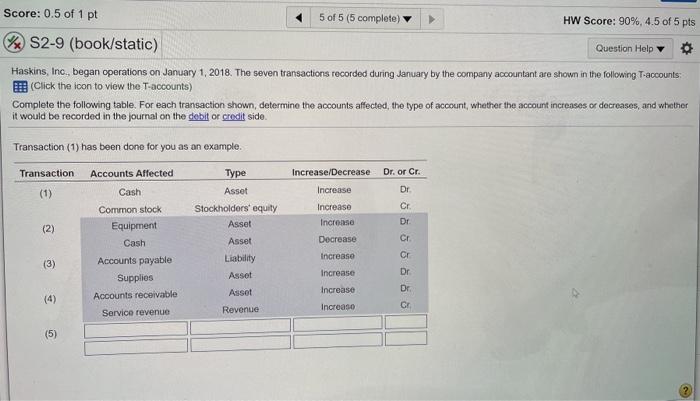

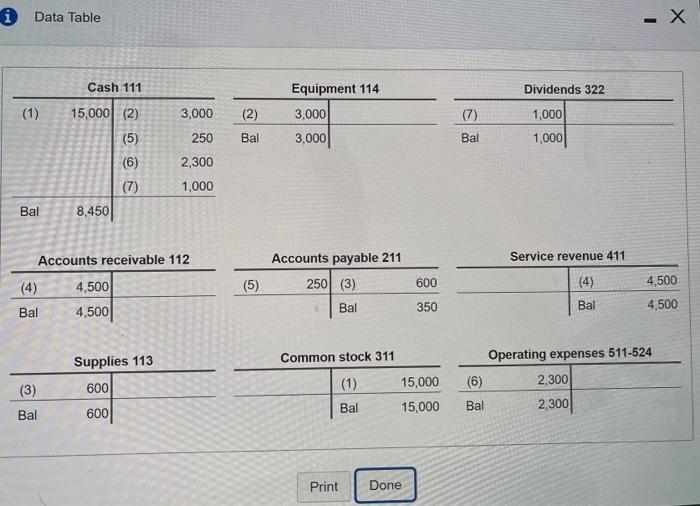

Score: 0 of 1 pt 1 of 6 (0 complete) HW Score: 0%, 0 of 6 pts P2-31A (book/static) Question Help Amanda Bradford practices law under the business title Amanda Bradford, Attorney at Law, Inc. During June, her law practice engaged in the following transactions: Click the icon to view the transactions.) Bradford's business uses the following accounts: (Click the icon to view the accounts.) Requirement 1. Journalize each transaction. No explanations are necessary. (Record debits first, then credits Exclude explanations from any journal entries ) Jun 1: Sold $95,000 of common stock to Bradford to start the business Journal Entry Accounts Date Debit Credit Jun Inco More Info Cash, Accounts receivable, Supplies Land, Oflice equipment, Accounts payable Notes payable, Common stock, Dividends Service revenue, Salaries expense. Rent expense, and Utilities expense Print Done Choose from any list or enter any number in the input i More Info Jun 1 Sold $95,000 of common stock to Bradford to start the business. 3 Paid $200 for the purchase of office supplies. 8 Paid $38,000 cash to purchase land for an office site. 12 Purchased office equipment on account, $3,500. 17 Borrowed $10,000 from the bank. Bradford signed a note payable to the bank in the nam of the business. 26 Paid $2,500 on account. 30 Revenues earned during the month included $11,000 cash and $25,000 on account. 30 Paid employees' salaries, $2,700; office rent, $1,800; and utilities, $365. 30 Paid $9,000 of dividends to stockholder, Bradford. Score: 0.5 of 1 pt 5 of 5 (5 complete) HW Score: 90%, 4.5 of 5 pts S2-9 (book/static) Question Help Haskins, Inc., began operations on January 1, 2018. The seven transactions recorded during January by the company accountant are shown in the following T-accounts: Click the icon to view the T-accounts) Complete the following table. For each transaction shown, determine the accounts affected the type of account, whether the account increases or decreases, and whether it would be recorded in the journal on the debitor credit side. Dr. or Cr. Dr Cr. Dr. Transaction (1) has been done for you as an example. Transaction Accounts Affected Type (1) Cash Asset Common stock Stockholders' equity (2) Equipment Asset Cash Asset (3) Accounts payable Liability Supplies Asset Accounts receivable Asset Service revenue Revenue Increase/Decrease Increase Increase Increase Decrease Increase Increase Increase Increase Cr Cr Dr Dr GE (5) 2 i Data Table - Cash 111 Dividends 322 (1) 3,000 (2) Equipment 114 3,000 3,000 (7) 1,000 250 Bal Bal 1,000 15,000 (2) (5) (6) (7) 8,450 2,300 1,000 Bal Accounts receivable 112 Service revenue 411 Accounts payable 211 250 (3) 4,500 (4) (5) 600 (4) 4,500 4,500 Bal Bal 350 Bal 4,500 Common stock 311 Supplies 113 600 Operating expenses 511-524 2,300 (3) (1) 15,000 15,000 Bal Bal 2,300 600 Bal Print Done