Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer both the correct answer is given 12 a. A Te Tiere pored stock with an ATY of 5:18 percent corpi 6.311-4)-3.757 le tax

please answer both the correct answer is given

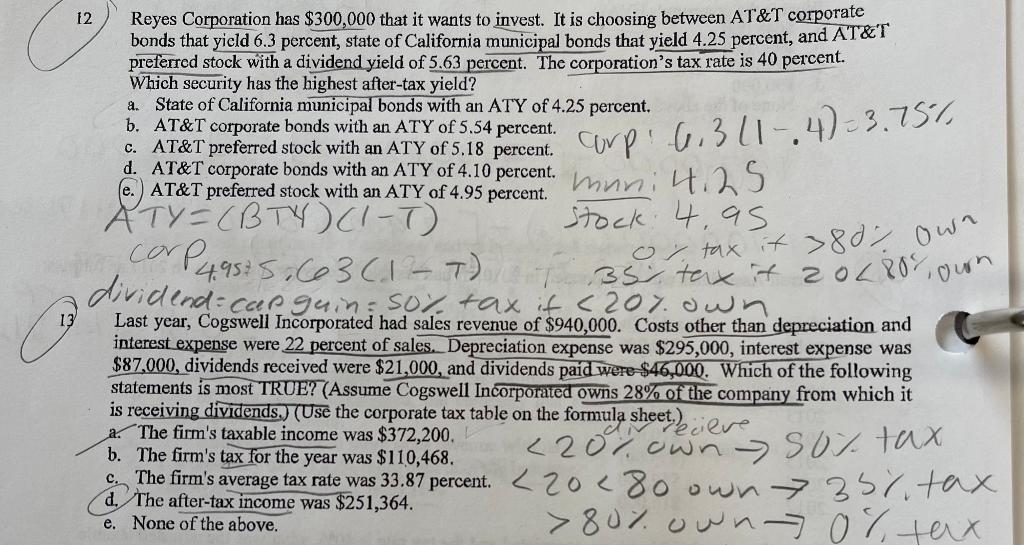

12 a. A Te Tiere pored stock with an ATY of 5:18 percent corpi 6.311-4)-3.757 le tax it 380) own Reyes Corporation has $300,000 that it wants to invest. It is choosing between AT&T corporate bonds that yield 6.3 percent, state of California municipal bonds that yield 4.25 percent, and AT&T preferred stock with a dividend yield of 5.63 percent. The corporation's tax rate is 40 percent. Which security has the highest after-tax yield? a. State of California municipal bonds with an ATY of 4.25 percent. b. AT&T corporate bonds with an ATY of 5.54 percent. . AT&T corporate bonds with an ATY of 4.10 percent. muni 4.25 AT&T preferred stock with an ATY of 4.95 percent. ATY = (BTH)(1-T) stock 4.95 corp 495:5.663 (17) 35 tex it 20680 0 dividend-car guin- soy tax it 4 207 ou Last year, Cogswell Incorporated had sales revenue of $940,000. Costs other than depreciation and interest expense were 22 percent of sales. Depreciation expense was $295,000, interest expense was $87,000, dividends received were $21,000, and dividends paid were $46,000. Which of the following statements is most TRUE? (Assume Cogswell Incorporated owns 28% of the company from which it is receiving dividends.) (Use the corporate tax table on the formula sheet.) cieve a. The firm's taxable income was $372,200. b. The firm's tax for the year was $110,468. 80% owna 0 % tax Crown 12 a. A Te Tiere pored stock with an ATY of 5:18 percent corpi 6.311-4)-3.757 le tax it 380) own Reyes Corporation has $300,000 that it wants to invest. It is choosing between AT&T corporate bonds that yield 6.3 percent, state of California municipal bonds that yield 4.25 percent, and AT&T preferred stock with a dividend yield of 5.63 percent. The corporation's tax rate is 40 percent. Which security has the highest after-tax yield? a. State of California municipal bonds with an ATY of 4.25 percent. b. AT&T corporate bonds with an ATY of 5.54 percent. . AT&T corporate bonds with an ATY of 4.10 percent. muni 4.25 AT&T preferred stock with an ATY of 4.95 percent. ATY = (BTH)(1-T) stock 4.95 corp 495:5.663 (17) 35 tex it 20680 0 dividend-car guin- soy tax it 4 207 ou Last year, Cogswell Incorporated had sales revenue of $940,000. Costs other than depreciation and interest expense were 22 percent of sales. Depreciation expense was $295,000, interest expense was $87,000, dividends received were $21,000, and dividends paid were $46,000. Which of the following statements is most TRUE? (Assume Cogswell Incorporated owns 28% of the company from which it is receiving dividends.) (Use the corporate tax table on the formula sheet.) cieve a. The firm's taxable income was $372,200. b. The firm's tax for the year was $110,468. 80% owna 0 % tax CrownStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started