please answer both will upvote

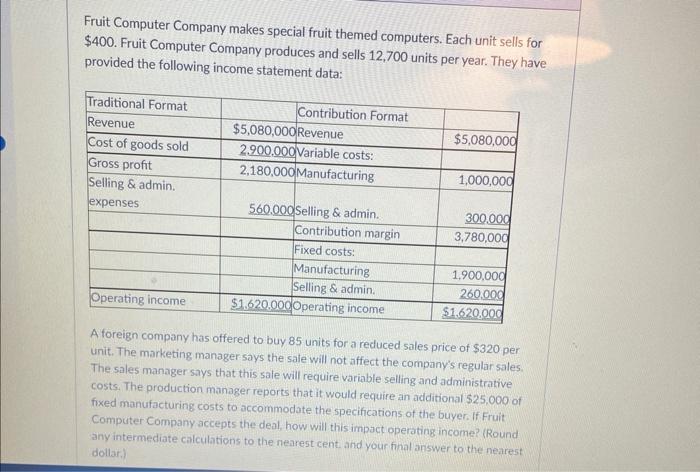

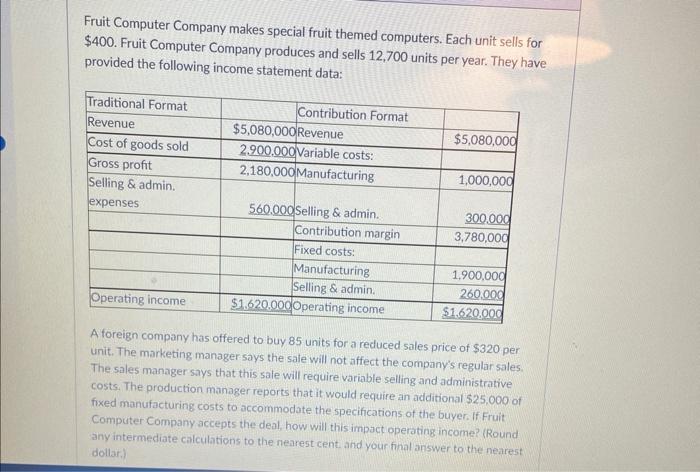

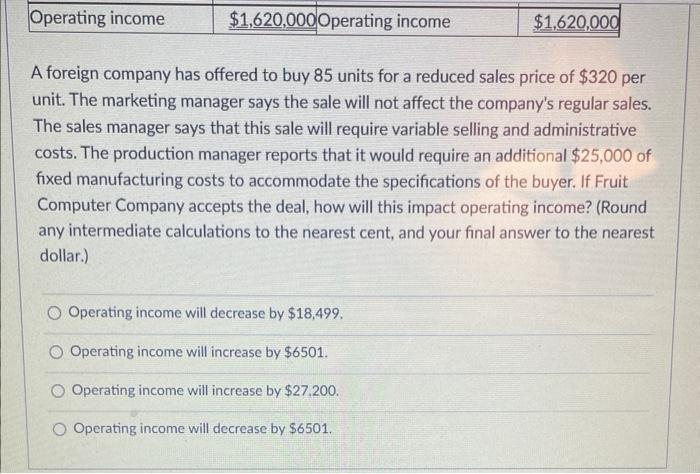

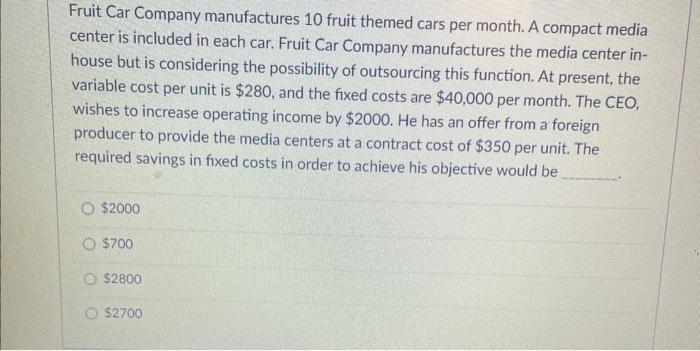

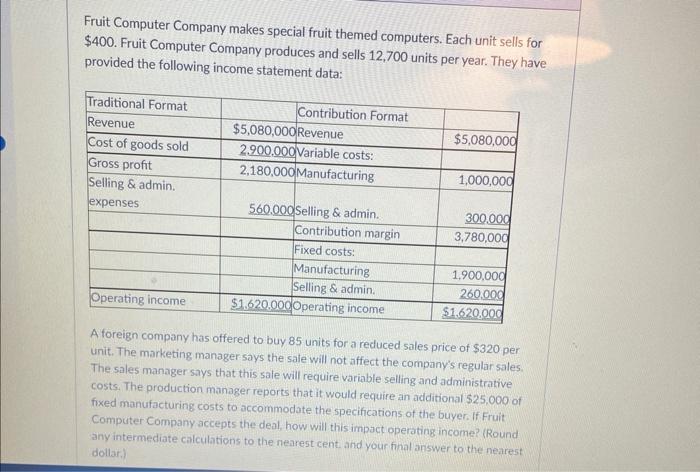

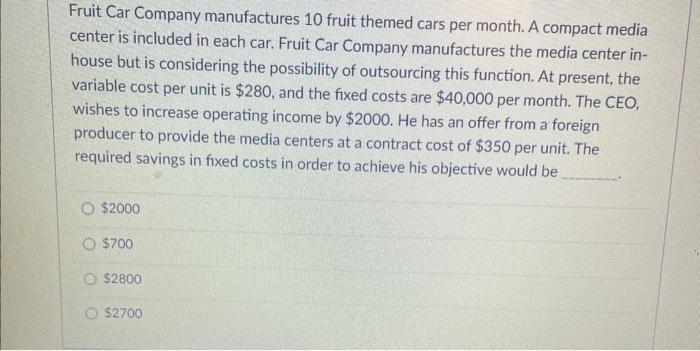

Fruit Computer Company makes special fruit themed computers. Each unit sells for $400. Fruit Computer Company produces and sells 12,700 units per year. They have provided the following income statement data: A foreign company has offered to buy 85 units for a reduced sales price of $320 per unit. The marketing manager says the sale will not affect the company's regular sales. The sales manager says that this sale will require variable selling and administrative costs. The production manager reports that it would require an additional $25,000 of fixed manufacturing costs to accommodate the specifications of the buyer. If Fruit Computer Company accepts the deal, how will this impsct operating income? (Round any intermediate calculations to the nearest cent. and your final answer to the nearest dollar.) A foreign company has offered to buy 85 units for a reduced sales price of $320 per unit. The marketing manager says the sale will not affect the company's regular sales. The sales manager says that this sale will require variable selling and administrative costs. The production manager reports that it would require an additional $25,000 of fixed manufacturing costs to accommodate the specifications of the buyer. If Fruit Computer Company accepts the deal, how will this impact operating income? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.) Operating income will decrease by $18,499. Operating income will increase by $6501. Operating income will increase by $27,200. Operating income will decrease by $6501. Fruit Car Company manufactures 10 fruit themed cars per month. A compact media center is included in each car. Fruit Car Company manufactures the media center inhouse but is considering the possibility of outsourcing this function. At present, the variable cost per unit is $280, and the fixed costs are $40,000 per month. The CEO, wishes to increase operating income by $2000. He has an offer from a foreign producer to provide the media centers at a contract cost of $350 per unit. The required savings in fixed costs in order to achieve his objective would be $2000 $700 $2800 $2700