Question: PLEASE ANSWER BOTH USING A BA II FINANCE CALCULATOR AND SHOW KEY STROKES. Will rate all answers, thanks!! ROOM FOR INTERPRETATION RELATIVE TO THIS INSTRUCTION,

PLEASE ANSWER BOTH USING A BA II FINANCE CALCULATOR AND SHOW KEY STROKES. Will rate all answers, thanks!!

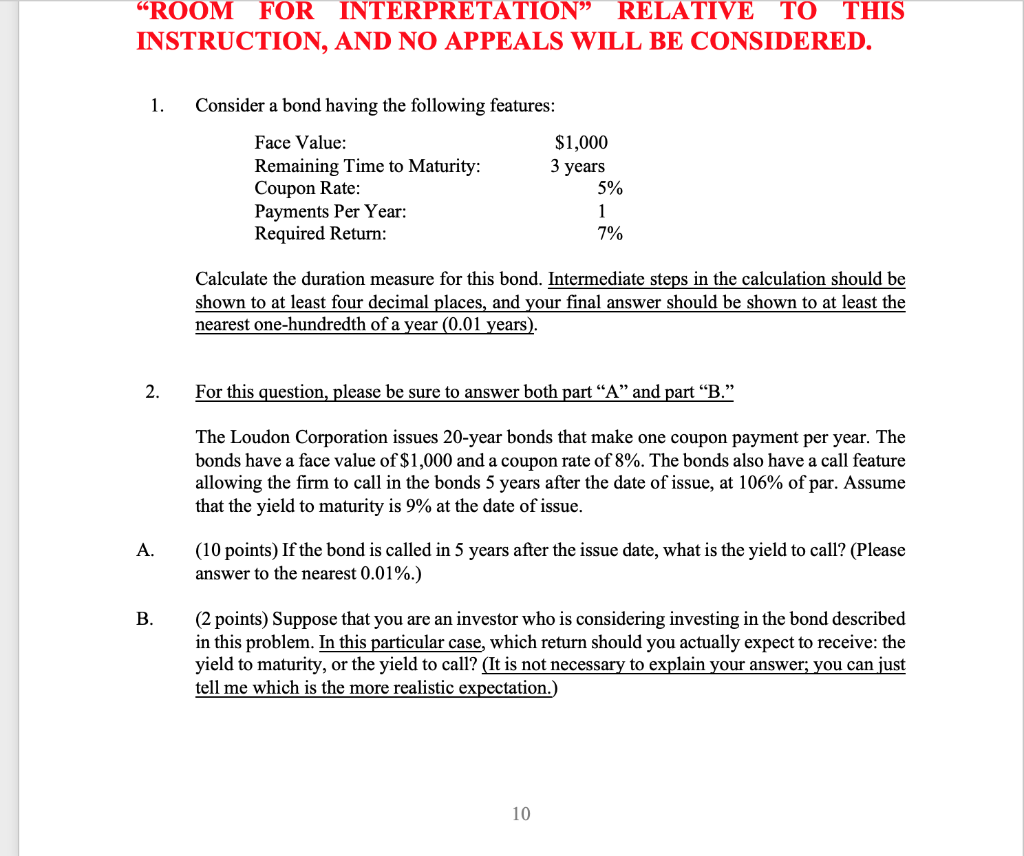

"ROOM FOR INTERPRETATION RELATIVE TO THIS INSTRUCTION, AND NO APPEALS WILL BE CONSIDERED. 1. Consider a bond having the following features: Face Value: $1,000 Remaining Time to Maturity: 3 years Coupon Rate: 5% Payments Per Year: 1 Required Return: 7% Calculate the duration measure for this bond. Intermediate steps in the calculation should be shown to at least four decimal places, and your final answer should be shown to at least the nearest one-hundredth of a year (0.01 years). 2. For this question, please be sure to answer both part "A" and part "B." The Loudon Corporation issues 20-year bonds that make one coupon payment per year. The bonds have a face value of $1,000 and a coupon rate of 8%. The bonds also have a call feature allowing the firm to call in the bonds 5 years after the date of issue, at 106% of par. Assume that the yield to maturity is 9% at the date of issue. A. (10 points) If the bond is called in 5 years after the issue date, what is the yield to call? (Please answer to the nearest 0.01%.) B. (2 points) Suppose that you are an investor who is considering investing in the bond described in this problem. In this particular case, which return should you actually expect to receive: the yield to maturity, or the yield to call? (It is not necessary to explain your answer; you can just tell me which is the more realistic expectation.) 10 "ROOM FOR INTERPRETATION RELATIVE TO THIS INSTRUCTION, AND NO APPEALS WILL BE CONSIDERED. 1. Consider a bond having the following features: Face Value: $1,000 Remaining Time to Maturity: 3 years Coupon Rate: 5% Payments Per Year: 1 Required Return: 7% Calculate the duration measure for this bond. Intermediate steps in the calculation should be shown to at least four decimal places, and your final answer should be shown to at least the nearest one-hundredth of a year (0.01 years). 2. For this question, please be sure to answer both part "A" and part "B." The Loudon Corporation issues 20-year bonds that make one coupon payment per year. The bonds have a face value of $1,000 and a coupon rate of 8%. The bonds also have a call feature allowing the firm to call in the bonds 5 years after the date of issue, at 106% of par. Assume that the yield to maturity is 9% at the date of issue. A. (10 points) If the bond is called in 5 years after the issue date, what is the yield to call? (Please answer to the nearest 0.01%.) B. (2 points) Suppose that you are an investor who is considering investing in the bond described in this problem. In this particular case, which return should you actually expect to receive: the yield to maturity, or the yield to call? (It is not necessary to explain your answer; you can just tell me which is the more realistic expectation.) 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts