Answered step by step

Verified Expert Solution

Question

1 Approved Answer

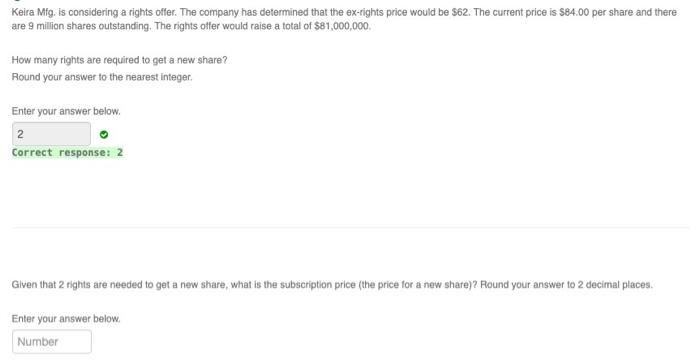

Please answer both! Thumbs up! Keira Mfg. is considering a rights offer. The company has determined that the ex-rights price would be $62. The current

Please answer both! Thumbs up!

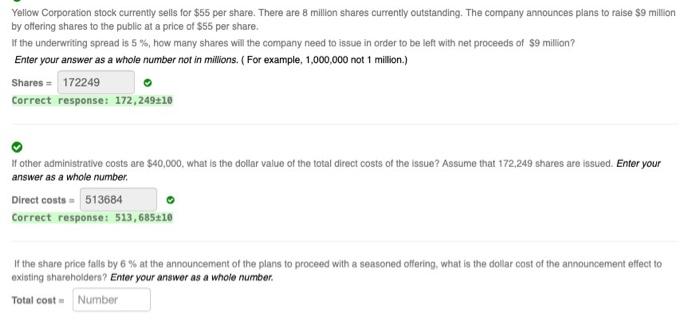

Keira Mfg. is considering a rights offer. The company has determined that the ex-rights price would be $62. The current price is $84.00 per share and there are 9 million shares outstanding. The rights offer would raise a total of $81,000,000 How many rights are required to get a new share? Round your answer to the nearest Integer Enter your answer below. 2 Correct response: 2 Given that 2 rights are needed to get a new share, what is the subscription price (the price for a new shate)? Round your answer to 2 decimal places. Enter your answer below Number Yellow Corporation stock currently sells for $55 per share. There are 8 million shares currently outstanding. The company announces plans to raise $9 million by offering shares to the public at a price of $55 per share. If the underwriting spread is 5%, how many shares will the company need to issue in order to be left with net proceeds of $9 million? Enter your answer as a whole number not in millions. (For example, 1,000,000 not 1 million) Sharos - 172249 Correct response: 172,249410 If other administrative costs are $40,000, what is the dollar value of the total direct costs of the issue? Assume that 172,249 shares are issued. Enter your answer as a whole number Direct costs - 513684 Correct response: 513,685210 of the share price falls by 6% at the announcement of the plans to proceed with a seasoned offering, what is the dollar cost of the announcement effect to existing shareholders? Enter your answer as a whole number Total cost Number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started