Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both What is the implied probability of repayment on one-year B-rated debt? Round your answer to the nearest two decimal places. If the

Please answer both

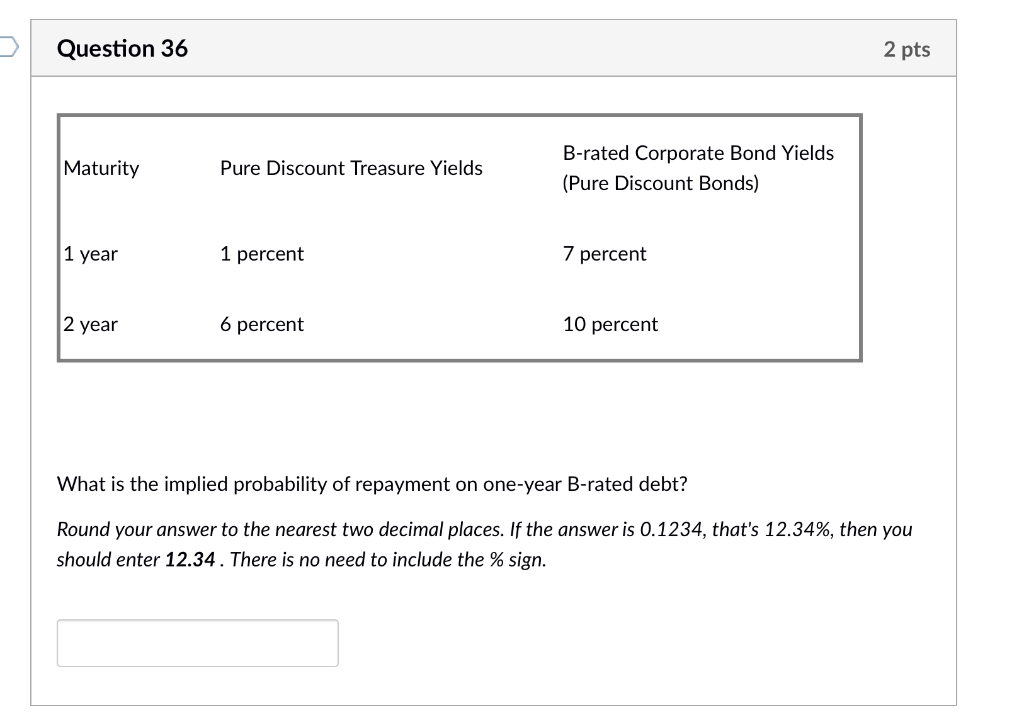

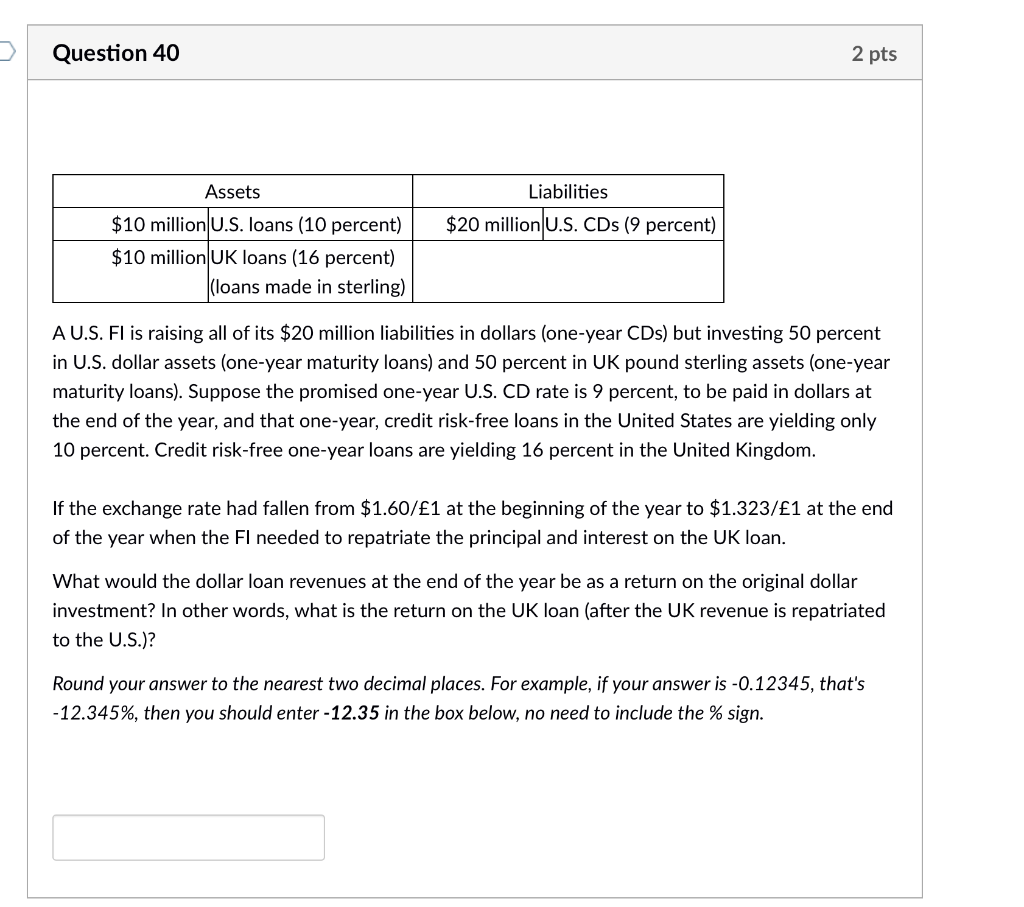

What is the implied probability of repayment on one-year B-rated debt? Round your answer to the nearest two decimal places. If the answer is 0.1234, that's 12.34%, then you should enter 12.34. There is no need to include the % sign. A U.S. FI is raising all of its $20 million liabilities in dollars (one-year CDs) but investing 50 percent in U.S. dollar assets (one-year maturity loans) and 50 percent in UK pound sterling assets (one-year maturity loans). Suppose the promised one-year U.S. CD rate is 9 percent, to be paid in dollars at the end of the year, and that one-year, credit risk-free loans in the United States are yielding only 10 percent. Credit risk-free one-year loans are yielding 16 percent in the United Kingdom. If the exchange rate had fallen from $1.60/1 at the beginning of the year to $1.323/1 at the end of the year when the FI needed to repatriate the principal and interest on the UK loan. What would the dollar loan revenues at the end of the year be as a return on the original dollar investment? In other words, what is the return on the UK loan (after the UK revenue is repatriated to the U.S.)? Round your answer to the nearest two decimal places. For example, if your answer is 0.12345, that's 12.345%, then you should enter 12.35 in the box below, no need to include the % signStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started